Decoding A Decade of Trends in U.S. Aggregate Mining.

By Jake Tanner

In the ever-evolving world of aggregate mining, understanding the past can be the compass to navigating the future. At Burgex, we’ve always been driven by a thirst for knowledge and a passion for exploration – both underground and within data. Our latest mission? Diving deep into the historical intricacies of the Aggregate Mining Market across the United States in building and expanding our Mineralocity Aggregates platform.

By meticulously amalgamating data from various sources and analyzing changes in work hours, acquisitions and production estimates for key players, we’ve managed to paint a timeline spanning a very transformative decade.

Navigating the Landscape of Aggregate Giants

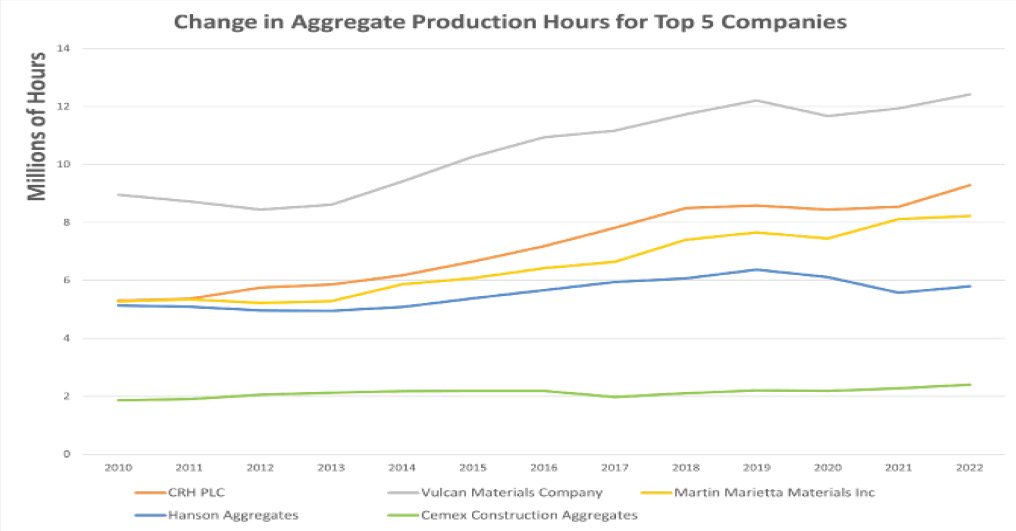

When it comes to the titans of the aggregate industry, the dynamics of their operational prowess are nothing short of fascinating. Over the past decade, five major companies have carved out their niches, each navigating the tumultuous terrains of market demands, geopolitical shifts, and technological innovations. Vulcan Materials Co., CRH PLC, Heidelberg Cement AG, Cemex Construction Aggregates, and Martin Marietta Materials Inc. have been at the vanguard of this evolution.

But rather than inundate you with a deluge of data, we’ve encapsulated their trajectories in a visually compelling format. The following graph paints a vivid picture, illustrating the changing rhythms of aggregate production hours across these industry juggernauts from 2010 to 2022. The sinuous lines not only capture the ups and downs but also whisper tales of resilience, adaptation and ambition.

