A National, State and County Analysis

By George S. Ford and Lawrence J. Spiwak

Natural aggregates – including crushed stone and sand and gravel – are a basic raw material used for residential, business and government construction projects, as well as in agriculture, and chemical and metallurgical processes. The aggregates industry – literally the foundation of our nation’s infrastructure – is a significant contributor to the economic wellbeing of the United States, generating $27 billion in annual sales and employing 100,000 mostly skilled workers. Impacts are felt throughout the broader economy. The industry supports $122 billion in national sales, $32 billion in national earnings (i.e., wages), and between 364,000 and 600,000 jobs across a wide range of occupations and industries.

Input-Output analysis reveals that each job in the aggregates industry supports an additional 4.87 jobs throughout the economy. These jobs are widely spread across industries and occupations. Each dollar of earnings (i.e., wages) creates another $4.19 of earnings in other sectors, and each dollar of sales in the industry produces another $3.47 of sales in other industries. The effect of the aggregates industry is both large and diverse. Sizable effects on employment and output are found also at the state and county levels.

Production in the aggregates industry is closely linked to the construction and maintenance of residential, commercial and government buildings, as well as transportation infrastructure including roads, highways, bridges and railroads. In recent years, the aggregates industry has experienced higher growth in response to increased construction in residential housing.

Proposals to expand infrastructure spending to repair and expand the nation’s crumbling infrastructure may portend even higher demand for the aggregates industry’s outputs. As demonstrated here, the growth of the aggregates industry will positively and materially impact jobs, earnings and sales in many sectors of the nation’s economy.

America’s infrastructure is in a state of inadequacy and decay. According to the American Society of Civil Engineers (ASCE), over the next 10 years (2016-2025) restoring the nation’s surface transportation infrastructure – roads and bridges – requires an investment of approximately $2 trillion.1

Under present funding targets, however, the government will spend less than half that, leaving an investment gap of $1.1 trillion. These direct costs grossly understate the magnitude of the problem, as poor road conditions and inadequate infrastructure impose economics costs related to increased operating costs for vehicles, increased travel times from congestion, the breakdown of transit vehicles, the high costs of repairing excessively deteriorated infrastructure, and environmental damage from increased travel times and delays. Other infrastructure investment shortfalls include water and wastewater ($105 billion), electricity ($177 billion), aviation ($42 billion), and ports and inland waterways ($15 billion).

Federal highway spending remains 23 percent below its 2002 level.2 While there has been some effort to improve the transportation infrastructure, much of the investment targets maintenance rather than capital improvements and expansions. Consequently, some gains in road roughness have occurred, but total congestion hours in the nations’ 50 largest cities has grown by 36 percent.3

According to the ASCE, our nation’s decaying transportation infrastructure costs businesses and households $147 billion annually, including $109 billion in vehicle operating costs, $36 billion in travel time delays, $1.4 billion in safety costs, and $0.7 billion in environmental costs.4 As the population grows, these problems will only mount. The ASCE estimates these cost will rise to $238 billion by 2025.

Rebuilding America’s infrastructure has bipartisan support. During the 2016 election campaign, both Senators Hillary Clinton and Bernie Sanders proposed to spend hundreds of millions to update our infrastructure.5 President Donald Trump also committed to rebuild America’s infrastructure, at times calling for $1 trillion in investment over 10 years.6 All of these proposals recognize that a key benefit of such infrastructure investments are not merely the physical facility but also the quality jobs required constructing them. Construction, unlike modern manufacturing, remains a labor-intensive endeavor.

How any new and significant infrastructure investment works its way through the economy and stimulates employment will be the focus of much attention. In light of the ASCE’s estimate that the largest shortfall is in transportation infrastructure, it is reasonable to presume that no small part of the infrastructure investment dollars will go to update the nation’s roads and bridges. In the American Recovery and Reinvestment Act (ARRA), for instance, $27.5 billion of the $105.3 billion infrastructure budget (one-quarter of the total) targeted roads and bridges.7 While the total spent of the ARRA was about $800 billion, presumably an infrastructure bill will more tightly focus on infrastructure projects. If the final legislation were to approach the $1 trillion mark, then funding for roads and bridges might rise by hundreds of millions of dollars.

According to the U.S. Geological Survey (USGS), in the construction of interstate highway, natural aggregates – crushed stone, sand and gravel – accounts for 94 percent of the materials used, with cement (3 percent), asphalt (2.2 percent) and steel (0.4 percent) making up the rest.8 A heavy use of aggregates is not limited to road construction. By volume, concrete is 60 percent to 75 percent natural aggregates.

According to the USGS:

Natural aggregates, which consist of crushed stone and sand and gravel, are among the most abundant natural resources and a major basic raw material used by construction, agriculture, and industries employing complex chemical and metallurgical processes. Despite the low value of the basic products, natural aggregates are a major contributor to and an indicator of the economic wellbeing of the nation.9

Clearly, an increase in infrastructure spending of nearly any sort, and especially spending targeting the nation’s transportation infrastructure, will affect operators in the natural aggregates

In this SCORECARD, we quantify the economic impacts on jobs and broader economic effects of the aggregates industry. Our analysis is intended to both be descriptive and predictive, quantifying the current impact of the aggregates industry on the broader economy and shedding light on how an expansion of the industry, perhaps through new infrastructure spending, might ripple through the economy more broadly. To do so, we employ a sophisticated and proprietary multiregional social accounting matrix developed by Economic Modeling Specialists International (Emsi).10

This modeling system estimates the direct effects and indirect effects of one type of economic activity on the sales, jobs, earnings, value-added (or gross regional product – GRP), and taxes at the county, state or national level. In computing these “ripple effects,” the model accounts for both supply-chain impacts (direct and indirect effects) and increases in household income (induced or spin-off effects).11 We also chose Emsi’s modeling approach because it tends to be conservative, thereby avoiding the exaggeration of economic impacts and providing policymakers a reasonable assessment of economic impacts.12

- Our analysis begins with an overview of the aggregates industry, including recent and time series data on the size of the industry.

