In This Quarterly Report, Provided Exclusively to Rock Products, Capstone Headwaters Provides Insight Into Mergers & Acquisitions (M&A), Capital Markets Trends And Aggregates Production Through The First Quarter Of 2020.

By Darin Good and Brian Krehbiel

Capstone’s Building Products & Construction Services Team advises industry business owners, entrepreneurs, executives and investors in the areas of M&A, capital raising, and various special situations. Due to our extensive background and laser focus within the industry, Capstone is uniquely qualified and has an unparalleled track record of successfully representing Building Products & Construction Services companies.

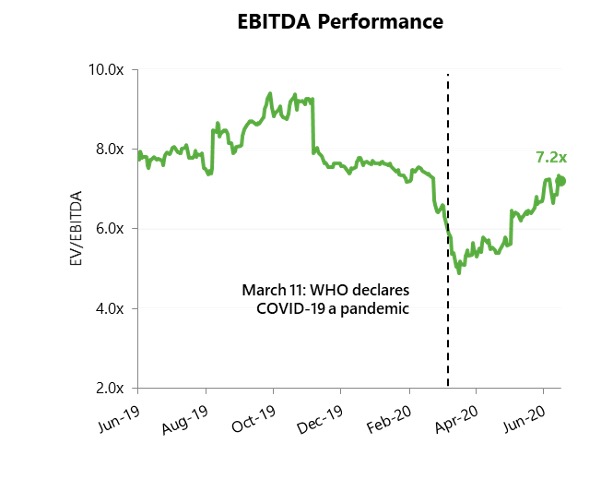

Public Valuation Commentary

EBITDA multiples in the Aggregates industry have rebounded since Q1, rising to an average of 9.2x. However, valuations remain depressed compared to the beginning of 2020 when average multiples stood at 10.5x.

Public Valuation Multiples

*TEV = Total Enterprise Value (Market Capitalization + Net Debt)

Source: FactSet as of June 18, 2020

Aggregates Performance

Aggregates Materials Index: -19.8%

S&P 500: -2.7%

Dow Jones Industrial Average: -8.5%

Capstone’s Aggregates Materials Index (AMI) has trailed the broader market YTD but has begun to show signs of recovery. While total return in the AMI Index fell to -19.8% in mid-June, this represents a substantial improvement from the index’s trough in mid-March when total return registered -48%.

Short-Term Industry Outlook

The aggregates industry has combated unprecedented challenges brought on by the pandemic, which has manifested in substantial declines in construction spending – down nearly 3% in April month-over-month – according to the U.S. Census Bureau.1 The Construction Labor market also experienced significant headwinds as project cancellations and equipment shortages forced nearly 40% of U.S. firms to lay off portions of their workforce, according to ENR.2 However, as shelter-in-place orders are lifted and state and local economies begin to reopen, optimism in the aggregates industry has been supported by a resumption of construction projects and contractor hiring activity toward the close of Q2. Following the lowest recorded backlog level in April (7.8 months), the Associated Builders and Contractors’ (ABC) construction backlog indicator increased to 7.9 months in May, with infrastructure and heavy industrial projects experiencing month-over-month activity growth.3 As construction levels begin to reflect pre-COVID trends with rising construction confidence, staffing and labor hours have followed to meet a resurgence of demand. At the depths of the pandemic, construction worker hours had fallen 17% compared to the first week of March (Procore)4 with job losses of approximately 975,000 in April, according to ABC.5 In recent weeks the workforce has rebounded immensely, with hours worked rising 19% in the final week of May, complimented by an addition of 464,000 new jobs which represented the largest monthly increase on record. As industry demand resumes, aggregates producers are poised to benefit from rising construction activity with forecasts of a modest recovery in the industry beginning in Q3, according to Dodge Data & Analystics.6

Merger and acquisition (M&A) activity has expectedly slowed in Q2, as industry players have focused on safeguarding internal assets, assessing their workforce, and defending revenues in the early stages of the pandemic. Through Q1 2020, total volume was slightly below 2019 levels at 26 transactions compared to 31. However, the 33 total transactions through YTD 2020 are markedly behind the 63 transactions in YTD 2019. As Q2 closes, industry players have begun to deploy their strategies for post-crisis activity, with M&A serving as a means to enter high-growth segments or generate cash through divestitures of non-core operations. Notably, Eagle Materials sold its Western Aggregates and Mathews Readymix businesses (see Notable Transactions) in order to place increased focus on other operating segments.

