History Will Not Repeat Itself For The Aggregates Industry.

By Barry Hudson and Laura Georgi

Over the past 30 years, the price evolution of construction aggregates in the United States has experienced various trends and fluctuations. Construction aggregates, including sand, gravel, crushed stone and other materials, are essential components in the construction industry, used for various applications such as road construction, concrete production, and building foundations.

In the early 1990s, the price of construction aggregates remained relatively stable due to steady demand and supply. However, as the economy improved and construction activities increased, the demand for aggregates surged. This led to a price increase in the late 1990s and early 2000s. Additionally, factors such as rising transportation costs and environmental regulations also contributed to the upward price trend.

The construction boom in the mid-2000s, fueled by the housing market bubble, further pushed the demand for aggregates. This resulted in a significant price spike as demand outpaced supply. The increased cost of fuel and transportation also played a role in the rising prices during this period. However, with the burst of the housing bubble and the subsequent economic recession in 2008, construction activities decreased, leading to a decline in aggregate prices.

Following the recession, the construction industry faced a slow recovery, causing the demand for aggregates to remain relatively low. This, combined with advancements in technology and more efficient production methods, resulted in a gradual decline in aggregate prices from 2010 to 2016. The decline was also influenced by decreased government spending on infrastructure projects during this period.

However, in recent years, the demand for construction aggregates has rebounded due to increased infrastructure investments and a growing population. The rise in construction projects, particularly in residential and commercial sectors, has led to a surge in demand for aggregates. As a result, prices have been on the rise since around 2016.

Furthermore, environmental factors and regulations have also affected the price evolution of construction aggregates. As concerns about sustainability and environmental impact have grown, the cost of complying with stricter regulations and implementing more green practices has been passed onto consumers, contributing to higher aggregate prices.

Another factor influencing aggregate prices is the availability and accessibility of raw materials. In some regions, the scarcity of high-quality aggregates has led to increased prices, as transportation costs from distant sources have to be considered.

Inflation Apathy and the Price Paradox

In an era of skyrocketing inflation, where prices seem to rise at an alarming rate, one industry stands out for its apparent indifference: U.S. aggregate producers. Despite the general economic trend, aggregate producers exhibit a puzzling reluctance to adjust their prices accordingly.

What is behind this unexpected phenomenon? What are the hidden motivations that keep U.S. aggregate producers from seizing the opportunity to increase their prices amidst the rampant inflation?

1. Reliance on Long-Term Contracts

Aggregate producers often operate under long-term contracts with their clients, which can span several years. These agreements typically include predetermined pricing structures that do not account for short-term fluctuations in the economy, including inflation. As a result, producers find themselves locked into fixed pricing arrangements, unable to capitalize on rising costs and inflationary pressures. The inertia created by these contracts ultimately prevents them from adjusting their prices in a timely manner.

2. Fear of Losing Market Share

In a highly competitive market, aggregate producers are acutely aware that any price increase could potentially drive their customers to seek alternative suppliers. The fear of losing market share and damaging long-standing relationships often outweighs the desire to maximize profits through price adjustments. This fear-driven strategy keeps aggregate producers hesitant to raise prices, even during periods of high inflation, as they prioritize maintaining their customer base over short-term gains.

3. Uncertainty about Inflation’s Longevity

While inflation may be running rampant in the short term, aggregate producers may harbor doubts about its sustainability. Concerns regarding the transitory nature of inflation, combined with the potential backlash from customers, lead producers to adopt a cautious approach. They may fear that increasing prices during a temporary inflationary period could backfire once the economy stabilizes, potentially alienating customers who perceive the price hikes as opportunistic rather than justified.

4. Economic Indicators vs. Operational Costs

Aggregate producers base their pricing decisions on a variety of factors, including operational costs, market demand, and economic indicators. While inflation affects the overall economy, producers may find that their specific operational costs do not rise at the same pace. For example, energy costs, a significant component of aggregate production, may not increase proportionally with overall inflation. Consequently, producers may deem it unnecessary to adjust their prices in response to inflationary pressures that do not directly impact their expenses.

5. Marketing and Perception Management

U.S. aggregate producers understand the importance of maintaining a favorable image and market perception. Raising prices during a period of high inflation may be seen as exploiting the economic situation for personal gain, potentially tarnishing their reputation and inviting scrutiny from customers, regulators, and the general public. In an effort to avoid negative perceptions, producers may deliberately keep prices stable, even if it means absorbing rising costs and sacrificing immediate profit potential.

What Tools Does Our Industry Use to Assist in Price Management?