- Second, we turn to the quantification of the broad economic impacts of the aggregates industry. We present evidence on economic impacts at the national level, the state level (for all states), and at the county level for three select counties.

- Third, we discuss how the aggregates industry impacts the economy in other ways, including the repurposing of quarries to provide both commercial and recreational benefits to the public, creating sustained economic benefits long after its quarry operations have ceased.

Overview of the Aggregates Industry

For our study, the aggregates industry is defined to include the economic sectors “Construction Sand and Gravel” and “Crushed Stone,” and the impact analysis focuses more narrowly on crushed stone quarrying and sand and gravel mining.13 The aggregates industry, as shown in Table 1, produced output valued at about $25 billion in 2016.14 Data for 2016, which was just released by the USGS (and is subject to revision), suggests a significant increase in demand for aggregates (a 10 percent increase from 2015) in the last year.

The USGS attributes the gain to “significantly stronger construction activity across the country in 2016, and recovery in the private sector and residential construction experiencing a level of growth not seen since late 2005, consumption of construction aggregates is likely to continue to increase.”15 Since 2011, the value of the industry’s output has grown by 7.1 percent annually. The increase in value is attributable mostly to production increases (nearly 5.3 percent annually). The average price (in nominal dollars) has risen at a rate of 3.1 percent annually since 2011, but much of that increase has occurred in the last few years in response to rapidly increasing demand and production.

Employment in 2016 for the aggregates industry was just over 100,000. Many of these jobs are highly skilled, local and well paying. Wages in the industry for hourly labor are on par with manufacturing jobs.16 The industry is also highly competitive, with over 4,000 private companies and government agencies in operation. Production occurs in all states, although half of the value of the industry is accounted for by Texas, California, Pennsylvania, Florida, North Carolina, New York, Virginia, Ohio, Illinois, Georgia and Missouri. The first three states in this list account for one-quarter of the industry’s value.

The cost of transporting aggregates is very high, so the need for operations in every state is a necessity. Bhagwat (2014) estimates that transportation costs are (mildly) non-linear in distance but across a wide range of distances average about $0.22 per mile.17 The delivered price of a metric ton of sand and gravel doubles at about 23 miles and doubles for crushed rock at about 45 miles, a finding matching that of the earlier study by Robinson and Brown (2002).18 In light of these high transportation costs, it is little surprise that 90 percent of aggregates are consumed within 50 miles of the place of extraction and that imports and exports are near non-existent, amounting to only about 1 percent of production and consumption.19 The vast majority of import and exports are with Canada and Mexico.20 To a large extent, the aggregates industry is a local business, its jobs and production activity well insulated from globalization.

Components of the Aggregates Industry

Table 2 decomposes the broader industry into its two primary components. Value of the crushed stone component ($16.3 billion) is nearly twice that of crushed sand and gravel ($8.8 billion), in part due to greater consumption (1,320 to 1,010 million metric tons) and in part to a higher price per ton ($10.98 to $8.80 per ton). Employment is twice as large in the crushed stone component, which is proportionate to the differences in production. The two components have nearly identical labor intensities.

According to the USGS, there are an estimated 4,100 companies and government agencies supplying construction sand and gravel, with about 6,300 operations across the 50 states. The largest producing states, accounting for just over half of all production, include Texas, California, Minnesota, Washington, Michigan, Colorado, Arizona, North Dakota, Wisconsin and Ohio. Natural aggregates are largely used as inputs to other products, and the USGS estimates that about 45 percent of construction sand and gravel was used as concrete aggregates, 25 percent for road base and coverings and road stabilization, 13 percent as asphaltic concrete aggregates and other bituminous mixtures, 12 percent as construction fill, among other products such as blocks, bricks, pipes, plaster and gunite sands, and snow and ice control, filtration, golf courses, railroad ballast, roofing granules, and other miscellaneous uses.

The 1.3 billion metric tons of crushed stone was produced by 1,430 companies. These companies operate 3,700 quarries, 82 underground mines, and 187 sales-distribution yards across the country. The largest producing states are similar to those for construction sand and gravel: Texas, Pennsylvania, Missouri, Florida, Ohio, Illinois, Kentucky, Indiana, North Carolina and Virginia. These states accounted for more than half of the total production. Most of the domestic crushed stone is limestone and dolomite (70 percent). Other sizable materials include granite (13 percent), traprock (6 percent), with smaller shares of sandstone, quartzite, marble, volcanic cinder and scoria, calcareous marl, slate, shell, and miscellaneous stone. The bulk of the crushed rock is used as construction material (76 percent), and largely for road construction and maintenance. Other types of use include cement manufacturing (11 percent), lime manufacturing (7 percent), and assorted uses including chemicals, agricultural uses, and miscellaneous other applications and products.

Aggregates Production Over Time

Figure 1 illustrates a time series of aggregates production over the period 1991 through 2016. The solid line shows the value of the aggregates industry and the dashed line is Gross Domestic Product (GDP).21 The value of aggregates production is shown to have a sizable growth during the housing bubble of the mid-2000s, and growth has been strong in recent years as the housing market has recovered. While the industry’s value does not appear to be strongly related to GDP, the USGS notes that the industry closely parallels the health of residential construction. Also shown in the figure is the Case-Shiller Home Price Index, a measure of U.S. residential real estate prices.22 A strong U.S. housing market is a key determinant (and leading indicator) for economic activity in the aggregates industry.

Figure 1 illustrates a time series of aggregates production over the period 1991 through 2016. The solid line shows the value of the aggregates industry and the dashed line is Gross Domestic Product (GDP).21 The value of aggregates production is shown to have a sizable growth during the housing bubble of the mid-2000s, and growth has been strong in recent years as the housing market has recovered. While the industry’s value does not appear to be strongly related to GDP, the USGS notes that the industry closely parallels the health of residential construction. Also shown in the figure is the Case-Shiller Home Price Index, a measure of U.S. residential real estate prices.22 A strong U.S. housing market is a key determinant (and leading indicator) for economic activity in the aggregates industry.

