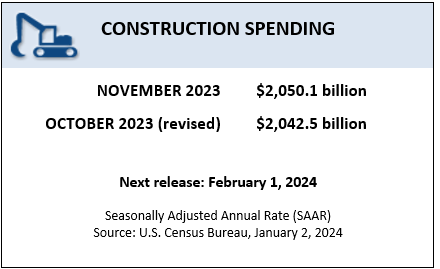

Construction spending during November 2023 was estimated at a seasonally adjusted annual rate of $2,050.1 billion, 0.4% (±1.0%) above the revised October estimate of $2,042.5 billion.

The November figure is 11.3% (±1.5%) above the November 2022 estimate of $1,842.2 billion. During the first 11 months of 2023, construction spending amounted to $1,817.1 billion, 6.2% (±1.0%) above the $1,711.1 billion for the same period in 2022.

In November, the estimated seasonally adjusted annual rate of public construction spending was $455.1 billion, 0.7% (±1.8%) below the revised October estimate of $458.1 billion.

- Educational construction was at a seasonally adjusted annual rate of $99.2 billion, 0.3% (±2.0%) below the revised October estimate of $99.5 billion.

- Highway construction was at a seasonally adjusted annual rate of $135.8 billion, 0.1% (±4.4%) above the revised October estimate of $135.6 billion.

Spending on transportation facilities fell 1%. Spending on other infrastructure categories tumbled even more: 1.6% for sewage and waste disposal, 1.4% for water supply, and 4.4% for conservation and development.

Spending on private construction was at a seasonally adjusted annual rate of $1,595.0 billion, 0.7% (±0.5%) above the revised October estimate of $1,584.4 billion.

- Residential construction was at a seasonally adjusted annual rate of $896.8 billion in November, 1.1% (±1.3%) above the revised October estimate of $887.3 billion.

- Nonresidential construction was at a seasonally adjusted annual rate of $698.2 billion in November, 0.2% (±0.5%) above the revised October estimate of $697.1 billion.

“Private construction spending is showing renewed vigor in homebuilding and selected private nonresidential categories, while developer-financed spending languishes,” said Ken Simonson, Associated General Contractors of America chief economist. “Unfortunately, public construction spending appears to have stalled.”

“Nonresidential construction spending dipped in November due to a 0.6% decline in public-sector activity,” said Associated Builders and Contractors (ABC) Chief Economist Anirban Basu. “Despite the monthly setback, spending is up an impressive 18.1% over the past year, with the gains evenly distributed between the public and private sectors, and currently sits just below the all-time high established in October.

“Manufacturing-related construction continues to surge and now accounts for roughly 45% of the year-over-year increase in nonresidential spending,” said Basu. “Other predominantly privately financed segments have posted impressive growth in 2023, with educational, health care and power construction all up significantly over the past 12 months, while certain publicly financed categories like highway and street and sewage and waste disposal have also posted strong year-over-year performances. With only 24% of contractors expecting their sales to decline over the next six months, according to ABC’s Construction Confidence Index, the industry appears set to carry momentum into the new year.”