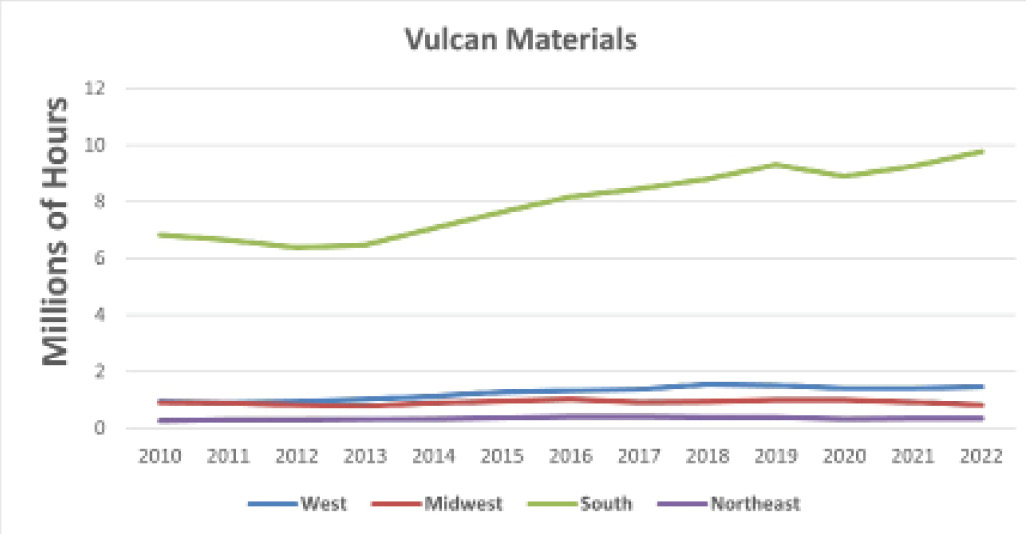

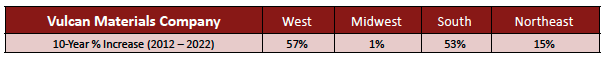

In our ongoing mission to shed light on the production dynamics of major players in the construction aggregate industry, we at Burgex have painstakingly analyzed their regional efforts across the United States over the past decade. The findings, which we present below, paint a vivid picture of where each company has channeled its energies.

Over the decade, Vulcan has been unmistakably biased towards the South in terms of growth and production, with only marginal expansions in other regions.

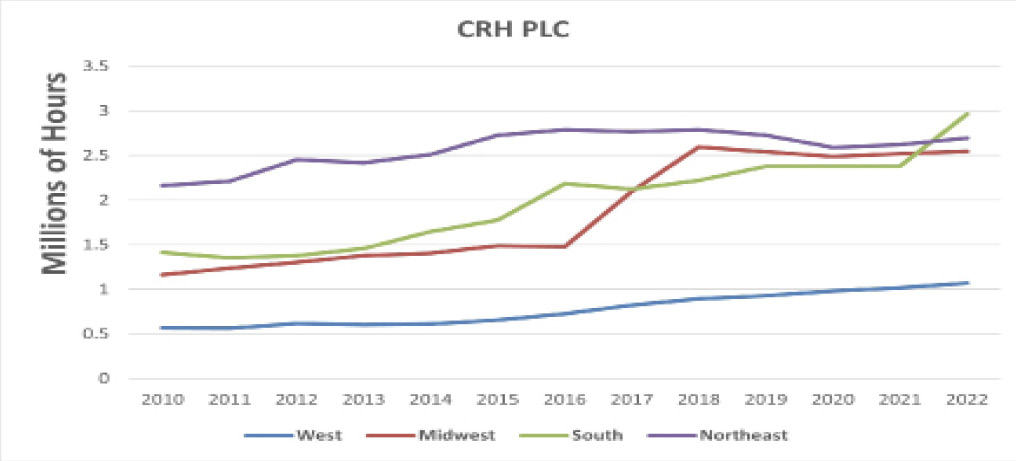

Observation reveals a concerted push by CRH in both the Midwest and South, with production levels increasing significantly. However, their endeavors in the Northeast appear to have plateaued.

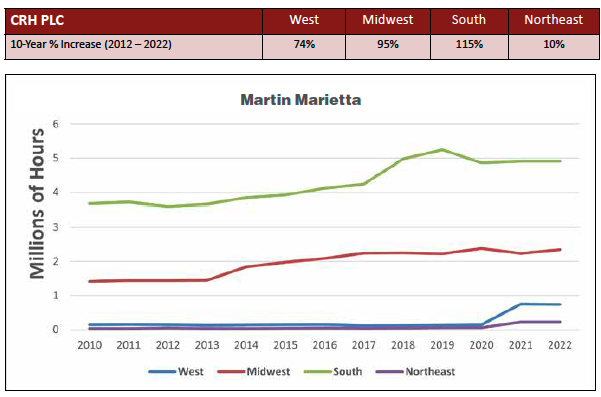

The past 10 years have seen Martin Marietta fortifying its production in the South and Midwest. Intriguingly, they’ve embarked on a new journey in the West, likely buoyed by recent acquisitions, leading to staggering growth.

In the ever-evolving world of construction aggregates, understanding production metrics offers a nuanced perspective on industry trends and corporate strategies. Over the last decade, a noticeable pattern has emerged. Observing the top five aggregate companies based on production hours provides clarity on this trend: aggregate production is soaring, matched by an increase in labor hours to meet the surging demand.

