Rock Products interviews Ksenia Yemelyanova of Price Bee About Analytics, The Market, Customers And Price Strategies.

By Mark S. Kuhar

Price management has become necessary in our industry, especially after the last few years of high inflation. How did you come to specialize in this area and what particular roles have you had that qualify you as an expert in this area?

For more than 11 years I worked in different industries, but everywhere I had analytical roles (senior analyst, head of analytics, business analytics). During these years I’ve worked in all major departments of a business, such as sales, marketing and finance. So I can say that I’ve seen business processes from different sides, but still – “price decides.”

No matter what area it is, Hotel, Restaurant & Cafe (HoReCa), E-com or Construction and Materials, everywhere analytics, a good understanding of the market, customers you interact with and corresponding price strategies leads to the best results.

My decision to focus on the construction and materials industry was partially a challenge, because before I mainly specialized in HoReCa, but I felt that I could help people from this industry to make operational decisions, based on data and analytics.

As an industry, we are recognized as being slow to adopt new technologies. How does the affect the drive for higher pricing performance?

This slow adoption to new technologies can be a real blocker for future development. Companies that neglect new up-to-date tools and services, can really be absorbed by every day, routine, time-consuming tasks, which in major cases can be automated and free up time for more operationally meaningful tasks. And without analytics and reporting tools, it can be really difficult to track the performance of pricing strategies and make necessary and quick adjustments. But for sure it’s better to reflect on any cases immediately, than to just look on the past results.

On the other hand, new technologies are mainly data-driven, so again, if companies don’t use these technical advantages, ultimately it can lead to wrong business decisions. Because without access to real-time data, which is crucial for making informed pricing decisions, companies can make pricing strategies that are based on outdated or inaccurate information.

Modern tools provide good history analytics, which is also very powerful in sales processes adjustments. In this case the company has a real opportunity to analyze prior mistakes and avoid them in future (increase profitability or optimize business processes).

