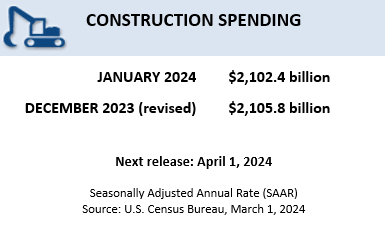

Construction spending during January 2024 was estimated at a seasonally adjusted annual rate of $2,102.4 billion, 0.2% (±0.8%) below the revised December estimate of $2,105.8 billion, according to the U.S. Census Bureau. The January figure is 11.7% (±1.5%) above the January 2023 estimate of $1,882.2 billion.

In January, the estimated seasonally adjusted annual rate of public construction spending was $479.0 billion, 0.9% (±1.5%) below the revised December estimate of $483.5 billion.

- Highway construction was at a seasonally adjusted annual rate of $150.1 billion, 2.1% (±3.6%) below the revised December estimate of $153.3 billion.

- Educational construction was at a seasonally adjusted annual rate of $101.5 billion, 0.7% (±3.1%) below the revised December estimate of $102.3 billion.

Spending on private construction was at a seasonally adjusted annual rate of $1,623.4 billion, 0.1% (±0.7%) above the revised December estimate of $1,622.3 billion. Residential construction was at a seasonally adjusted annual rate of $900.8 billion in January, 0.2% (±1.3%) above the revised December estimate of $899.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $722.6 billion in January, 0.1% (±0.7%) below the revised December estimate of $723.2 billion.

“The dip in January is more likely due to bad weather than to weakening demand overall,” said Ken Simonson, Associated General Contractors of America chief economist. “But high financing costs and falling rents are dragging down income-dependent sectors like warehouse and retail construction, while single-family homebuilding and manufacturing remain solid.”

Association officials urged federal leaders to take steps to accelerate new infrastructure investments. For example, they are calling on the Biden administration to reform its approach to implementing new Buy America, Build America rules to avoid the confusion and delays that are currently holding up projects.

“Nonresidential construction spending fell sharply in January, ending a 19-month streak of monthly gains,” said Associated Builders and Contractors (ABC) Chief Economist Anirban Basu. “Some of this decrease is due to weather-related factors. That’s especially true in infrastructure categories like highway and street and water supply, both of which exhibited steep declines in spending to start the year but should remain elevated through 2024.

“Construction spending in the manufacturing category, on the other hand, continued to surge in January,” said Basu. “Manufacturing now accounts for nearly $1 of every $5 of nonresidential construction spending.

“Despite January’s disappointing data, nonresidential construction spending is still up more than 17% over the past year,” said Basu. “Given that year-over-year strength and the fact that a majority of contractors expect their sales to increase over the next six months, according to ABC’s Construction Confidence Index, spending is likely to rebound over the coming months.”