In Figure 2, a radar scatter diagram shows more clearly that the value of the output of the aggregates industry is more closely related to the housing market than to GDP. This figure plots the percentage annual change in the three illustrated series. Wide swings in the housing and aggregates industry are temporally proximate, though unsurprisingly coincident with the milder movements in GDP. While general economic activity (GDP) affects the aggregates industry, the sectors output is more strongly related to changes in sectors—here residential housing—that use aggregates as key inputs of production. Analysis of the consumption of aggregates shows that the primary economic sectors in which aggregates are consumed include: residential buildings (33 percent); highways and streets (31 percent); commercial buildings (19 percent); government buildings (5 percent); other public works (8 percent); railroads (3 percent); and private non-construction (1 percent).23 While highway spending has been relatively constant and inadequate over the past few decades, changes in infrastructure spending, especially investments aimed at transportation infrastructure, are likely to have a sizable effect on the aggregates industry.

In Figure 2, a radar scatter diagram shows more clearly that the value of the output of the aggregates industry is more closely related to the housing market than to GDP. This figure plots the percentage annual change in the three illustrated series. Wide swings in the housing and aggregates industry are temporally proximate, though unsurprisingly coincident with the milder movements in GDP. While general economic activity (GDP) affects the aggregates industry, the sectors output is more strongly related to changes in sectors—here residential housing—that use aggregates as key inputs of production. Analysis of the consumption of aggregates shows that the primary economic sectors in which aggregates are consumed include: residential buildings (33 percent); highways and streets (31 percent); commercial buildings (19 percent); government buildings (5 percent); other public works (8 percent); railroads (3 percent); and private non-construction (1 percent).23 While highway spending has been relatively constant and inadequate over the past few decades, changes in infrastructure spending, especially investments aimed at transportation infrastructure, are likely to have a sizable effect on the aggregates industry.

Economic Impacts

We now turn to the quantification of the economic contributions of the aggregates industry. To do so, we employ Emsi’s proprietary multiregional social accounting matrix (MR-SAM). This model estimates the employment and monetary contributions of one sector to the broader economy. Emsi’s MR-SAM characterizes over 1,100 industries, 16 demographic cohorts, and 750 occupations to represent the flow of all economic transaction in an economic area, which may be defined at the county, state, or national levels. The effects vary considerably across the level analyzed, so we offer evidence at all three levels of aggregation. Emsi’s proprietary data and analysis system – called “Analyst” – employs a similar statistical approach as that found in the widely-used input-output models IMPLAN and RIMS II.

One distinguishing difference is that Emsi uses a higher number of available industries, thereby allowing the Emsi multipliers to better reflect local, sub-regional, and regional economic changes. Even in light of these differences and improvements in precision, the jobs impacts from Emsi’s input-output model are comparable to those computed by IMPLAN and RIMS II. Emsi’s model is data rich and draws from nearly 90 government (federal and state) data sources and creates an integrated dataset that balances accuracy with up-to-date relevance.

What are Impact Multipliers?

Using a rich dataset on industry relationships, the Emsi’s Input-Output model is able to calculate how changes in one industry – say a change in jobs or sales – will then propagate to other industries in a regional economy.24 The relationship between the two industries is measured by a multiplier, which is, in effect, the quantification of a “ripple effect.” Interpretation of a multiplier is mechanically rather straightforward. For example, a jobs multiplier of 3.0 means that an increase of 100 jobs in the industry of interest would lead to a total increase of 300 jobs (3.0 x 100 = 300) in the economy more broadly (within the region of interest).

Likewise, reductions in jobs will reduce employment in the broader regional economy. As defined in this SCORECARD, this change of 300 includes the original 100 jobs, meaning the additional change in jobs from the activity is the remainder of 200 jobs. Of course, industries with strong ties to other industries (i.e., a strong supply chain) generally have higher multipliers than industries with weak supply chain. Unlike some types of economic activity, quarries and mines operate over many decades, so the industry’s multiplier effects are recurring and not short-lived (e.g., construction projects). The economic effects reported here are sustained and not a short-term response to investment projects.

Multipliers quantify four types of effects: (1) initial; (2) direct; (3) indirect; and (4) induced. The initial and direct multipliers are linked to the industry in which the primary change is occurring. The initial multiplier is always 1.00. The direct multiplier represents the most immediate “ripple effect” resulting from the initial change. Like the initial multiplier, these changes are linked to the industry in which the primary change is occurring. For instance, adding five salespeople to Industry A should result in more jobs being added to Industry A such as managerial, support, or production personnel. The indirect multiplier represents the change that will occur in the industries that supply the industry in which the primary change is occurring.

Finally, the induced multiplier is the result of initial, direct, and indirect activity. That is, the new workers from these direct and indirect effects spend their incomes in the region of interest to buy groceries, healthcare, and so forth, and this increase in expenditures affects the sales, employment, and earnings of these industries. The indirect and induced effects are hypothetical in nature based on generally accepted supply chain and increased spending effects. (Table 9 illustrates how these multiplier effects are distributed across industries.)

There are many types of multipliers, but here we will focus on multipliers for jobs, earnings, and sales. Jobs multipliers indicate how important an industry is in regional job creation. Often, the types of jobs created outside the industry of interest are spread over many industries, especially those resulting from the induced effects. An earnings multiplier is based on the total amount of employee compensation paid by employers in the industry. If the earnings multiplier is 1.5, then for every $1 of compensation in the industry of interest there is $1.50 of compensation throughout the economy. A large jobs multiplier and a small earnings multiplier implies that many low wage jobs are created (and vice versa). Thus, the relative sizes of the two multipliers says something about the quality of the jobs created. Sales multipliers quantify how total sales in one industry relates to total sales in other industries. Since sales figures are widely available, the sales multiplier has broad applicability.