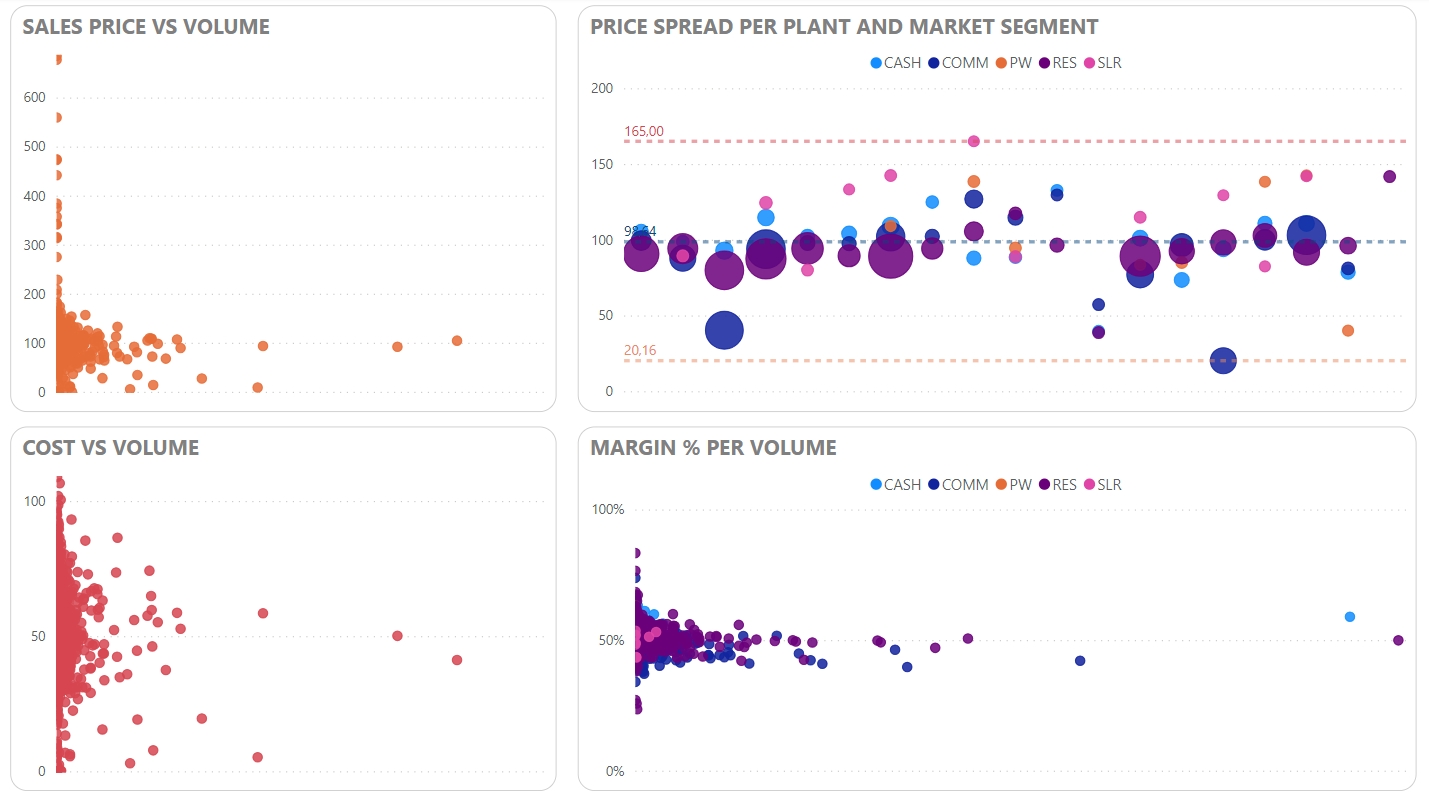

Without the use of advanced pricing software, companies may have limited flexibility in their pricing strategies. For example, they may not be able to implement dynamic pricing or price segmentation effectively. But our experience shows that proper pricing segmentation or discount analysis are very efficient and can hide many hints of how profit can be increased.

And we have to remember, that since all companies are acting on a common market, one day they may find themselves at a competitive disadvantage compared to companies that leverage technology to optimize their pricing strategies.

You have performed pricing analysis across most construction materials product lines, in countries such as the United States, Australia, New Zealand and Ireland. What common issues do you observe with current pricing strategies?

Well, the main ones are data structuring and correct calculations, market volatility, geographical variations and proper customer segmentation.

