In This Quarterly Report, Provided Exclusively to Rock Products, Capstone Partners Offers Insight Into Merger and Acquisition Activity, Capital Markets Trends, Aggregate Production and Pricing.

By Darin Good, Brian Krehbiel and Crista Gilmore

Capstone Partners’ Building Products & Construction Services Team is pleased to share its ltest Rock Products Aggregates Industry Market Report. Aggregates sector players have continued to seek attractive consolidation opportunities through year-to-date (YTD) 2023. While elevated interest rates have challenged the sector, demand has remained robust for many market participants. Several additional key takeaways are outlined below.

- Backlogs have largely remained healthy across the Aggregates space which has fueled optimism for continued growth in 2024.

- Public companies in the sector have outperformed broader markets, benefiting from a healthy aggregates pricing backdrop.

- Merger and acquisition (M&A) activity has moderated compared to the prior year, however, large strategics have continued to optimize their business portfolios and create acquisition opportunities.

- While aggregates shipments have tracked lower for many sector participants, increases in materials prices have helped drive robust revenues.

Introduction

In this quarterly report, also published by Rock Products, Capstone Partners provides insight into recent mergers & acquisitions, capital markets trends, aggregates production, and pricing data.

Capstone’s Building Products & Construction Services Team advises industry business owners, entrepreneurs, executives, and investors in the areas of M&A, capital raising, and various special situations. Due to our extensive background and laser focus within the industry, Capstone is uniquely qualified and has an unparalleled track record of successfully representing Building Products & Construction Services companies.

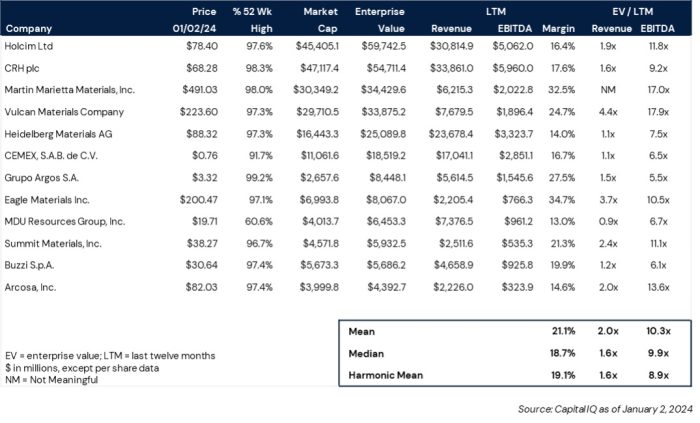

Public Company Commentary

Aggregates players have demonstrated healthy returns in public markets with many leading sector participants’ stock prices trading near 52-week highs.

Aggregates Players Outpace Broader Markets In 2023

Public companies in the Aggregates sector have continued to outperform broader equity markets with Capstone’s Aggregate Materials index climbing 41.6% over the past one-year period. While broader equity markets have registered healthy performance, favorable pricing dynamics and persistent construction demand have propelled Aggregates sector players above many other industries.

Favorable Pricing And Aggregates Spending Drives Demand

A favorable pricing environment and steady demand for aggregates-intensive projects have fueled growth in the Aggregates space through year end. Leading public companies have captured elevated revenues through YTD and cost control initiatives have yielded healthy levels of profitability. Leading aggregates and heavy building materials supplier, Martin Marietta (NYSE:MLM), grew gross profit in its Aggregates segment by 32.1% year-over-year (YOY) in Q3, supported by a 20% increase in prices, according to its earnings release.1 Martin Marietta’s Cement segment experienced a similar trend with gross profit rising 61.5% YOY as pricing growth of 18.9% YOY offset relatively flat shipments. The pricing power of leading Aggregates players has demonstrated the sector’s defensibility—with large players able to capture outsized profit growth despite lower volume levels. Moving into 2024, substantial infrastructure funding and healthy state and local budgets are expected to drive continued demand for Aggregates sector players.

Construction backlogs have remained healthy approaching year-end, rising to 8.5 months in November from 8.4 months in October, according to Associated Builders and Contractors.2 However, compared to the prior year, backlog levels have fallen 0.7 months. While the Commercial and Institutional and Heavy Industrial segments have registered declines in contracted work YOY, the Infrastructure segment has benefited from robust project visibility. In November, Infrastructure backlogs rose 1.2 months YOY to 7.9 months.