The short answer to the subtitle – not enough. (See figure 1 below.)

The Aggregates Industry is Stuck in a Toolless Rut

In an era defined by technological advancements and data-driven decision making, it is astonishing to discover that a significant portion of companies operating in the aggregates industry remain shackled by outdated practices and inadequate tools.

The latest data from Price-Bee.com sheds light on the alarming state of affairs, revealing a startling lack of market understanding, inefficient sales analysis, and an overwhelming desire for improved pricing and quotation tools among sales personnel. This article aims to provoke a discussion on the urgent need for change and innovation within the aggregates industry.

Market Blindness

According to Price-Bee.com, a staggering 56% of companies in the aggregates industry either lack up-to-date market overviews or fail to comprehend their market position. This revelation is nothing short of concerning.

How can businesses hope to thrive in a rapidly evolving marketplace if they are oblivious to the dynamics that shape it? The absence of a comprehensive understanding of the market not only hampers growth but also leaves companies vulnerable to fierce competition and potential obsolescence.

Sales Analysis: Beyond the Basics

The data further exposes a startling fact – a whopping 76% of companies in the aggregates industry possess no sales analysis beyond rudimentary average selling price (ASP) reports.

This implies that decision-makers are relying on a mere snapshot of their sales performance, devoid of any nuanced insights or deeper understanding. By limiting sales analysis to such a basic level, companies are essentially operating blindfolded, unable to identify trends, capitalize on opportunities, or address weaknesses within their sales strategies.

Misallocated Human Resources

The statistics regarding the allocation of sales personnel’s time in the aggregates industry are equally disconcerting. It is revealed that salespeople spend a significant 60% of their time on quotation and order fulfillment activities, leaving less than 5% for the crucial task of prospecting.

This skewed distribution of time and resources effectively obstructs business growth, as salespeople are unable to dedicate themselves to the critical task of expanding their customer base. It is imperative for companies to reassess their priorities and reallocate resources to ensure that prospecting receives the attention it deserves.

Neglected Technological Advances

The data presented by Price-Bee.com uncovers a shocking reality – a staggering 68% of companies in the aggregates industry have yet to implement a Customer Relationship Management (CRM) or Configure Price Quote (CPQ) system.

These tools, essential for efficient customer management and streamlined sales processes, are inexplicably absent from the majority of companies’ arsenals. As a result, businesses are left grappling with manual processes, wasting precious time and resources, and missing out on opportunities to personalize customer experiences and boost sales.

Craving for Better Tools

A resounding 88% of salespeople in the aggregates industry express dissatisfaction with their pricing and quotation tools, yearning for more helpful alternatives.

This overwhelming desire for improved tools speaks volumes about the current state of affairs. Sales personnel, the driving force behind revenue generation, are burdened with tools that hinder their productivity and hinder their ability to meet customer expectations. It is high time for companies to heed these calls for change and invest in tools that empower their sales teams to excel.

What Can the Latest Tools do to Assist With Maximizing Revenue?