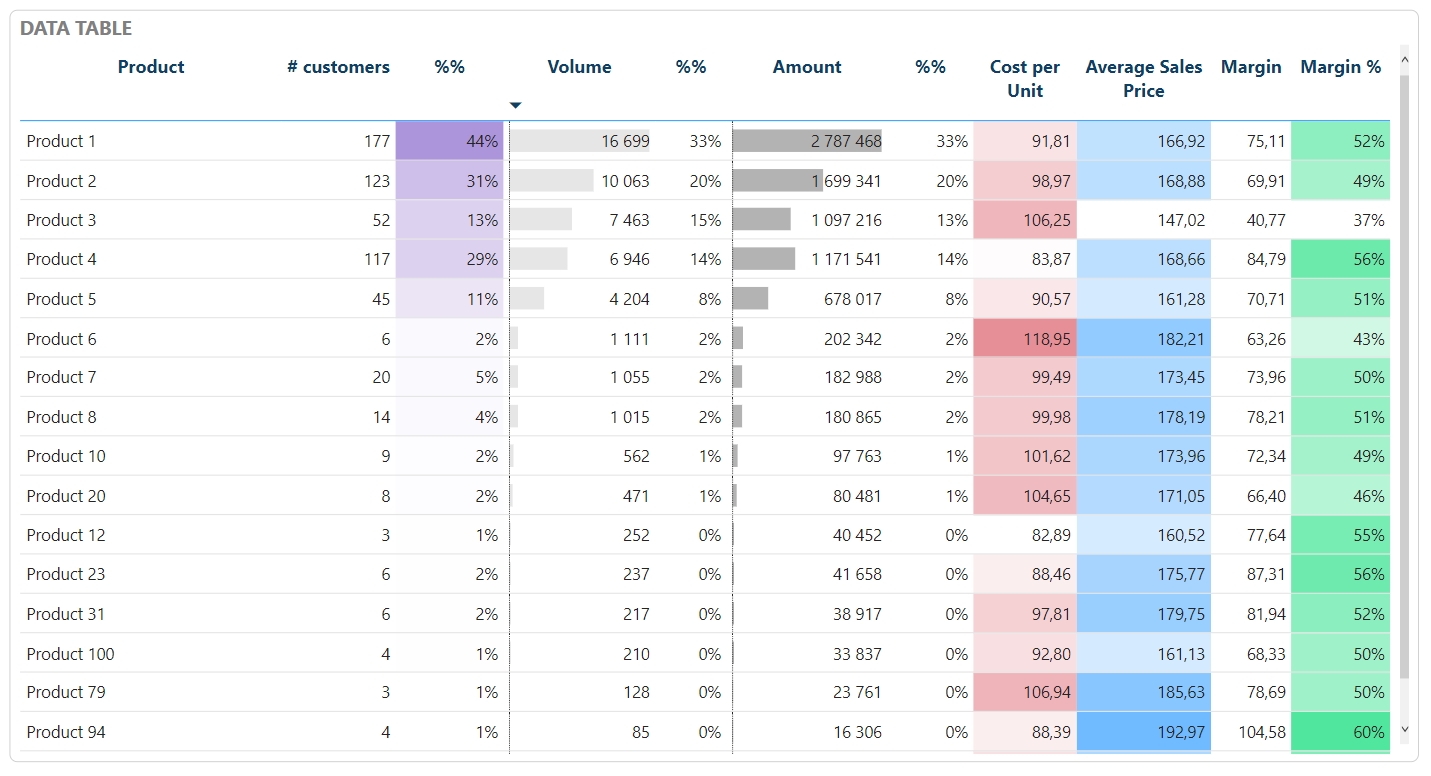

Data structuring and calculations are more about how internal data is organized, how clear it is and which conclusions it may lead to. For example, if internally a company doesn’t store the history of a cost change it would be extremely difficult to analyze it and forecast any future changes. Or if the company calculates total cost, not dividing it into transport, production, labor – again it would be difficult to impact it. And incorrect cost calculation can lead to incorrect final margin when cost-plus strategy is applied.

As for the market, of course a better way to plan your pricing strategy is not only analyze your customers and price changes, but also look around and understand where your prices are in comparison with other market players.

Geographic variations are important because product cost, delivery cost and price strongly depend on location. Factors such as local regulations, labor costs, transportation costs and proximity to raw materials can all impact the cost structure and hence the pricing.