Despite elevated interest rates, contractors expect sales, profit margins, and staffing levels to expand over the next six months—supporting sector optimism heading into the new year. Sector players are expected to continue to actively manage their business portfolio to drive efficiencies, which is likely to provide ample M&A opportunities. Privately-owned players with strong gross margins, substantial revenue visibility, and a footprint in attractive regions, are poised to continue to garner buyer interest.

M&A Volume Slows, Strategics Continue To Seek Acquisitions

M&A volume in the Aggregates sector has moderated through YTD 2023, falling 35.7% YOY to 83 transactions announced or completed. An elevated cost of capital has encouraged greater discipline and selectivity among buyers in their acquisition pursuits. However, favorable infrastructure spending and the need for aggregates-intensive projects have contributed to steady cash flows for many potential target companies. As valuable construction bidding opportunities have continued to come to market, sector players have recognized the need to scale capabilities, often through inorganic growth.

Strategic acquirers have continued to drive the majority of deal activity, comprising 74.7% of YTD transaction volume. Public strategics have actively pruned their portfolios to create more streamlined, optimized business segments—which has given rise to significant acquisition opportunities for other sector players. Notably, CRH (NYSE:CRH) announced its acquisition of a portfolio of cement and ready-mixed concrete assets from Martin Marietta (NYSE:MLM) for an enterprise value of $2.1 billion, equivalent to 12.4x EV/EBITDA (more details on next page). Large public strategics are expected to remain ready buyers for divested assets of other sector players as they continue to seek cost synergies to drive economies of scale.

Financial buyers have found it difficult to compete with strategics in the M&A market and have comprised a modest 25.3% of YTD transactions. Private equity buyers typically plan to realize their investments within a five -to seven-year time horizon—which is often not conducive to the time period required to drive profits from a newly constructed aggregates production plant. Sponsors have typically focused on businesses with an established footprint, further downstream from the production process. Notably, Clayton, Dubilier & Rice-backed White Cap acquired Form Tech Concrete Forms, a provider of concrete forming and shoring rental equipment (July, undisclosed).

Private Equity Activity

GF Dataprovides quarterly data from over 200 private equity firm contributors on the number of completed transactions. The data, although not industry specific, demonstrated a continued decline in Total Debt/EBITDA multiples, which fell to 3.7x through Q3. However, TEV/EBITDA multiples appreciated quarter-over-quarter (QoQ) to 7.5x.

Leading Strategics Turn To Portfolio Management

Large public companies in the Aggregates space have increasingly examined their business segments to create more optimized and streamlined operations. This has spurred transaction activity as sector players have continued to drive consolidation of the market.

Transaction Overview

CRH agreed to acquire a portfolio of cement and ready-mixed concrete assets in Texas from Martin Marietta for an enterprise value of $2.1 billion, equivalent to 12.4x EV/EBITDA (November). The assets comprise a 2.1 metric ton capacity cement plant, a network of terminals, and a portfolio of 20 ready-mixed concrete plants, according to a press release.3

M&A and Sector Takeaways

The acquisition strengthens CRH’s position in the high-growth Texas market and is expected to result in attractive synergies and self-supply opportunities. It also demonstrates CRH’s commitment to growing its U.S. footprint. Notably, following the announcement of the acquisition, CRH communicated plans to divest its lime operations in Europe to SigmaRoc (AIM:SRC) for an enterprise value of $1.1 billion, equivalent to approximately 7.9x EV/EBITDA (November). As infrastructure spending and federal support for construction remains robust, leading strategics are expected to continue to expand their presence in the U.S.

Transaction Overview

Summit Materials (NYSE:SUM) entered into a definitive agreement with Cementos Argos (BVC:CEMARGOS) under which Summit will combine with Argos USA for an enterprise value of $3.2 billion, equivalent to approximately 10.0x EV/EBITDA (September). Argos USA operates four integrated cement plants, nearly 140 ready-mix plants, and eight ports, according to a press release.4

M&A and Sector Takeaways

The combination of Summit Materials and Argos USA will create a leading cement platform with over $4 billion in revenue. The transaction provides Summit with a national footprint, geographic diversification, and enhanced capabilities. In addition, the transaction is expected to drive synergies in excess of $100 million per year and increase Summit’s Aggregates and Cement EBITDA by 78% and 70%, respectively, according to the press release.