Economic impacts may be quantified at the county, state or national levels. The size of the multipliers will vary by the level of geographic aggregation. Multipliers are larger the larger is the geography of interest. Multipliers calculated at the county level are the smallest because the direct, indirect, and induced effects may be realized outside the narrow geographic boundaries of the county. Induced effects are consumption-based, and consumption – say a vacation – may occur nearly anywhere. Importantly, the smaller relatively sizes of the county multipliers does not imply the effects of the industry are small, only that the economic impacts may be felt in other counties, states, or even nations. We provide evidence on the multipliers at all three levels of aggregation. At the county level, we compute the economic impacts of the aggregates industry (or parts thereof) for Larimer County, Colo.; Lancaster County, Pa.; and Talladega County, Ala.

Details of the Aggregates Industry

Given the nature of the data, our analysis is limited to an analysis of the quarry operations of the aggregates industry. Specifically, the component sectors included in the analysis are listed in Table 3.

Employment for these components of the aggregates industry included 61,042 workers in 2016, which amounts to just over 60 percent of the reported total employment in the industry. These quarrying jobs represent about 9 percent of the broader mining industry. While mining employment has fallen by 8.1 percent over the past five years, employment in the quarrying industry has increased by about 6 percent, reflecting, in part, the growth in residential housing (see Figure 1). Employment in these components fell sharply between 2006 and 2011 (about 24 percent over the period), coinciding with the collapse of the U.S. housing market and a recession.25 As shown in Table 1, total employment in aggregates industry has also grown by about 6 percent, so it appears that the industry’s employment growth is proportional to growth in the quarry component. Average earnings per job in the quarry component are $75,129 in 2016, well above the national average of $61,586, reflecting in part the high-skilled nature of the jobs. Table 4 lists the top 10 occupations (by Standard Occupational Classification or SOC) in terms of employment for the quarry industry.26

The overall size of the aggregates industry for purposes of the Input-Output analysis is summarized in Table 5. Total annual sales (gross receipts) includes sales to both consumers and other industries of production was $27.2 billion in 2016. Of gross sales, earnings – including wages, salaries, supplements (additional employee benefits), and proprietor income – was over $6.1 billion. Property income – sometimes referred to as “non-labor income” or “gross profits” – is equal to gross receipts less payments to labor, taxes on production, and the purchase of produced inputs. Property income for 2016 was $8.2 billion. About $570 million was paid by the aggregates industry in taxes in 2016. Gross Regional Product (GRP) – a type of “value added” – measures the final market value of all goods and services produced in a region. This figure is the sum of earnings, property income, and taxes on production. Total GRP from the quarry industry in 2016 was almost $15 billion.

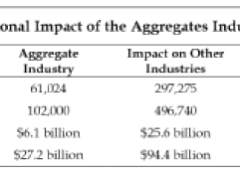

National Impact of the Aggregates Industry

National Impact of the Aggregates Industry

We now turn to estimates of how the aggregates industry contributes to the economy more broadly. In Table 6, the jobs, earnings, and sales multipliers are provided and each is broken into its component parts. These multipliers capture the broadest economic impacts by including government impacts. The aggregates industry – a key input into the construction industry and concrete – is a significant supply chain contributor. Consequently, the industry has high multipliers. As shown in the table, the quarry industry does not have high direct and indirect multipliers. Due in part to the higher than average earnings per worker (and thus more disposable income), the induced multipliers are very high.

Using the multipliers from Table 6, we can extrapolate the effect of the aggregates industry to the national economy. Table 7 summarizes the aggregates industry’s impact on the national economy. The jobs impact is calculated in two ways. First, we apply the multiplier to the 61,042 jobs in the quarry component of the broader aggregates industry. Second, we apply the multiplier to the entire employment base of the aggregates industry estimated by the USGS to be 102,000, which assumes that the multiplier from the quarry industry is equal to the non-quarry jobs in the aggregates industry.

Using the multipliers from Table 6, we can extrapolate the effect of the aggregates industry to the national economy. Table 7 summarizes the aggregates industry’s impact on the national economy. The jobs impact is calculated in two ways. First, we apply the multiplier to the 61,042 jobs in the quarry component of the broader aggregates industry. Second, we apply the multiplier to the entire employment base of the aggregates industry estimated by the USGS to be 102,000, which assumes that the multiplier from the quarry industry is equal to the non-quarry jobs in the aggregates industry.

The aggregates industry exerts a sizable influence on the U.S. economy. In addition to the direct employment in the quarry industry, the economic activity of the industry is associated with an additional 297,275 jobs for a total employment effect of 358,317 jobs. Extending the analysis to the employment of entire aggregates industry, the industry’s economic contribution is nearly 600,000 jobs.27 The industry’s $6.1 billion in earnings (payments to labor and proprietors) ripples through the economy to create an additional $25.6 billion in earnings, for a total of nearly $32 billion in earnings. Including multiplier effects, the aggregate industry’s $27 billion in sales drives nearly $122 billion in total sales through the economy.

The aggregates industry exerts a sizable influence on the U.S. economy. In addition to the direct employment in the quarry industry, the economic activity of the industry is associated with an additional 297,275 jobs for a total employment effect of 358,317 jobs. Extending the analysis to the employment of entire aggregates industry, the industry’s economic contribution is nearly 600,000 jobs.27 The industry’s $6.1 billion in earnings (payments to labor and proprietors) ripples through the economy to create an additional $25.6 billion in earnings, for a total of nearly $32 billion in earnings. Including multiplier effects, the aggregate industry’s $27 billion in sales drives nearly $122 billion in total sales through the economy.

