By Allen-Villere Partners

THE PULSE: CONSTRUCTION MATERIALS MARKET ANALYSIS

- The Federal Reserve has held rates steady for just over seven months now, at 5.33%. The most recent update is that the Fed will likely cut rates by a cumulative 0.75 percentage points to 1 point in 2024 as they attempt to achieve a “soft landing.”

- Inflation increased 3.2% year-over-year in February, while the Consumer Price Index (CPI) increased 0.4% for the month and 3.8% for the year.

- The continuation of inflated housing prices, the presidential election, and whether or not we will truly see rates cuts are all things to watch in 2024 as they will have a significant impact on the overall economy

- Both Concrete Products and Construction Aggregates prices held steady this month, after consistent increases over the past year

- ABC’s Construction Backlog Indicator declined to a most recent monthly reading of 8.1 months in February 2024 from 8.4 months in January. This is down 1.1 months from February 2023, which was 9.2 months.

- The Infrastructure Investment and Jobs Act has provided a safety net to the Construction Materials Industry by increasing infrastructure investments which will help negate the possible slowing in residential construction due to higher interest rates and a slowing overall economy

PIERRE-VILLERE’S MARKET ASSESSMENT

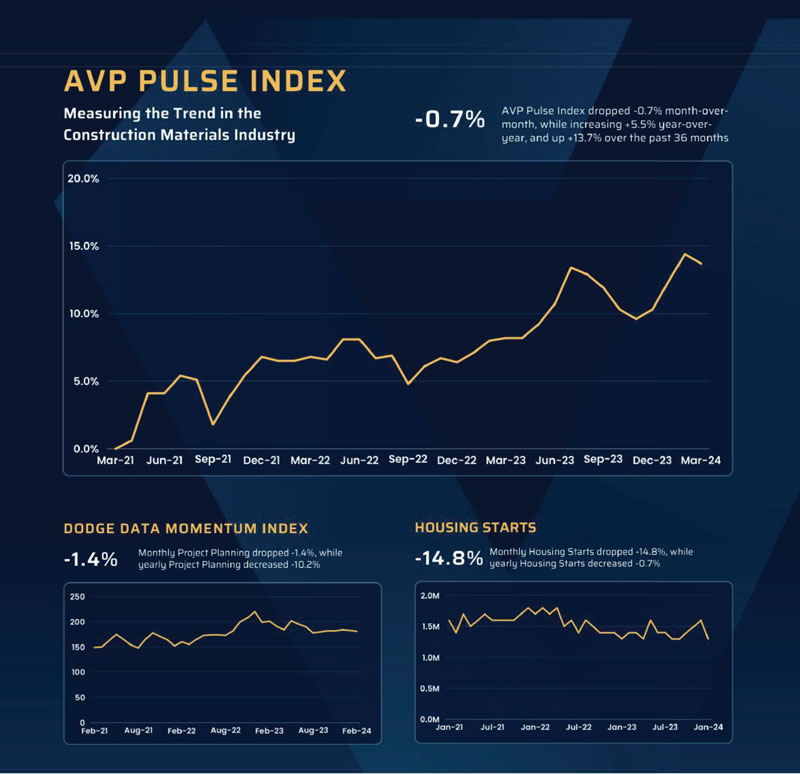

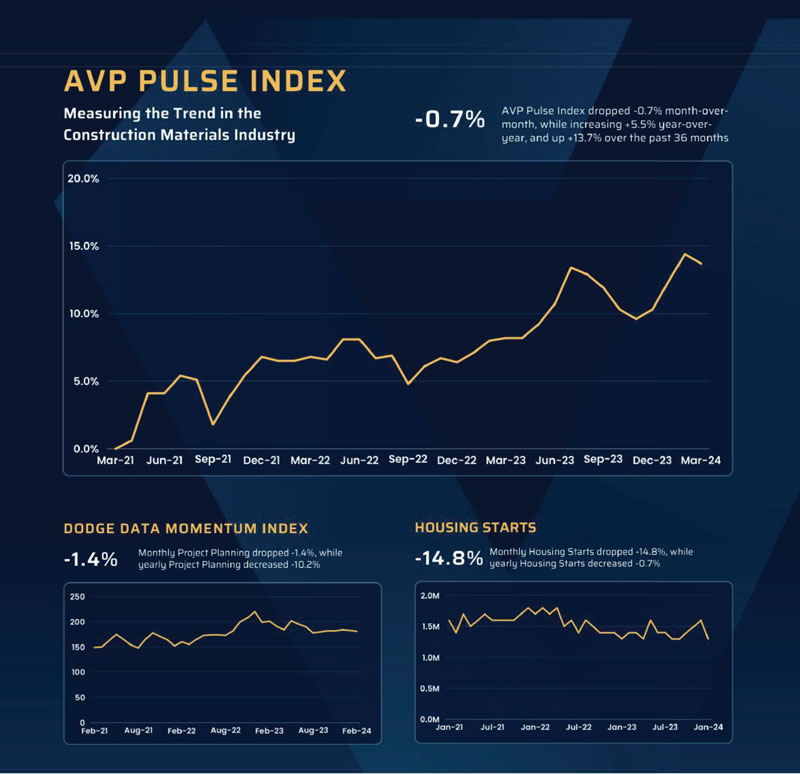

In the latest update on the construction materials industry, the AVP Pulse Index experienced a modest decline of 0.7% for the month, although it experienced a strong year-ever-year growth of 5.5%. Over the past 36 months, the index increased impressively by 13.7%, indicating sustained strength within the sector. Notably, industry stocks continue to hit new all-time highs, underlining persistent optimism regarding future industry performance, and this metric alone was a major driver in our Index’s performance this month.

As anticipated, the fourth guarter saw cyclical production metrics, typical as the industry encounters the winter months. However, amidst this seasonality, there’s a noticeable uptick in Producer Price Index (PPl) and pricing strength, signaling positive momentum for the industry.

Housing starts experienced a slight pullback, attributed to persistently high mortgage rates, compounded by uncertainty surrounding the Federal Reserve’s timeline for cutting the Fed Funds Rate.

Nonetheless, total construction spending remains robust, with only a marginal monthly pullback of-0.2%. Encouragingly, compared to the same period last year, total construction spending is up by a significant 11.7%.

In the view of Allen-Villere Partners, the construction materials industry is poised to remain healthy for the foreseeable future, buoyed by strong demand fueled by increasing federal outlays for construction projects under the Infrastructure Investment and Jobs Act (IIJA), the [HIPS Act, and the Inflation Reduction Act. Against this backdrop, coupled with the industry’s resilience and positive indicators such as pricing strength and sustained high construction spending, the outlook remains favorable.

The industry’s ability lo capitalize on these opportunities while navigating challenges underscores its enduring stability and potential fer sustained prosperity.

It is worth repeating that the AVP Pulse Index is a trend measure, like an arrow, albeit a crooked one; it points up or down depending □n the direction of the construction industry. As stated above the outlook is for continued growth and profitability for our industry based on the !railing trends.

Contact Pierre via email at [email protected].Follow him on Twitter @Allenvillere.