Select Transactions

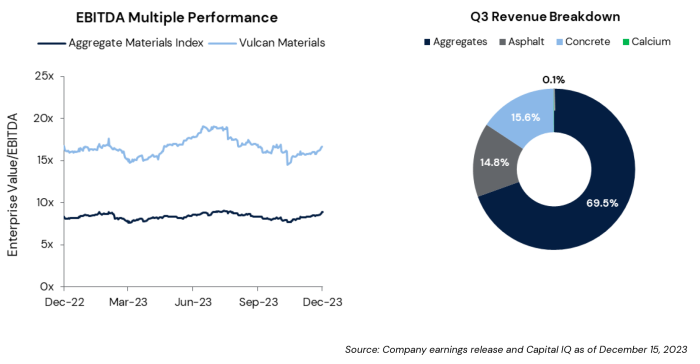

Vulcan Continues To Record Healthy Profitability Levels

Company Description

Robust pricing growth and steady end market demand have driven healthy operating performance for Vulcan Materials (NYSE:VMC) through YTD 2023. In Vulcan’s Aggregates segment, gross profit increased 17% YOY in Q3 with gross margin rising 200 basis points, according to its earnings release.5 Favorable pricing momentum, evidenced by the freight-adjusted price of aggregates growing 15% YOY, helped drive strong segment results. Vulcan’s Asphalt segment experienced a similar trend, with gross profit margin expanding 660 basis points YOY.

“We expect 2024 to be another year of earnings growth and strong cash generation. Geographic footprint is important, from both a diversification and growth standpoint, and ours is unmatched. Leading indicators remain supportive of continued growth in public construction activity, and we are well positioned in high growth markets where the need is greatest,” commented Tom Hill, Vulcan Materials’ Chairman and CEO, in the company’s earnings release.

Vulcan has noted aggregates prices exceeding historic levels in recent quarters which has supported top line growth. In addition, its portfolio optimization initiatives, including its disposition of its Texas concrete assets, have been received favorably by public markets. Through YTD, Vulcan’s total return has amounted to 29.9%—outpacing the S&P 500 and in line with the broader Aggregate Materials Index. Moving towards 2024, Vulcan is expected to continue to benefit from a healthy backdrop of infrastructure spending and robust state and local government budgets.

Source: Company earnings release and Capital IQ as of December 15, 2023

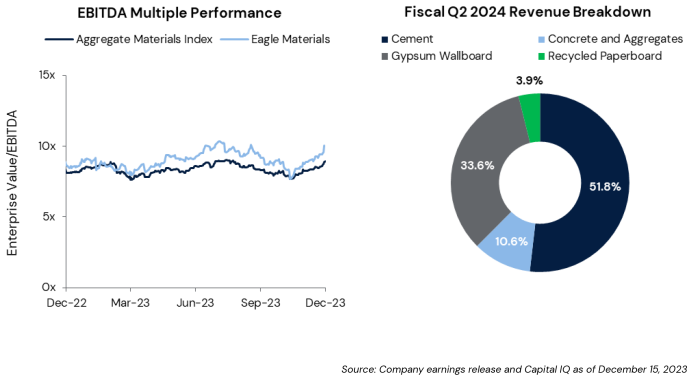

Eagle Materials Garners Strong Public Market Performance

Company Description

Robust infrastructure contract activity and manufacturing construction fueled record revenues for Eagle Materials, with sales rising 3% YOY to $622.2 million in its fiscal Q2 2024, according to its earnings release.6 Eagle Materials’ Heavy Materials segment largely drove revenue gains, experiencing a YOY increase of 10%, mainly attributed to higher cement sales prices. Concrete and aggregates volumes experienced a deceleration, which led to revenue declines of 5%, which were slightly offset by elevated concrete pricing. Sales in Eagle Materials’ Light Materials segment fell 8% YOY in its most recent quarter on the heels of lower wallboard and paperboard volumes and moderation in paperboard pricing.

“Market conditions for our construction materials remained resilient during the quarter, even as the Fed continued to raise interest rates and tighten money supply to contain inflation,” commented Michael Haack, President and CEO, in the company’s earnings release.

Eagle Materials has been among the standouts in the Aggregates sector in the public markets, with total return amounting to 53.6% YTD. Eagle Materials has also engaged in inorganic growth to bolster its cement distribution network and production capacity. Notably, Eagle acquired Martin Marietta’s cement import and distribution business in northern California in May. Terms of the transaction were not disclosed. M&A will likely serve as a key lever for strategics in the new year as sector players seek enhanced scale, capacity, and an expanded geographic footprint.