As multipliers are derived from statistical models, it is sensible to include a range of estimates. We present in Table 8 more conservative estimates of the multipliers. In constructing these estimates, both indirect and induced effects are retained, but government impacts are excluded, recognizing that such effects may by policy based rather than economically driven. The differences in the multipliers are limited to the induced component of the multiplier. The multipliers remain large. The aggregates industry drives between 275,000 and 459,000 jobs and nearly $78 billion of economic activity for the American economy. Even these conservative estimates are quite large.

As multipliers are derived from statistical models, it is sensible to include a range of estimates. We present in Table 8 more conservative estimates of the multipliers. In constructing these estimates, both indirect and induced effects are retained, but government impacts are excluded, recognizing that such effects may by policy based rather than economically driven. The differences in the multipliers are limited to the induced component of the multiplier. The multipliers remain large. The aggregates industry drives between 275,000 and 459,000 jobs and nearly $78 billion of economic activity for the American economy. Even these conservative estimates are quite large.

Table 9 shows how the jobs created by the aggregates industry are distributed across broad job classifications. As expected, the initial jobs are concentrated in “Construction and Extraction” and “Transportation and Material Moving” occupations. In the direct supply chain, the most affected occupations include “Office and Administration Support,” “Transportation and Material Moving,” “Management,” “Business and Financial Operations,” Construction and Extraction,” and Sales and Related.” Finally, diverse occupation classes are implicated by the indirect and induced components of the multiplier, but the larger effects include “Sales and Related,” “Office and Administrative Support,” and “Management.”

State-Level Impact of the Aggregates Industry

We turn now to the state-level economic impacts. State multipliers will vary across states and generally be smaller than those calculated at the national level. We also use the more conservative estimates of the multiplier in addressing state-level effects, excluding government effects and thereby reducing the induced multiplier. For instance, the sales multiplier in California is 2.38 (the largest) and in Kentucky only 1.19 (the smallest). Table 10 summarizes the state-level impacts on sales.28 Across all states (for which sufficient data is available), the average sales multiplier is 1.82, which is, as expected, smaller than the national sales multiplier is 2.86 (From Table 7).29

Table 10 shows some sizeable ripple effects. In California, for instance, the $1.52 billion in aggregates sales has a $3.6 billion effect on the state’s economy. Texas’ $2.2 billion in sales ripples through the state’s economy to produce a $4.8 billion total economic effect. A relatively large multiplier in Arizona converts sales of one-half billion dollars to a total effect of nearly one billion dollars. Table 11 summarizes the state-level impacts on jobs, though state-level data is only available for quarry jobs (representing about 60 percent of total aggregates industry employment). Again, the multipliers reported are a weighted average of crushed stone and sand-gravel components based on the relative sales. Across all states, the average sales multiplier is 2.40, which is lower than the national jobs multiplier is 5.87. There is much variation in the levels of the jobs multipliers. The jobs multiplier is 4.67 in Connecticut (the largest) but only 2.07 in Kentucky (the smallest). Even so, a quarry job in Kentucky produces more than one additional job for the state’s economy. In Connecticut, the state’s 486 quarry jobs translate into 2,267 statewide jobs. Texas, the state with the largest quarry work force, has 11,506 statewide jobs resulting from its 4,257 quarry jobs.

The figures in Table 11 represent only the effects of the 61,024 quarry jobs reflected in the impact analysis. Estimates of total employment in the aggregates industry is just over 100,000 jobs. Assuming that the uncounted jobs are distributed across the states in proportional to the number of quarry employees and the multipliers are legitimately applied to these other types of employment, then the magnitude of the effects reported in Table 11 may be understated by about 66 percent. Table 12 offers the total jobs impacts after grossing up the quarry jobs figures for total aggregates industry employment.30

We see that the employment effects are much larger if we adjust the employment level upward to reflect industry estimates. For instance, the 1,831 quarry jobs in Alabama would rise to 3,050 total aggregates industry jobs. Applying the multiplier of 2.34, the total jobs in the state resulting from the aggregates industry is 7,143 jobs. In Texas, the total employment impact of the industry rises from 11,506 to 19,169 statewide jobs.

County-Level Effects of the Aggregates Industry

The aggregates industry operates in every state. Given the high cost of transportation, quarries must be geographically disperse, and thus operate in a large number of the nation’s counties. In fact, 90 percent of aggregates are consumed within 50 miles of the place of extraction.31 Since much of the economic impact is based on induced effects, the economic impact at the county level will be much smaller than either the state or national multipliers. While other areas are certain to benefit from the economic activity of the aggregates industry in any one county, the county level economic impacts do not include these extra-regional effects. To determine the county level economic impacts, and to see how they may vary across counties, we estimated the multipliers for three counties: (1) Larimer County, Colo.; (2) Lancaster County, Pa.; and (3) Talladega County, Ala. To quantify the economic effects of a quarry operation, we compare two states of the county economy: one with active quarry operations to a hypothetical alternative of one without active operations. Table 13 summarizes the key results.

In Larimer County, the aggregates industry produces total earnings for the county of $13 million. About $8.6 million of these earnings come directly from quarry operations (66 percent of the total); $1.8 million from direct effects (multiplier = 0.21); $0.3 million from indirect effects (0.04); and $2.28 million from induced effects (0.26). The aggregates industry supports 341 jobs, with 241 being aggregate industry jobs. The remainder of jobs includes a direct effect of 32 jobs (0.13); an indirect effect of 8 jobs (0.03); and an induced effect of 59 jobs (0.24). The total jobs multiplier for quarry operations is 1.4 for the county. Local, state and federal governments each benefit from approximately $450,000 in tax revenue.

Economic impacts of the quarry industry are much larger in Lancaster County. Earnings amount to $35.8 million, with $23.9 million of those earnings (about 60 percent) coming from the quarry industry. The remainder of the earnings include $4.95 million from direct effects (0.21); $0.7 million from indirect effects (0.04); and $6.2 million from induced effects (0.26). The aggregates industry supports a total of 585 jobs in the county, 351 of which are quarry jobs. The remainder of jobs includes a direct effect of 81 jobs (0.23); an indirect effect of 15 jobs (0.04); and an induced effect of 39 jobs (0.39). The total jobs multiplier for quarry operations is 1.66 for the county. Local and state each benefit from nearly $2 million in tax revenue, while the federal government receives about $2.4 million in tax revenue.

