Six Strategies For Successful M&A In The Competitive Aggregates Market.

By Ryan Brown

With apologies to Playwright George Bernard Shaw, the single biggest problem with acquiring a company is the illusion that it has taken place.

As highlighted in recent Rock Product news, the aggregates industry is currently focused on strategic acquisitions, where producers target assets to complement their existing operations. While data on industry success rates is limited, the continued M&A activity suggests that many aggregates producers indeed view them as growth drivers.

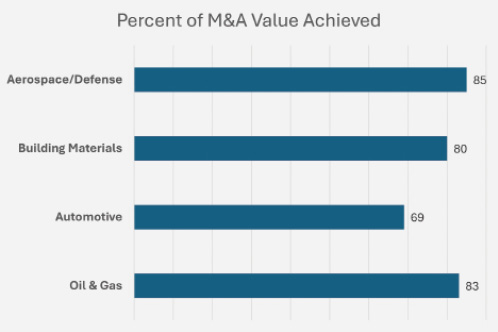

Yet, if aggregates fit into the statistical norm of other sectors like building products or oil & gas, these acquisitions will achieve only about 80% of the expected financial targets.

Exhibit 1: Average gap of 21% between expected vs. actual synergy attainment

Key Reasons for Aggregates M&A

When acquisitions are smartly selected and effectively executed, they can reward the buyers with greater market share and pricing power. This is usually achieved in three ways:

- Cost Savings and Efficiency Gains: Merging downstream operations can lead to cost savings through elimination of duplicate functions, greater purchasing power and logistical network optimization (freight).

- Expanding Your Reach: Acquisitions allow producers to expand their geographic reach and access new customer bases, strengthening their market positions.

- Access to New Resources: New reserves of materials, such as quarries or gravel pits, are crucial for companies looking to secure their long-term supply chain and meet growing infrastructure demand.

And recently, this sector has also been facing heightened challenges with labor shortages, making M&A an attractive option for producers to acquire new talent and expertise quickly.

When Reality Doesn’t Match the Spreadsheet

More times than not, unfortunately, the expected integration dividends are not fully realized and so the deal is viewed as unsuccessful by shareholders.

“There is no question that accretive synergies in an acquisition are widely overvalued by both the seller and the acquirer (e.g. de-duping operations, consolidating back offices, unifying the IT stack, optimizing the sales teams, etc.),” said John D. Wagner, a managing director at 1stWest M&A. “Neither buyer nor seller should expect to goose EBITDA in the months immediately following the closing based on discovered synergies. Companies really should be acquired for good old-fashion cashflow and solid EBITDA margins, not for some future as-yet-unrealized bounty from efficiencies.”

I personally have participated in multiple successful and unsuccessful ventures during my career, and I submit the root cause of failure can be traced to one (or a combination of) these six reasons:

Common Pitfalls Before and During Acquisitions

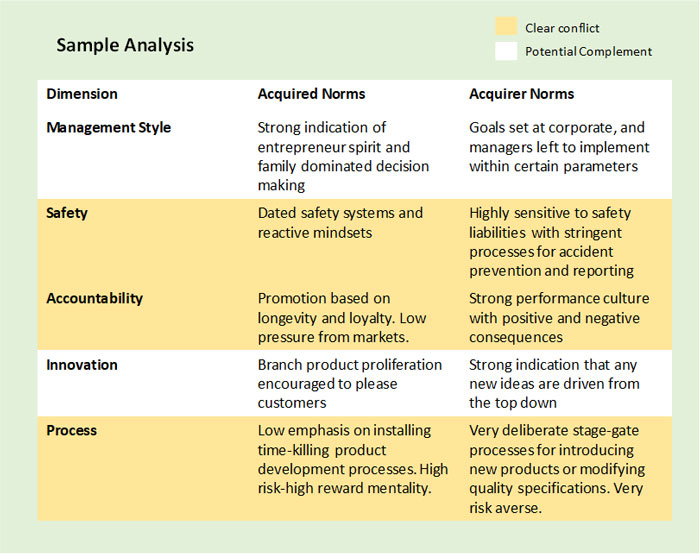

Culture mismatch: The essence of culture is reflected in a company’s a) leadership style, b) its approach to innovation, c) how decisions are made, and d) its internal vs. external focus. The tricky bit early in deals is that culture doesn’t often show itself in the P&L. It is, nonetheless, a very real factor to consider and blindly blending two distinct cultures can be a recipe for disaster (Exhibit 2). If something can’t be seen, can it be managed?