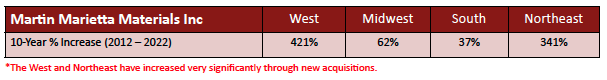

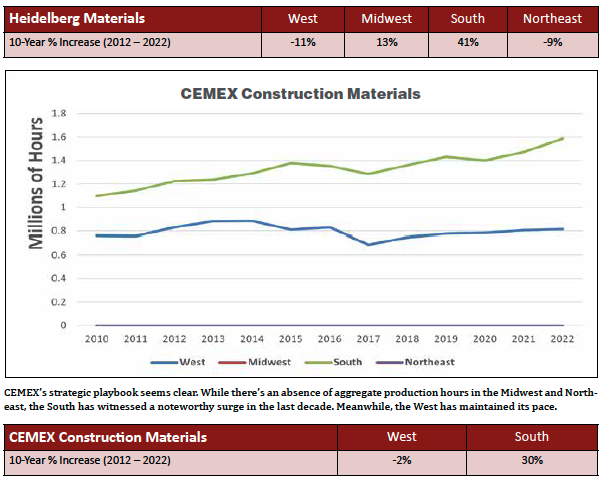

Heidelberg’s production narrative is one of highs and lows. The South has seen a commendable rise in dedication, while the Midwest and Northeast have been consistent. The West, however, narrates a different story with a noticeable dip, even falling below levels from a decade ago.

In the ever-evolving world of construction aggregates, understanding production metrics offers a nuanced perspective on industry trends and corporate strategies. Over the last decade, a noticeable pattern has emerged. Observing the top five aggregate companies based on production hours provides clarity on this trend: aggregate production is soaring, matched by an increase in labor hours to meet the surging demand.

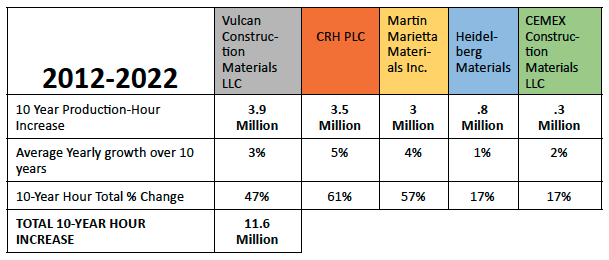

Diving deeper into the figures, we uncover the following insights:

- Vulcan Materials Co.: Standing tall with an impressive increase of 3.9-million hours in production, translates to a consistent 3% average yearly growth. Over the 10-year period, they’ve seen a 47% hike in their total production hours, signaling their dedication to meeting industry needs.

- CRH PLC: Not far behind with an increase of 3.5-million production hours over a decade, CRH PLC showcases an average yearly growth rate of 5%. This culminates in a total percentage change of 61% in their production hours, pointing to their substantial commitment to scaling operations.

- Martin Marietta Materials Inc.: With an upswing of 3-million production hours, Martin Marietta reflects a 4% average yearly growth. The total decadal percentage change in their production hours stands at a commendable 50%, indicating a strategic focus on enhancing their production capacities.

- Heidelberg Materials (including former Hanson Aggregate operations): Although their growth might appear more modest with an 800,000-hour increase, Heidelberg Materials has maintained a steady 1% average yearly growth. Their decade-long journey culminates in a 17% total increase in production hours, suggesting a measured and consistent approach.

- CEMEX Construction Materials LLC: Rounding off the list, CEMEX has amplified their production by 300,000 hours. With an average yearly growth of 2% and a total percentage change of 17% over ten years, their trajectory indicates a stable commitment to enhancing their operational scale.

- Cumulative Insights: Combining the efforts of these industry stalwarts, we observe a staggering collective increase of 11.6 million production hours over the past decade. This growth is a testament to the robustness of the aggregate industry and the ceaseless endeavors of its key players.

The overarching narrative is clear: the demand for aggregates across the United States is on an upward trajectory. Burgex’s market forecasts further solidify this outlook. Projections for 2023 anticipate an aggregate demand of approximately 2.81 billion tons. Fast forward five years, and the demand is expected to touch nearly 2.89 billion tons by 2028.

As the construction aggregate industry continues its march forward, these insights underscore the commitment of its leaders to not only maintain their foothold but to also scale and innovate in response to market demands.