Finally, in Talladega County, total earnings in the county from the economic influence of the quarry industry are $36 million, the vast majority of which ($30 million, or 83 percent) comes directly from the quarry industry. Relative to the other two counties, the earnings effects are highly concentrated in the aggregates industry. The direct effect on earnings equals $2.9 million (0.10); the indirect effect sums to only $0.23 million (0.01); and the induced effect equals $2.8 million (0.09). Of the 509 total employment effect of the quarry industry, 354 are quarry jobs. The remainder include the direct effect of 68 jobs (0.10); the indirect effect of 7 jobs (0.02); and the induced effect of 80 jobs (0.23). The jobs multiplier is 1.35. Local and state governments each receive about $1.8 million in tax revenues, and the federal government receives $1.5 million in tax revenues.

The local impacts are also smaller than the statewide impacts, and much smaller than the national effects, and these differences may be of some significance, depending on the purpose of quantifying these sorts of economic impacts. Moreover, as indicated by these three cases, the multipliers do vary significantly across counties. Consequently, the accurate assessment of local economic impacts requires the quantification of impacts for the specific economic areas of interest.

Table 14 summarizes the types of industries affected by the jobs impact of quarry operations. As would be expected, the initial effect on the mining/quarrying/extraction industry is the largest. Outside of these initial effects, the construction, retail, professional/technical services, transportation, and healthcare have the largest effects. In light of the large induced effects, many sectors of the economy are impacted by the aggregates industry.

Table 15 describes the types of occupations – classified broadly – impacted by the aggregates industry. The bulk of the types of jobs impacted include occupations related to construction, extraction, transportation, production and administration (72 percent of the total). Sales and management occupations are also materially affected. A large number of other occupations are impacted by the industry (grouped into “Other”), though their individual job counts are small at the county level.

Other Economic Impacts of the Aggregates Industry

As demonstrated above, the aggregates industry provides significant benefits – e.g., sales, earnings and jobs – to local and state economies, and the nation. However, even after all of the usable material has been extracted, the economic benefits from quarries can continue for years to come via innovative reclamation plans. While many fear that an abandoned quarry will be an eyesore, this fear is misplaced. Quarry operators are often required by law to reclaim quarries for the protection of the environment and for subsequent beneficial use of the quarry and reclaimed land.32 Among other requirements, these protections often include the mandatory requirement that quarry operators both file a reclamation plan and post a performance bond as a prerequisite condition for obtaining a quarry permit in the first instance.33

The techniques used to maximize reclamation have evolved and innovated over time. These modern techniques include, but are certainly not limited to: (1) rollover slopes; (2) backfilling; (3) bench planting restoration; (4) blasting; and (5) natural recovery.34 As highlighted below, the reclamation results are often stunning.35

Brownstone Park (Connecticut)

Starting in the early 1990s, this quarry was converted into an adventure park featuring a variety of outdoor activities, including cliff-jumping, rock climbing, swimming, kayaking, scuba diving, climbing and rappelling, wakeboarding, rope-swings, 750-ft. zip-lining, a 100-ft. water slide and inflatable water toys. Brownstone Park has successfully yielded high revenue for the city due to the increasing number of visitors that attend the park every year as well as a large number of employment opportunities. Monitoring of the area by park lifeguards and police officers has eliminated safety hazards posed by the quarry lake prior to redevelopment. Not only does the adventure park re-use the land, but it stimulates outdoor activities that bring people out of their homes and into nature.36

Citiva (San Diego, Calif.)

Located in the center of San Diego, Calif., this quarry had served as the major stone and concrete source for construction projects in the region for the last 70 years, including the downtown baseball stadium of the San Diego Padres and airport runways. After nine years of planning, a plan to develop the old quarry was approved by the San Diego City Council by a vote of 7-1. In 2010, the developers broke ground on Civita and the first homes were occupied in 2011. In 2013, following hundreds of public meetings and 10 years of planning, the San Diego Parks and Recreation Board approved the design of Civita’s central park, Civita Park. The 230-acre Civita project is one of the largest examples of “urban infill,” which is the development of vacant or underused city sites, in the U.S. In all, the Civita development plans call for 60 to 70 acres of parks and open space, 4,780 residences (including approximately 478 affordable units), an approximately 480,000-sq.-ft. retail center, and 420,000 sq. ft. for an office/business campus. The $2 billion Civita project will ultimately create a high-density urban village organized around a network of parks and open space, with housing, retail, office and civic components linked by pedestrian trails, walkable streets and bike paths.37

Fantasy Lake Scuba Park (Wake Forest, N.C.)

About 30 years ago, reclamation efforts began at Fantasy Lake to convert a 100-year-old quarry into a unique scuba diving recreational and training park. Recently referred to by the Raleigh News & Observer as “a scuba diving mecca,” the lake is ideal for building scuba diving experience and advancing certification. The lake is recognized by dive groups, rescue groups, law enforcement and the military as an excellent facility for advanced training. The great expanse, visibility and depths of the lake set it apart from smaller facilities.38

The Quarry Golf Course (Giants Ridge Resort, Minn.)

Sculpted out of a former sand quarry, the Quarry at Giants Ridge is an excellent example of a repurposed industrial site and it is a fitting tribute to northeastern Minnesota’s rich mining history. Today, the Quarry is the number one public golf course in Minnesota, according to Golf Digest. Since its opening, it has also been ranked in the top 20 public courses in the United States every year it has been eligible.39

Six Flags (San Antonio)

This amusement park occupies ground that once provided material to build the surrounding community. The former limestone quarry first produced aggregates in 1934 in a much less developed location compared to the San Antonio of the 21st century.40 According to Theme Park Review, Six Flags Fiesta Texas is the most picturesque park in the Six Flags chain because the former rock quarry “creates a backdrop for the park and allows for some unique interaction between rides.”41

Chambers Bay Golf Course (Puget Sound, Wash.)

