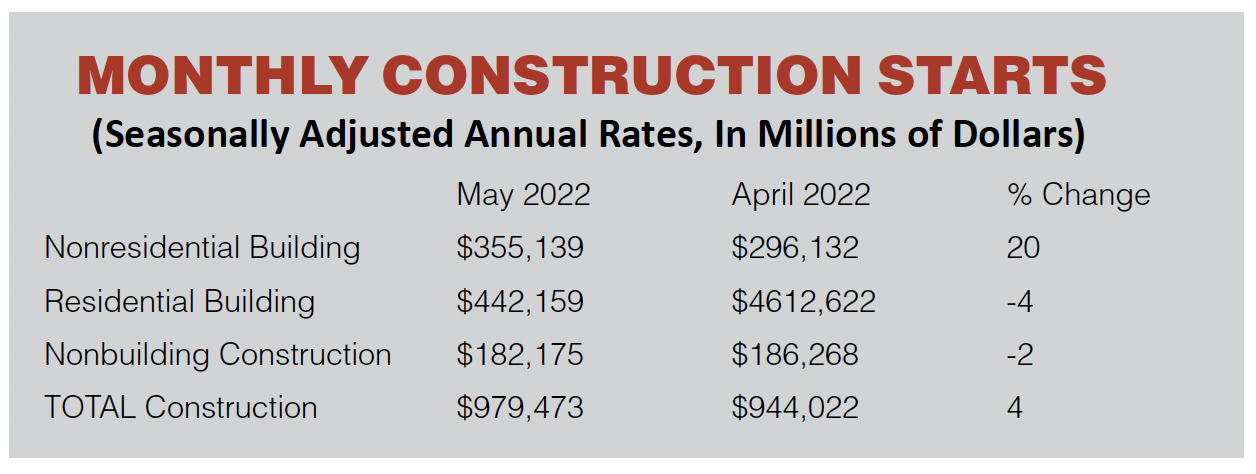

Total construction starts rose 4% in May to a seasonally adjusted annual rate of $979.5 billion, according to Dodge Construction Network. Nonresidential building starts rose 20%, while residential starts fell by 4% and nonbuilding lost 2% during the month.

Highway and bridge starts were up slightly.

Year-to-date, total construction was 6% higher in the first five months of 2022 compared to the same period of 2021. Nonresidential building starts rose 17% and residential starts gained 3%, while nonbuilding starts were 5% lower. For the 12 months ending May 2022, total construction starts were 10% above the 12 months ending May 2021. Nonresidential starts were 20% higher, residential starts gained 8% and nonbuilding starts were down 3%.

Nonbuilding construction starts fell 2% in May to a seasonally adjusted annual rate of $182.2 billion. Highway and bridge starts showed marginal growth over the month, while utility/gas plant starts jumped 22%. The drag on growth came from environmental public works starts, which fell 14% in May, and miscellaneous nonbuilding starts, which lost 3%. Through the first five months of the year, total nonbuilding starts were 5% lower than in 2021. Highway and bridge starts gained 22% through five months and environmental public works projects were 2% higher. At the same time, miscellaneous nonbuilding and utility/gas plants starts dropped 35% and 41%, respectively, through five months.

For the 12 months ending May 2022, total nonbuilding starts were 3% lower than in the 12 months ending May 2021. Environmental public works starts were up 9%, and street/bridge starts gained 7%. Miscellaneous nonbuilding starts were 33% lower and utility/gas plant starts were down 15%.

Nonresidential building starts rose 20% in May to a seasonally adjusted annual rate of $355.1 billion. In May, commercial starts rose 35% due to a large gain in office starts. Institutional starts rose 9% and manufacturing starts fell 5%. Through the first five months of 2022, nonresidential building starts were 17% higher than during the first five months of 2021. Commercial starts advanced 17% and institutional starts rose 2%, while manufacturing starts were 97% higher on a year-to-date basis.

For the 12 months ending May 2022, nonresidential building starts were 20% higher than in the 12 months ending May 2021. Commercial starts grew 18%, institutional starts rose 9%, and manufacturing starts swelled 116% on a 12-month rolling sum basis.

Residential building starts fell 4% in May to a seasonally adjusted annual rate of $442.2 billion. Single family starts dropped 10% and multifamily starts rose 8%. Through the first five months of 2022, residential starts were 3% higher than in the first five months of 2021. Multifamily starts were up 21%, while single family housing slipped 3%.

For the 12 months ending May 2022, residential starts improved 8% from the same period ending May 2021. Single family starts were 2% higher and multifamily starts were 27% stronger on a 12-month rolling sum basis.

Regionally, total construction starts in May rose in the Northeast, Midwest and South Central regions, but fell in the South Atlantic and West.