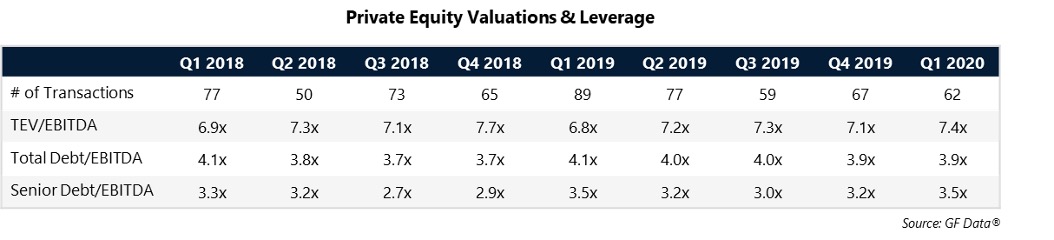

Private Equity Transaction Activity & Valuations

GF Data Resources, a provider of detailed information on business transactions ranging in size from $10 to $250 million, provides quarterly data from over 200 private equity firm contributors on the number of completed transactions. The following chart provides the number of completed transactions from GF Data contributors, the average total enterprise value (TEV)/EBITDA multiples, and the average amount of debt utilized in the transaction computed as a multiple of EBITDA. The data, although not industry specific, displayed a slight decline in transaction volume, with EBITDA multiples increasing to 7.4x in Q1. Total debt/EBITDA remained at healthy levels at 3.9x while senior debt/EBITDA increased modestly from Q4 2019.

Notable Transactions

Teichert, Inc. acquires Western Aggregates LLC and Mathews Readymix LLC – (April 2020, $93.5 Million)

Teichert has acquired Western Aggregates and Mathews Readymix from Eagle Materials for an enterprise value of $93.5 million. Western Aggregates vested-right-to-mine spans 3,900 acres and includes over 900 million tons of aggregates. Mathews Readymix offers three concrete batch locations and a fleet of 26 trucks. California-based Teichert provides residential, site development, and public infrastructure construction services in addition to construction materials.

The sale of Western Aggregates and Mathews Readymix to Teichert aligns with Eagle Materials ongoing portfolio reshaping to bolster and refine its Heavy Materials segment by selling off non-core concrete and aggregates assets. “We are especially keen on having the most strategically coherent set of heavy-side assets established in advance of our previously announced spin-off. These divestitures along with the integration of the Kosmos cement plant acquisition, create a focused heavy materials business with a broad capability to serve U.S. heartland cement markets,” commented Michael Haack, Eagle Materials President and CEO in a press release.7

Northwest Pipe Company acquires Geneva Pipe, Inc. – (February 2020, $49.4 Million)

Northwest Pipe Company has acquired leading concrete pipe and precast concrete products manufacturer, Geneva Pipe, for an enterprise value of $49.4 million and equivalent to 1.2x revenue. Utah-based Geneva Pipe’s product offerings include reinforced concrete pipe, box culverts, bridge structures, and septic tanks. Geneva has approximately 140 employees and recorded revenues of $43 million in 2019, according to a press release.8

Northwest Pipe Company has acquired leading concrete pipe and precast concrete products manufacturer, Geneva Pipe, for an enterprise value of $49.4 million and equivalent to 1.2x revenue. Utah-based Geneva Pipe’s product offerings include reinforced concrete pipe, box culverts, bridge structures, and septic tanks. Geneva has approximately 140 employees and recorded revenues of $43 million in 2019, according to a press release.8

Northwest Pipe is the largest manufacturer of engineered steel water pipeline systems in North America and its operations have been deemed essential through the pandemic as it provides critical water transmission systems. Northwest Pipe has maintained a strong backlog of $224 million through Q1 2020, according to its shareholder meeting presentation.9 The acquisition enhances Northwest’s water infrastructure capabilities and is expected to be immediately accretive to financial results.

Select Transactions

|

|

|

|

Enterprise |

EV / LTM |

||

|

Date |

Target |

Acquirer |

Target Business Description |

Value (mm) |

Revenue |

EBITDA |

|

06/08/20 |

Les Carrières Sylvio Galipeau |

ALI Excavation |

Operates a quarry that produces aggregates for highway, industrial, and residential construction. |