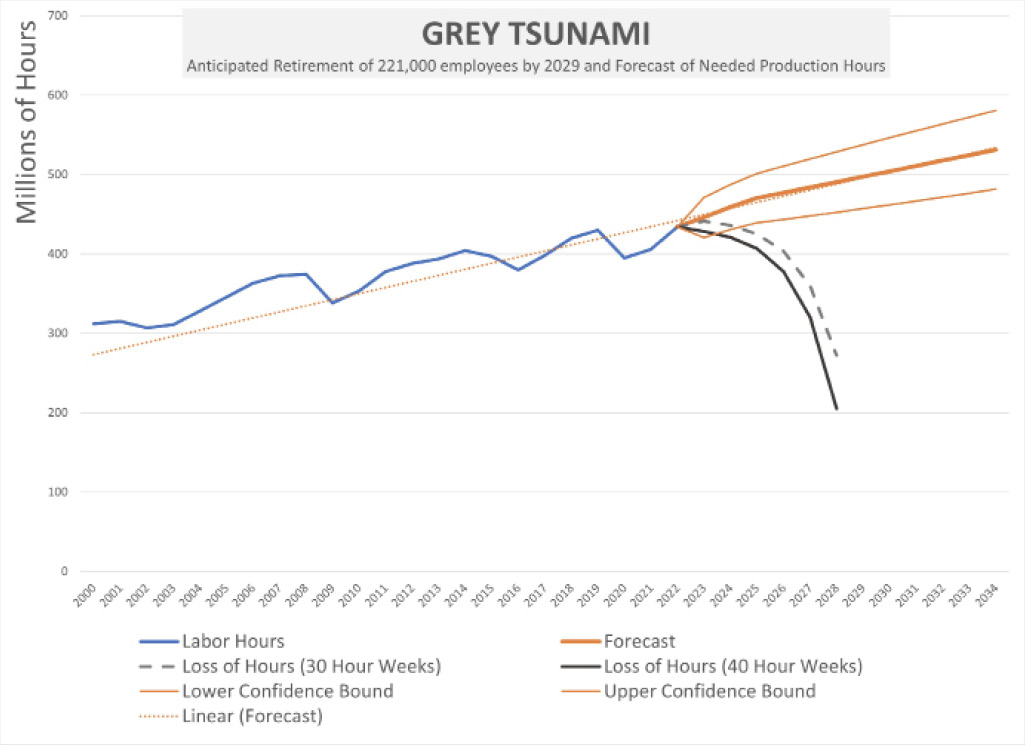

The dynamics of the aggregate industry are intricate, influenced not just by market demand, but also by the very workforce that propels it. Currently, we’re perched on the precipice of a significant challenge that stands to affect our capacity to fulfill the burgeoning demand projections.

Walter Copan, vice president of research and technology Transfer at the Colorado School of Mines, rang the alarm bells during his June 2023 testimony before the House Committee on Natural Resource. His insights painted a concerning picture: the backbone of the mining industry, comprising over 200,000 dedicated employees, is approaching a seismic shift. A staggering number of these professionals are poised to retire within the forthcoming six-year span. This isn’t merely a changing of the guard, but a potential void that could significantly hamper the gears of production.

The implications of this workforce transition are manifold. An immediate repercussion would be the potential for markets to experience undersaturation. With a leaner workforce, production capacities might struggle to maintain pace with demand. Such a scenario invariably ushers in the law of supply and demand, and the scales could tip unfavorably. We’re talking about potential price inflations – an outcome that could challenge the affordability and accessibility of aggregates for numerous projects.

Projecting these workforce dynamics onto the present trajectory of hourly production paints a more dire picture. It’s not just about the ebbs and flows of market demand; it’s about having the hands-on-deck to meet that demand. Should the industry face a shortfall in its skilled workforce without a timely and effective replenishment strategy, we might witness disruptions in the aggregate supply chain.

In essence, while the demand side of the aggregate equation looks promising, the supply side – especially concerning human capital – demands our immediate attention and proactive strategizing. As stakeholders, it’s imperative to understand these shifts, foresee the challenges, and collectively work towards ensuring continuity in our industry’s growth trajectory.

Where Are We Going To Take This Data?

What’s the next step for Burgex with this wealth of data? Our aim is to elevate our data analysis prowess. By melding our detailed population distribution datasets with forward-looking forecasts, we seek to elucidate the intricate relationship between them for sharper future planning.

Our focus will be on pinpointing markets pivotal to the mining and aggregates sector and discerning their alignment with major players’ acquisition strategies. Furthermore, we’re set to leverage our market forecasts to assess whether such acquisitions align with expected outcomes. In essence, we’re moving towards data-driven strategic clarity for the industry’s future.

Jake Tanner is architect of Mineralocity Aggregates/lead GIS developer at Burgex Mining Consultants.