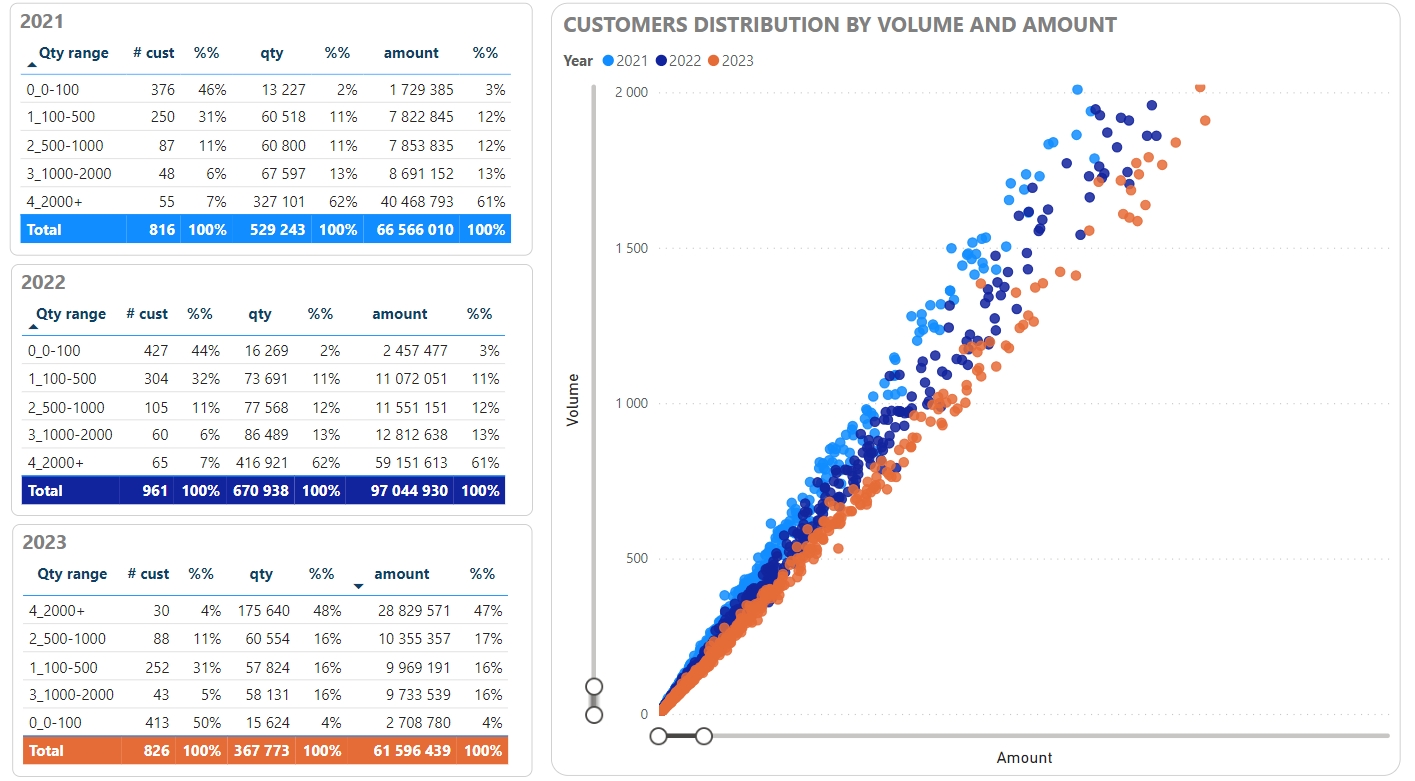

And the most interesting one is customer segmentation. To my mind this is a very powerful thing, when results of analysis give not only an understanding of who your best customers are, which discount value is the best one and on which customers the company should focus in order to increase profitability. However, accurately segmenting customers and understanding their price sensitivity can be challenging.

And I would add that communication between sales departments and strategists is very important, because sometimes they act like separate units and rely on different information, but to my mind they need to be on the same page all the time.

It’s crucial to have robust data management practices, follow market changes and technological trends, understand the local context of each market, and maintain a deep understanding of the competitive landscape and customer preferences.

The aggregates industry uses applications such as Excel for many tasks, including pricing. What are the advantages to the pricing process of utilizing cloud-based applications instead?

As an analyst I really love Excel and Google Sheets because they are easily customizable for almost any main needs, while with cloud-based applications customization will take much more time. But, nevertheless, they are absolutely non-scalable and that is a main disadvantage for any company that wants to grow, especially in the aggregates industry, where pricing data can be extensive and very complex.

Applications like Excel can be used as an extra option for a very quick calculation of something, but definitely not as a single pricing tool. It’s hard to manage large datasets there, it is not convenient for teamwork and updates management. In comparison with cloud-based tools, Excel will be much more time-consuming, when for example price was changed and salesperson has to change it manually in 100 files (which easily can cause mistakes). Imagine how it can slow down the sales process and decrease accuracy.

Excel or similar traditional tools can’t be easily integrated into current business tools, they are not fully secure and don’t provide real-time change. Sometimes it leads to situations when several people work with different prices, just because they were not updated in time and in each Excel sheet. So using Excel, users see just a small part of a process instead of looking at all aspects which affect pricing.

In short, while Excel and other traditional applications have their place, cloud-based applications can offer significant advantages in terms of accessibility, scalability, real-time updates, integration, security, cost-effectiveness, data backup, and advanced features. These advantages can definitely make the pricing process more data-driven, efficient, accurate and collaborative.

Pricing has been a hot topic over the last two years, with inflation running at record levels and input costs for aggregates producers skyrocketing. How do you implement a price strategy and keep that strategy relevant in such turbulent times?

