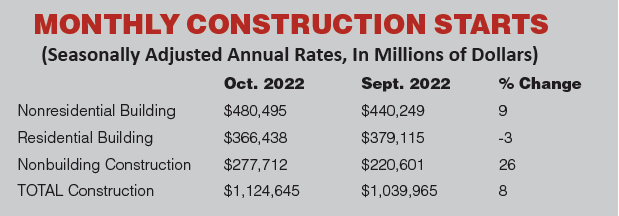

Total construction starts rose 8% in October to a seasonally adjusted annual rate of $1.12 trillion, according to Dodge Construction Network. In October, nonresidential building starts gained 9%, and nonbuilding starts rose 26%; however, residential starts fell by 3%.

Highway and bridge starts rose a startling 57%.

Year-to-date, total construction was 16% higher in the first 10 months of 2022 compared to the same period of 2021. Nonresidential building starts rose 37% over the year, residential starts remained flat, and nonbuilding starts were up 17%.

Nonbuilding construction starts rose 26% in October to a seasonally adjusted annual rate of $277.7 billion. Highway and bridge starts soared 57%, while utility/gas plants increased 19%, and environmental public works were 13% higher.

This growth is tempered as miscellaneous nonbuilding starts fell 20% in the month. Through the 10 months of the year, total nonbuilding starts were 17% higher than in 2021. Highway and bridge starts were 25% higher, environmental public works were 14% higher, and miscellaneous nonbuilding starts increased 17% on a year-to-date basis. Utility/gas plant starts were flat.

The largest nonbuilding projects to break ground in October were the $576 million TX DOT Interstate Highway 820 reconstruction project in Fort Worth, Texas, the $548 million TX DOT Interstate Highway 35 widening project in Austin, Texas, and the $364 million repaving project in Honolulu.

Nonresidential building starts rose 9% in October to a seasonally adjusted annual rate of $480.5 billion. During the month, commercial starts rose 19%, led by office and hotel projects. Institutional starts rose 8% due to a surge in education projects, while manufacturing starts fell by 5%.

Through the first 10 months of 2022, nonresidential building starts were 37% higher than the first 10 months of 2021. Commercial starts grew 23%, and institutional starts rose 21%. Manufacturing starts were 157% higher on a year-to-date basis.

The largest nonresidential building projects to break ground in October were the $3.2 billion Texas Industries chip fabrication plant (building 1) in Sherman, Texas, the $2.0 billion General Motors Orion EV plant in Orion Township, Mich., and the $1 billion Gevo Net-Zero 1 hydrocarbon plant in Lake Preston, S.D.

Residential building starts fell 3% in October to a seasonally adjusted annual rate of $366.4 billion. Single-family starts lost 3%, while multifamily starts dropped 4%. Through the first 10 months of 2022, residential starts were flat when compared to the same time frame in 2021. Multifamily starts were up 26%, while single-family housing slipped 10%.

The largest multifamily structures to break ground in October were the $564 million Long Island City Center II in Long Island City, N.Y., the $450 million Waldorf Astoria residences and hotel in Miami, and the $167 million Modera McGavock mixed-use building in Nashville.

Regionally, total construction starts in October rose in the Midwest and South Atlantic regions, but fell in the South Central and West.