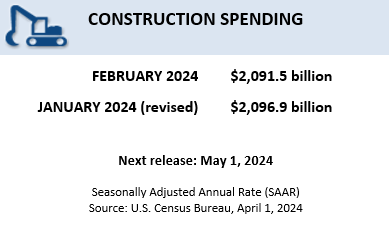

Construction spending during February 2024 was estimated at a seasonally adjusted annual rate of $2,091.5 billion, 0.3% (±0.8%) below the revised January estimate of $2,096.9 billion. The February figure is 10.7% (±1.3%) above the February 2023 estimate of $1,889.6 billion. During the first two months of this year, construction spending amounted to $298.1 billion, 11.9% (±1.3%) above the $266.5 billion for the same period in 2023.

In February, the estimated seasonally adjusted annual rate of public construction spending was $474.4 billion, 1.2% (±1.5%) below the revised January estimate of $480.1 billion.

- Highway construction was at a seasonally adjusted annual rate of $147.3 billion, 1.6% (±4.8%) below the revised January estimate of $149.7 billion.

- Educational construction was at a seasonally adjusted annual rate of $100.5 billion, 1.8% (±2.0%) below the revised January estimate of $102.3 billion.

Public construction spending soared 16.8% from a year earlier. The largest public segment, highway and street construction, was up 18.5% from February 2023.

Spending on private construction was at a seasonally adjusted annual rate of $1,617.1 billion, virtually unchanged from (±0.7%) the revised January estimate of $1,616.8 billion.

- Residential construction was at a seasonally adjusted annual rate of $901.1 billion in February, 0.7% (±1.3%) above the revised January estimate of $894.5 billion.

- Nonresidential construction was at a seasonally adjusted annual rate of $716.0 billion in February, 0.9% (±0.7%) below the revised January estimate of $722.3 billion.

“There were monthly decreases for nearly all types of nonresidential projects,” said Ken Simonson, Associated General Contractors of America (AGC) chief economist. “But every spending segment increased from a year earlier, suggesting the current downturns may reflect short-term challenges such as severe weather, not fading demand.”

Association officials said the big jump in year-over-year public-sector investments in infrastructure and construction was good news for the industry, but also cautioned that many firms continue to struggle to find enough workers to hire. They urged federal, state, and local officials to boost funding for construction education and training programs to help encourage more people to seek construction careers.

“Virtually every nonresidential construction segment experienced a decline in spending in February,” said Associated Builders and Contractors (ABC) Chief Economist Anirban Basu. “In certain instances, the monthly decline was sharp, including health care (-2.2%), commercial (-1.9%) and water supply (-1.8%). The optimist will likely shrug off both the January and February nonresidential construction spending declines as merely reflecting winter weather. The pessimist will proclaim this release a wake-up call to contractors and an indication that higher interest rates have finally begun to make their mark.

“As always, interpreting the data is complicated,” said Basu. “While 15 of 16 nonresidential construction segments recorded monthly declines on a seasonally-adjusted basis, all segments have experienced year-over-year growth in spending. In 10 instances, construction spending has increased more than 10%, including 36% growth in the public safety category and 32% in manufacturing. Moreover, ABC’s Construction Confidence Index indicates that contractors remain confident with respect to their sales over the next six months, signaling that the data could improve with the weather.”