Chambers Bay is a public golf course in the northwest United States, located in University Place, Wash., on Puget Sound southwest of Tacoma.42 Formerly a sand and gravel quarry, within 10 years of starting reclamation the site went from an abandoned quarry to a world-class golf course which hosted 2015 U.S. Open Golf Championship in 2015.43

Conclusion

In this SCORECARD, we demonstrate that the aggregates industry – crushed stone, sand and gravel – is a significant contributor to the economic wellbeing of the United States. Not only does the aggregates industry generate $27 billion in annual sales and employ 100,000 workers at above-average wages, but the economic activity in the sector has large effects on other industries. The industry supports $122 billion in national sales, $32 billion in national earnings (i.e., wages), and between 364,000 and 600,000 jobs across a wide range of occupations and industries.

Each job in the aggregates industry supports an additional 4.87 jobs throughout the economy; each dollar of earnings (i.e., wages) creates another $4.19 of earnings in other sectors; and each dollar of sales in the industry produces another $3.47 of sales in other industries.

The effect of the aggregates industry is both large and diverse. Proposals to expand infrastructure spending to repair and expand the nation’s crumbling infrastructure portends a higher demand for the aggregates industry’s outputs and, in turn, a positive and material impact on jobs, earnings and sales in many sectors of the nation’s economy.

George S. Ford, PhD., is chief economist and Lawrence J. Spiwak, Esq., is president of the Phoenix Center for Advanced Legal and Economic Public Policy Issues. Reprinted with Permission.

-

Citations

-

1 Failure To Act Closing The Infrastructure Investment Gap For America’s Economic Future (UPDATE), American Society of Civil Engineers (May 2016) (available at: http://www.infrastructurereportcard.org/wp-content/uploads/2016/05/ASCE-Failure-to-Act-Reportfor-Web-5.23.16.pdf).

-

2 Id. at p. 13.

-

3 Id.

-

4 Id. at p. 14. See also B. Borzykowski, Cashing In on Trump’s $1 Trillion “Rebuilding America” Plan, CNBC (January 12, 2017) (“Repairing roads also has an economic benefit beyond new construction jobs – a smoother ride gets people to work faster, said Dennis Mitchell, the Toronto-based manager of Sprott Asset Management’s Global Infrastructure Fund. “There’s tangible benefit to spending money here,” he said. “Improving roads to get people from A to B faster and more efficiently reduces unproductive time.”) (available at: http://www.cnbc.com/2017/01/12/cashing-in-on-trumps-1-trillion-rebuilding-americaplan. html).

-

5 See, e.g., Hillary Clinton, Fixing America’s Infrastructure (available at: https://www.hillaryclinton.com/issues/fixing-americas-infrastructure) (“In my first 100 days as president, I will work with both parties to pass a comprehensive plan to create the next generation of good jobs. Now the heart of my plan will be the biggest investment in American infrastructure in decades, including establishing an infrastructure bank that will bring private sector dollars off the sidelines and put them to work there”); Bernie Sanders (“Our nation’s infrastructure is collapsing, and the American people know it. Every day, they drive on roads with unforgiving potholes and over bridges that are in disrepair. [ ] That is why I have proposed the Rebuild America Act, to invest $1 trillion over five years to modernize our infrastructure.”) (available at: https://berniesanders.com/issues/creating-jobs-rebuilding-america). 6 See, e.g., R. Bradley, What You Need to Know About Donald Trump’s $1 Trillion Infrastructure Plan, FORTUNE (December 21, 2016) (available at: http://fortune.com/2016/12/21/donald-trump-publicinfrastructure- building); M. Zanona, Trump’s Infrastructure Plan: What We Know, THE HILL (January 13, 2017) (available at: http://thehill.com/policy/transportation/314095-trumps-infrastructure-plan-whatwe- know).

-

7 Slide Presentation: The American Recovery and Reinvestment Act of 2009 (ARRA), Enacted February 17, 2009, US Department of Transportation, Federal Highway Administration (available at:

-

http://www.fhwa.dot.gov/economicrecovery/arrapresentationfinal05012009.ppt).

-

8 D. E. Sullivan, Materials in Use in U.S. Interstate Highways, U.S. Geological Survey (2006) (available at: https://pubs.usgs.gov/fs/2006/3127/2006-3127.pdf).

-

9 V.V. Tepordei, Natural Aggregates—Foundation of America’s Future, U.S. Geological Survey (1997) (available at: https://minerals.usgs.gov/minerals/pubs/commodity/aggregates/fs14497.pdf).

-

10 http://www.economicmodeling.com. We are grateful to John Hawkins and his team at Emsi for their support in the production of the economic impact measures used in this report. Any errors in the use of Emsi’s materials are our responsibility alone.

-

11 H. Galloway, EMSI’s Input-Output Model Multipliers: A Brief Overview and Comparison with Other Major Models, EMSI Resource Library (October 2007) (available at: http://www.economicmodeling.com/wpcontent/ uploads/2007/10/ed_multiplier_methodology_comparison.pdf).

-

12 Id. at 2 (“we have also realigned our multipliers to be more conservative in hopes that they will better reflect local, sub-regional, and regional economies.”); see also S. Kim and C. Miller, An economic model comparison of EMSI and IMPLAN: Case of Mistletoe Marketplace, TOURISM ECONOMICS (2016) (available at: http://dx.doi.org/10.1177/1354816616656420).