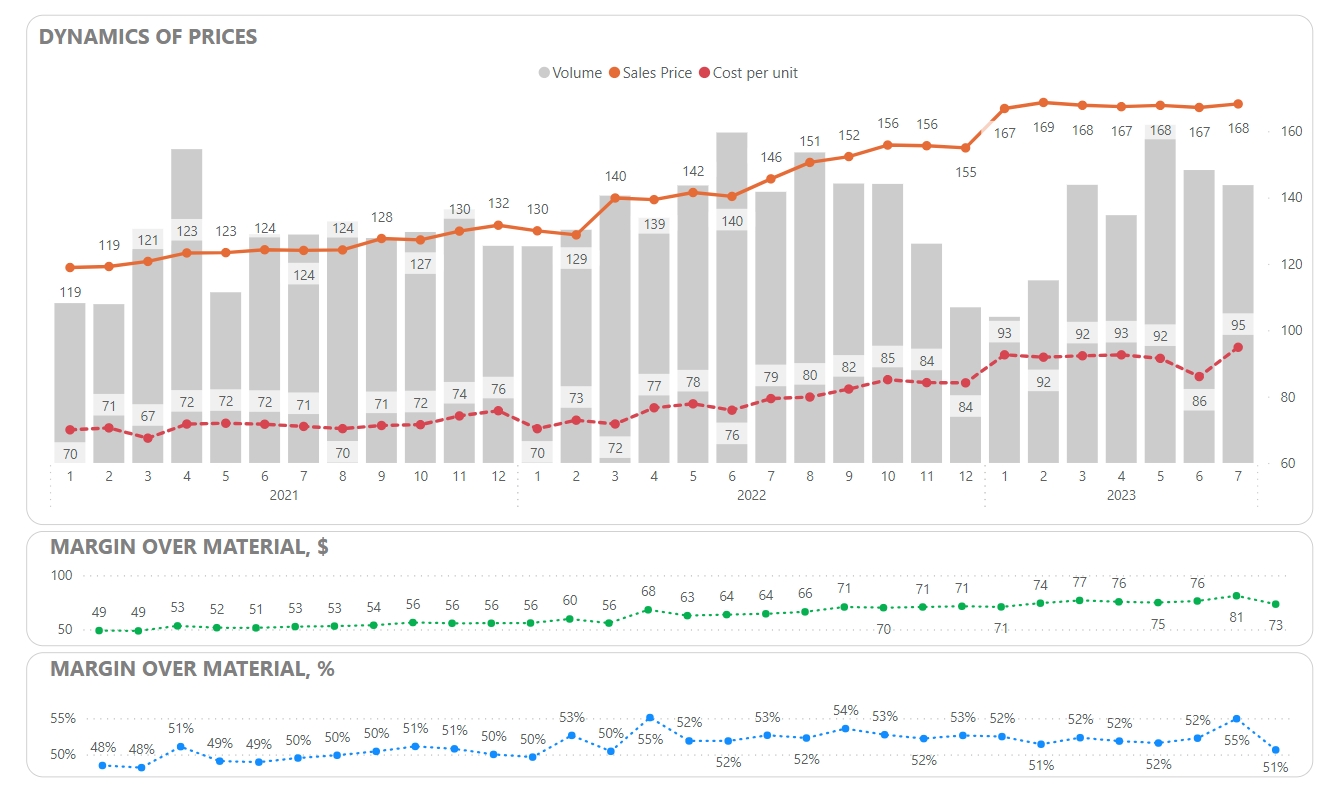

The key to effective price management is flexibility and responsiveness. I would suggest making regular market and own-price reviews, checking not only price change over time, but also price spread by customer groups and product categories. It would help to be confident that the current price strategy is still relevant. And you should always be prepared to adapt your pricing strategy as market conditions change.

It’s also important to communicate openly with your customers about changes in your prices and the reasons for them. With a proactive and strategic approach to pricing, you can navigate these challenges and maintain the profitability of your business.

In times of rising costs, the most efficient price strategy would be perhaps a cost-plus. In this case you can be sure that your prices keep pace with your costs. However, coming back to the market analysis idea, it’s important to also consider the market conditions and customer willingness and readiness to pay.

But sometimes there are no opportunities to increase prices (exactly because of other market players’ behavior), so since the final target is a profit, I would suggest improving operational efficiency and reducing costs. This could involve investing in new technology, optimizing your processes, or finding cheaper suppliers.

Also one of the insights that can come up as a result of pricing and cost analysis is diversification. Diversifying your product range can help spread risk. If the costs of one product rise significantly, you may be able to offset this with sales of other products.

What are the largest challenges you see when analyzing a company’s data to establish a baseline for pricing?

The most frequent one is Data Quality and Consistency, it obviously can significantly impact the accuracy of the pricing analysis. I can even say that it’s one the main steps towards good pricing analysis and at the same time complex. There are different cases. In one project the most difficult was to find and combine data from more than 50 different tables and sources; in another, the complexity was not in data collection, but in validation: when different responsible users gave different information (back to communication issues).

The second challenge I would say is data visualization, because all users are different, some of them like long text presentations, and some vice versa are waiting for some charts and recommendations. When each day you dive deep into digits, everything looks very understandable and familiar, but sometimes it takes time to make really straight-forward reports.

And the third one is to understand local context and build a new price strategy into current processes in a company, because it always affects not only customers, but salespeople as well.

What pricing tips can you give a company who wants to go down the path of effective price management?

First of all, make your data well-structured and all metrics measurable. Pay attention to understanding your costs (both variable and fixes ones). These are the very first steps towards effective price management. Keep in mind that if production cost varies from plant to plant, then prices should vary respectively.

Analyze your key products, their impact into profit and focus on their pricing. Segment your customers and calculate the price index in order to understand price change for them. Divide customers into tiers by volume and offer different prices/discounts (depends on a strategy type you choose).

And finally ensure that your sales team understands your pricing strategy and can communicate it effectively to customers.

On the Price Bee website (price-bee.com) you mention that you typically see revenue increase in aggregates by 4-8%. That is a very high increase in profitability. How confident are you that this is a realistic number?

It is realistic, because it’s a real result of one of the companies we’ve worked with. But it was reached by a really huge complex of actions. Among them: cost optimization, implementation of diversified pricing strategy and sales team training.

Ksenia Yemelanova is a pricing and data specialist at Price-Bee.com. For further information please email Ksenia at [email protected].