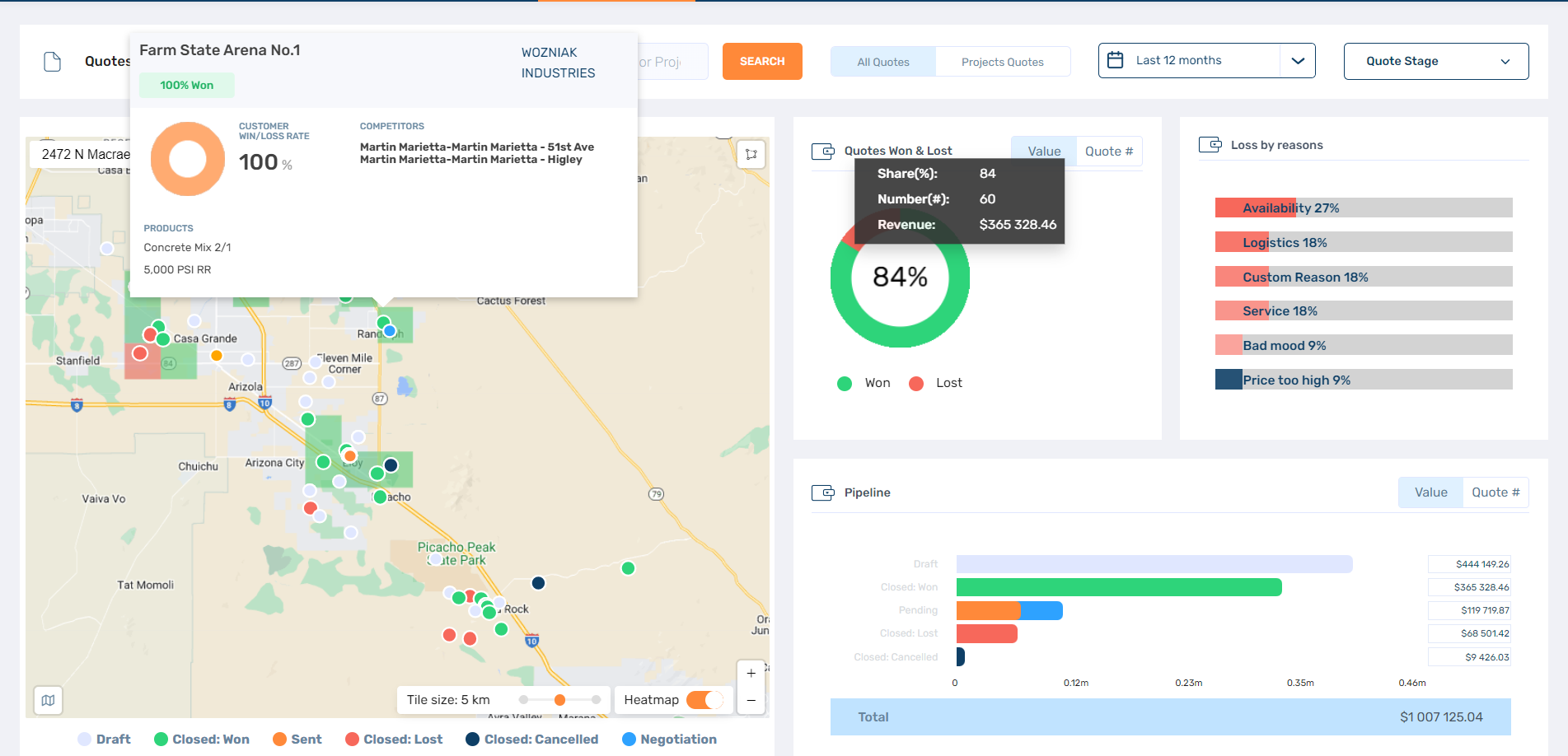

Price-Bee.com is an industry specific quote and price management tool. The following are some screenshot examples of how technology can help you improve revenue, and have a simplified sales process, that enhances your customer experience initiatives and enables proper real time decision making.

In figure 2, the Price-Bee CPQ illustrates in real time for the person preparing a quotation, many data points that are critical to pricing a job effectively. Mouseover datapoints on the map quickly overview previous quotes prepared, while win/loss rates that can be filtered by customer, product type, reason for losses – including price, logistics, proximity advantage, quality or customer service. A heat map is used to look for favorable volumes, profitability or pricing. Imagine trying to compare all of this data without a specialized CPQ tool.

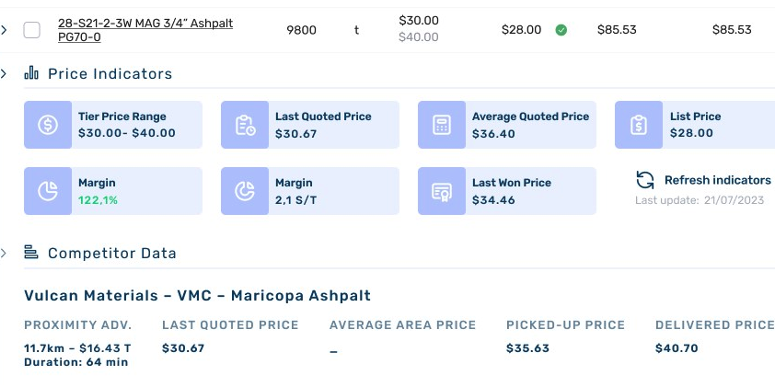

In figure 3, we see an example of the latest sales process or CPQ products, Price-Bee.com will offer to the person preparing the quotation the latest snapshot of pricing for that product, in the specific area the product where the jobsite is.

At your fingertips, you have your last won price for that product, the absolute margin or percentage margin for your selected sales price, competitor data including proximity advantage, in time, distance or dollars.

With tools such as Price-Bee.com coming on to the market, the period of where our aggregates industry cannot price effectively, will be a thing of the past.

The digitalization of the sales process has only just begun. It will usher in an era where our industry will be able to manage the revenue side of our business, rather than being overly obsessed with the operational side.

Barry Hudson and Laura Georgi are with Price-Bee.com. To contact the authors: [email protected] or [email protected].