Source: Company earnings release and Capital IQ as of December 15, 2023

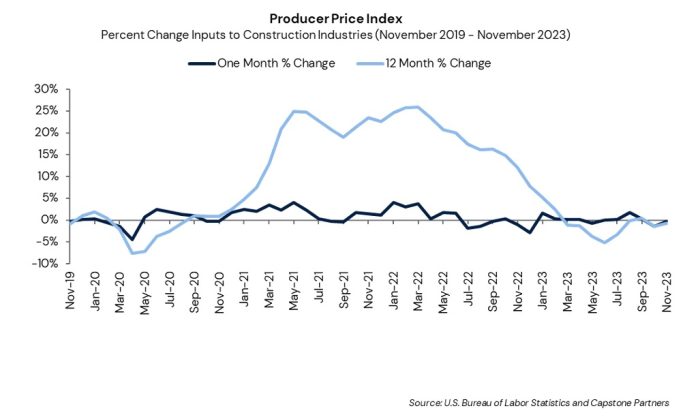

Construction Materials Update

Construction input prices have continued to moderate through November, falling 0.3% MoM and 0.8% YOY, according to the Bureau of Labor Statistics.7

Aggregate Materials Update

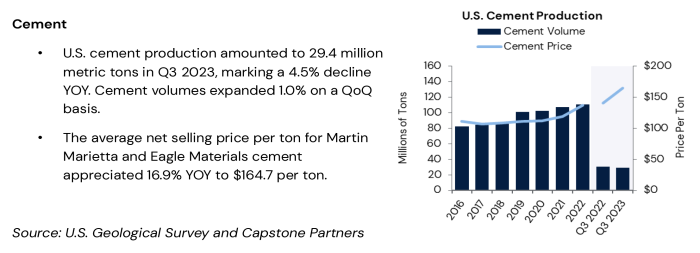

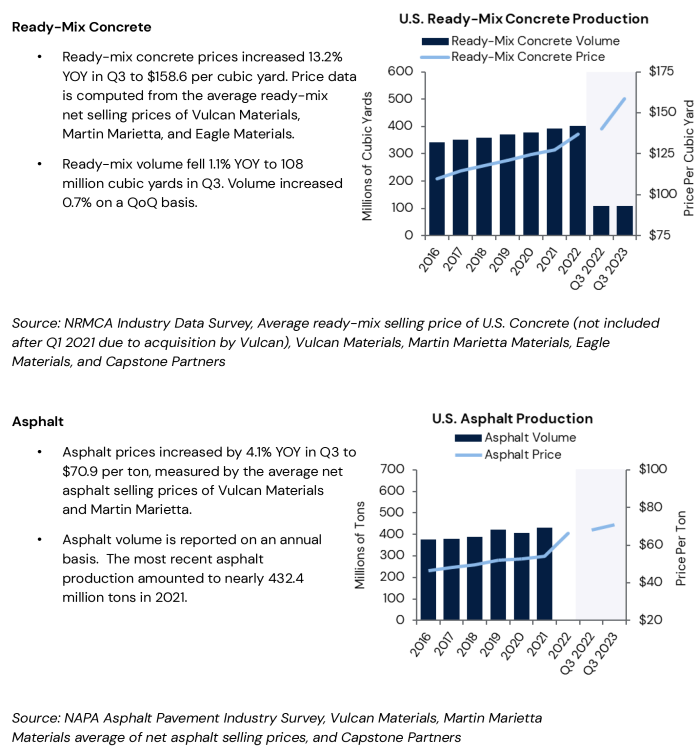

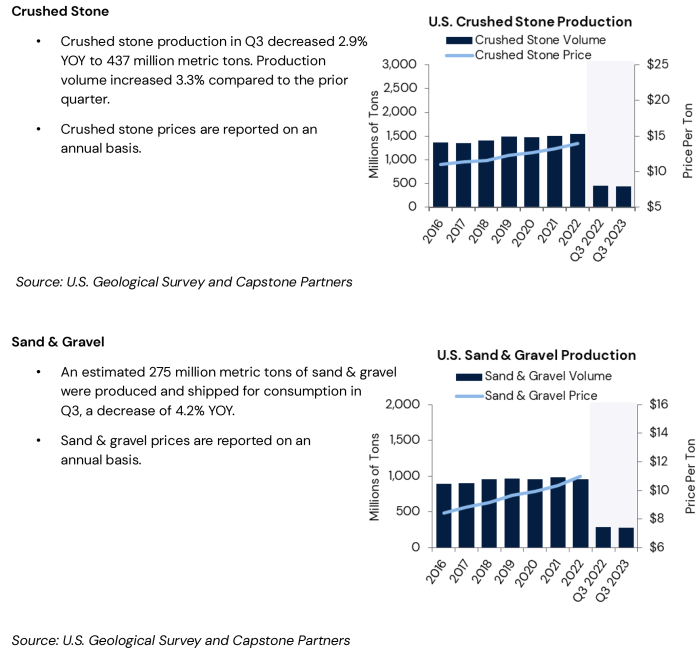

Pricing has improved across all aggregate materials through Q3, with cement prices experiencing the largest YOY expansion at 16.9%.

ENDNOTES

- Martin Marietta, “Martin Marietta Reports Third-Quarter 2023 Results,” https://ir.martinmarietta.com/news-releases/news-release-details/martin-marietta-reports-third-quarter-2023-results, accessed December 18, 2023.

- Associated Builders and Contractors, “ABC’s Construction Backlog Indicator Inches up in November, Contractors Remain Confident,” https://www.abc.org/News-Media/News-Releases/abcs-construction-backlog-indicator-inches-up-in-november-contractors-remain-confident, accessed December 18, 2023.

- CRH, “CRH agrees $2.1bn acquisition of materials assets in Texas,” https://www.crh.com/media/press-releases/2023/crh-agrees-acquisition-of-materials-assets-in-texas, accessed December 18, 2023.

- Summit Materials, “Summit Materials to Combine with Argos USA, Creating a Materials-led Enterprise with National Scale,” https://investors.summit-materials.com/news-events/press-releases/news-details/2023/Summit-Materials-to-Combine-with-Argos-USA-Creating-a-Materials-Led-Enterprise-with-National-Scale/default.aspx, accessed December 18, 2023.

- Vulcan Materials, “Vulcan Reports Third Quarter 2023 Results,” https://ir.vulcanmaterials.com/news/news-details/2023/VULCAN-REPORTS-THIRD-QUARTER-2023-RESULTS/default.aspx, accessed December 18, 2023.

- Eagle Materials, “Eagle Materials Reports Record Second Quarter Results With 15% EPS Growth,” https://ir.eaglematerials.com/news-releases/news-release-details/eagle-materials-reports-record-second-quarter-results-15-eps, accessed December 18, 2023.

- U.S. Bureau of Labor Statistics, “PPI Commodity Data,” https://data.bls.gov/timeseries/WPUIP2300001, accessed December 18, 2023.