-

13 We include the following North American Industry Classification System (“NAICS”): 212312, 212313, 212319, and 212321.

-

14 Minerals Commodities Summaries, USGS (Multiple Years): Crushed Stone (available at: https://minerals.usgs.gov/minerals/pubs/commodity/stone_crushed) and Construction Sand and Gravel (available at: https://minerals.usgs.gov/minerals/pubs/commodity/sand_&_gravel_construction

-

15 Mineral Commodities Summary, USGS (2017) at p. 143 (available at: https://minerals.usgs.gov/minerals/pubs/commodity/sand_&_gravel_construction/mcs-2017- sandc.pdf).

-

16 www.bls.gov (Series CEU1021231003, CEU3000000003).

-

17 S.B. Bhagwat, Cost of Transportation of Construction Aggregates in Illinois in 2014, Illinois State Geological Survey, Circular 587 (2014) at pp. 3-4 (available at: https://www.isgs.illinois.edu/sites/isgs/files/files/publications/47th-Forum- Bhagwat_replacement%2012-3-15_one.pdf).

-

18 G.R. Robinson Jr. and W.M. Brown, Sociocultural Dimensions of Supply and Demand for Natural Aggregate – Examples from the Mid-Atlantic Region, U.S. Geological Survey Open-File Reports 02-350 (2002) (available at: https://pdfs.semanticscholar.org/1ab0/7216ed1bd79d4dd0310542bd67e57d0cede2.pdf).

-

19 50 Fascinating Facts About Stone, Sand & Gravel, National Stone, Sand & Gravel Association (Undated) (available at: http://msgravel.com/assets/1312/50facts.pdf); Natural Aggregate: Building America’s Future, U.S. Geological Survey Circular 110 (1993) (available at: https://pubs.usgs.gov/circ/1993/1110/report.pdf).

-

20 USGS, Mineral Commodities Summaries, Crushed Stone and Construction Sand 20 USGS, Mineral Commodities Summaries, Crushed Stone and Construction Sand and Gravel (2017) (available at: https://minerals.usgs.gov/minerals/pubs/commodity/sand_&_gravel_construction/mcs- 2017-sandc.pdf; https://minerals.usgs.gov/minerals/pubs/commodity/stone_crushed/mcs-2017- stonc.pdf).

-

21 The series are measured in current dollars and scaled for purposes of the illustration.

-

22 The S&P CoreLogic Case-Shiller Home Price Indices track changes in the value of residential real estate both nationally as well as in 20 metropolitan regions (available at: http://us.spindices.com/indexfamily/ real-estate/sp-corelogic-case-shiller). Data available at: https://fred.stlouisfed.org/series/CSUSHPINSA.

-

23 J.J. Wilson, The Aggregates Business in the U.S.A., Presentation by the President of the National Stone, Sand & Gravel Association (Undated) (available at: https://ioqnz.co.nz/uploads/JoyWilson-NZ.pdf).

-

25 See, e.g., K. Byun, The U.S. Housing Bubble and Bust: Impacts on Employment, 133 Monthly Labor Review 3-17 (2010) (available at: https://www.bls.gov/opub/mlr/2010/12/art1full.pdf); I.G. Ellen and S. Dastrup, Housing and the Great Recession, Stanford Center on Poverty and Inequality (2012) (available at: http://furmancenter.org/files/publications/HousingandtheGreatRecession.pdf). The “Great Recession” dates between December 2007 to June 2009 (http://www.nber.org/cycles.html).

-

27 Authors’ calculations.

-

28 The multipliers reported are a weighted average of crushed stone and sand-gravel components based on the relative sales.

-

29 This is weighted-average based on sales.

-

30 Authors’ calculations.

-

31 50 Fascinating Facts, supra n. 19; see also Natural Aggregate: Building America’s Future, U.S. Geological Survey Circular 110 (1993) (available at: https://pubs.usgs.gov/circ/1993/1110/report.pdf).

-

32 See, e.g., West Virginia Quarry Reclamation Act, 22 West Virginia Code Chapter 4, § 22-4-17 et seq.

-

33 See, e.g., id., § 22-4-17; § 22-4-20. 34 See, e.g., I.A. Legwalla, E. Lange and J. Cripps, Quarry Reclamation in England: A Review of Techniques,

-

34 Journal American Society Of Mining And Reclamation 55 (2015).

-

35 See, e.g., B. Pack, Old Quarries Turned into Gold Mines, SAN ANTONIO EXPRESS NEWS (August 11, 2015) (available at: http://www.expressnews.com/150years/economy-business/article/Old-S-A-quarries-aresuccessfully- redeveloped-as-6438913.php).

-

36 C. McCandless, No Longer Just a Hole in the Ground: The Adaptive Re-Use of Resource Depleted Quarries, MIT (2013) (available at: http://www.mit.edu/people/spirn/Public/Ulises-11-308/Quarrying.pdf).

-

37 R. Showley, Construction Starts on Mission Valley’s Largest Development, San Diego Union-Tribune (December 1, 2013) (available at: http://www.sandiegouniontribune.com/business/growthdevelopment/ sdut-civita-begins-mission-valley-2010dec01-story.html).

-

38 Fantasy Lake Scuba Park webpage (available at: http://www.fantasyscubapark.com/about_us.htm).

-

39 Wild North Golf (available at: http://www.wildnorthgolf.com/northern-minnesota-golfcourses/ the-quarry-at-giants-ridge).

-

40 Sunrock Group (http://www.thesunrockgroup.com/sustainable-development/environmentalstewardship).

-

41 Theme Park Review (available at: http://www.themeparkreview.com/parks/park.php?pageid=47).

-

43 D. Sheinin, In 10 Years, Chambers Bay Went from Abandoned Quarry to U.S. Open Host, Washington Post (June 17, 2015) (available at: https://www.washingtonpost.com/sports/golf/in-10-years-chambersbay- went-from-abandoned-quarry-to-us-open-host/2015/06/17/d9d16106-14f6-11e5-9518- f9e0a8959f32_story.html?utm_term=.d0df062b3473).