Solution: Understand ahead of time what sort of culture they most closely represent and find some common ground. For example, both parties might carry bottom-line philosophies and a keen sense of customer service. As they work through synergy projects, managers of both companies should be jointly involved to identify sources of value.

“In my experience, most companies underestimate the cultural fit aspect of an acquisition and its impact on successful integration,” said Ron Henley, president of GCC of America and chairman of the Portland Cement Association (PCA) board of directors. “The longer you put off the people side (culture) of integrating the harder it is to change. Assess and address this quickly so you can focus efforts on delivering benefits and synergies.”

Hidden Liabilities and Unexpected Costs: Environmental liabilities, worn equipment or unproven reserves not caught during due diligence can lead to higher costs and integration problems. Solution: Utilize scenario planning to identify early warning signs of integration issues. An example of this would be in the creation of a “driver tree” analytics tool that helps identify key assumptions and how sensitive the deal is to changes in those assumptions.

Exhibit 2: Examples of blended culture harmony and conflict

Brain drain: Important resources sometimes leave before the integration can be completed. Solution: Identify key talent before finalizing the deal, particularly those with deep industry knowledge or unique skillsets. Maintain transparent communication with these people throughout the acquisition process. Explain the rationale behind the deal, the vision for the combined entity, and their potential roles in the future organization.

“Some acquirers that our firm has dealt with have been quite clever with efforts to stop potential brain drains,” Wagner added, “not only with attractive comp / commission packages – but also with meaningful ‘stay bonuses’ for down-list employees who are promised cash payments, that ‘vest’ (are distributed) on the first anniversary of the closing. The stay bonuses do not stick the acquirer with a bad employee the way an employment agreement might; the stay bonuses are just incentives for the at-will employee to stick around long enough to reduce workforce volatility, while allowing the new ownership time to see if they are worthy of retention.”

There are also pitfalls to be alert to after the acquisition and during the integration process.

Challenges Faced During Integration

Change Management Fumbles: Mergers can sometimes lead to employee turnover and customer dissatisfaction, impacting profitability. Solution: Recognize that middle managers could react to the news differently than hourly workers in the mines. Tailor your communication and support strategies to address the specific concerns of these and other employee groups. For customers, assign dedicated account managers from the acquiring company to key accounts. These account managers can build relationships, understand customer needs, and address emerging service concerns.

Overly Optimistic Synergy Estimates: Targets created during the deal phase might be overly optimistic due to underestimation of transport or regulatory complexities. Solution: Consider engaging a third-party consultancy to validate the value estimates developed internally. This can provide an objective perspective and identify potential biases.

Slow Integration Progress: Integration efforts can be slow and disjointed, leading to delays in realizing synergies. Solution: Establish a dedicated Integration Management Office (IMO) with clear authority to oversee the integration process and track synergy capture. Continuously monitor progress towards achieving synergy targets and regularly report on key metrics to stakeholders.

Aggregates producers continue to seek expanded share, secure resources and navigate labor shortages using acquisitions, despite high interest rates. This heightened risk makes realizing synergies even more important going forward. M&A can be successful if well-planned and executed. However, a focus on cultural integration, careful due diligence, and a structured implementation process are crucial for maximizing the chances of a positive outcome.

In the world of M&A, the illusion of integration can be a powerful one. The biggest challenge isn’t necessarily acquiring a company, as my opening line suggests. It’s ensuring the acquired company truly becomes part of the new whole.

Ryan Brown has worked in the Building Materials sector for nearly 30 years. As founder and managing director of Next Level Essentials, LLC., they deliver bottom-line impacts in operational improvement, supply chain optimization, and post-merger integration. He can be reached at [email protected].