Capstone Partners has developed a full suite of corporate finance solutions, including M&A advisory, debt advisory, financial advisory, and equity capital financing to help privately owned businesses and private equity firms through each stage of the company’s lifecycle, ranging from growth to an ultimate exit transaction.

To learn more about Capstone’s wide breadth of advisory services and Building Products & Construction Services industry knowledge, please click here. [https://www.capstonepartners.com/contact/]

Disclosure

This report is a periodic compilation of certain economic and corporate information, as well as completed and announced merger and acquisition activity. Information contained in this report should not be construed as a recommendation to sell or buy any security. Any reference to or omission of any reference to any company in this report should not be construed as a recommendation to buy, sell or take any other action with respect to any security of any such company. We are not soliciting any action with respect to any security or company based on this report. The report is published solely for the general information of clients and friends of Capstone Partners. It does not take into account the particular investment objectives, financial situation or needs of individual recipients. Certain transactions, including those involving early-stage companies, give rise to substantial risk and are not suitable for all investors. This report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Prediction of future events is inherently subject to both known and unknown risks and other factors that may cause actual results to vary materially. We are under no obligation to update the information contained in this report. Opinions expressed are our present opinions only and are subject to change without notice. Additional information is available upon request. The companies mentioned in this report may be clients of Capstone Partners. The decisions to include any company in this report is unrelated in all respects to any service that Capstone Partners may provide to such company. This report may not be copied or reproduced in any form or redistributed without the prior written consent of Capstone Partners. The information contained herein should not be construed as legal advice.