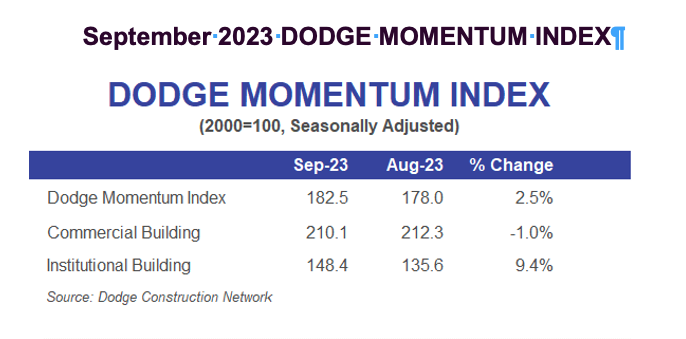

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, improved 3% in September to 182.5 (2000=100) from the revised August reading of 178.0. Over the month, the commercial component of the DMI fell 1%, while the institutional component increased 9%.

“Solid demand for data centers, life science labs and hospitals supported the uptick in nonresidential planning activity last month,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. “While month-to-month trends can be volatile, year-to-date trends show an overall decrease in commercial planning, offset by more institutional projects entering the queue. If financial conditions improve in early 2024, steady planning activity should follow.”

Weaker office planning drove the commercial segment of the DMI down, while the acceleration in the institutional segment was supported by stronger education, notably life science buildings, and healthcare planning activity. Year over year, the DMI was 5% lower than in September 2022. The commercial segment was 12% below year-ago levels, while the institutional segment was up 12% over the same time period.

A total of 20 projects valued at $100 million or more entered planning in September. The largest commercial projects to enter planning included the $400 million Platform 16 office development in San Jose, Calif., and the $230 million Waterford Millstone Data Center in Waterford, Conn.

The largest institutional projects to enter planning included the $927 million UC San Diego Research Park in San Diego, and phases three and four of the Kilroy Oyster Point Life Sciences Complex in San Francisco, valued at a total of $634 million.

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.