– |

– |

– |

|

05/11/20 |

Burnt River Quarry |

Sunrock Group |

Comprises aggregates reserves. |

– |

– |

– |

|

05/05/20 |

Assets of Quove |

PureBase |

Comprises mineral mining process equipment for cementitious materials. |

– |

– |

– |

|

05/01/20 |

Wall to Wall Tile & Stone |

Saxum Stone |

Provides granite and quartz for countertops. |

$4.4 |

– |

– |

|

04/21/20 |

Bowman Ready Mix |

Dickinson Ready Mix Co & Concrete |

Manufactures ready-mix concrete. |

– |

– |

– |

|

04/17/20 |

Western Aggregates/ Mathews Readymix |

Teichert |

Provides concrete and aggregates products. |

$93.5 |

– |

– |

|

03/27/20 |

Instone |

Capstone Therapeutics |

Distributes manufactured and natural stone veneer products. |

– |

– |

– |

|

03/17/20 |

Strand-Tech Manufacturing |

Insteel Wire Products |

Manufactures fabricated wire products including concrete poles and building foundations. |

$22.5 |

0.8x |

– |

|

03/09/20 |

Big Rock Natural Stone |

SiteOne |

Distributes stone products including boulders, slabs, bluestone, veneers, bulk stone, and pavers. |

– |

– |

– |

|

03/04/20 |

Assets of Clio Holdings |

KC Solid Surfaces |

Provides granite countertop manufacturing. |

$1.2 |

– |

– |

|

03/04/20 |

Sealcoating Supplies |

GemSeal |

Distributes pavement preservation products. |

– |

– |

– |

|

03/03/20 |

Rayner Equipment |

Etnyre |

Provides pavement maintenance solutions. |

– |

– |

– |

|

03/02/20 |

Kleary Masonry |

Cornerstone Building Brands |

Manufactures and installs stone veneer. |

$40.0 |

1.0x |

– |

|

03/02/20 |

U.S. MIX |

Oldcastle APG |

Manufactures concrete products including concrete mixes, sands, cements, and grouts. |

– |

– |

– |

|

02/28/20 |

Willcan |

Sequatchie Concrete Service |

Distributes and manufactures ready-mix concrete. |

– |

– |

– |

|

02/25/20 |

Coram Materials |

U.S. Concrete |

Operates sand and gravel mining operations. |

$142.0 |

– |

~7.0x |

|

02/14/20 |

Assets of Oldcastle Spokane |

Knife River |

Comprises precast and prestressed concrete components business. |

– |

– |

– |

|

02/04/20 |

Trowel Trades Supply |

GMS |

Provides interior building materials including stone, brick, masonry, and drywall. |

– |

– |

– |

|

02/02/20 |

Geneva Pipe |

Northwest Pipe |

Manufactures concrete pipes and precast products. |

$49.4 |

1.1x |

– |

|

01/15/20 |

Carstin Brands |

Wolf Organization |

Provides kitchen and bath products including marble and granite countertops. |

– |

– |

– |

|

01/06/20 |

RidgeRock Retaining Walls |

Tysinger Acquisitions |

Manufactures concrete blocks. |

– |

– |

– |

|

01/02/20 |

JSL Materials |

Peckham Industries |

Produces and supplies construction materials including stones. |

– |

– |

– |

|

01/02/20 |

Wittkopf Landscape |

SiteOne |

Provides hardscape and landscape services and products including pavers and gravel. |

– |

– |

– |

Source: Capital IQ, PitchBook, FactSet, and Capstone Research

Company Spotlight

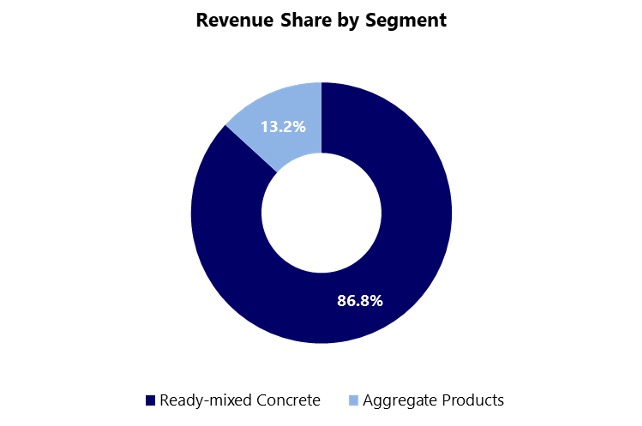

Ticker: NASDAQ:USCR

Ticker: NASDAQ:USCR

Headquarters: Euless, Texas

Markets: Construction Materials

LTM Revenue: $1.4 Billion

Market Capitalization: $438.6 Million

U.S. Concrete reported consolidated revenue of $334.4 million in Q1 2020, representing a 0.4% increase year-over-year, according to its earnings report.10 Notably, ready-mix concrete and aggregates product revenue increased 0.6% and 1.6% respectively. Total adjusted EBITDA fell modestly to $34.2 million in Q1 2020, compared to $34.5 million in the previous year. U.S Concrete benefited from many of its operations being deemed essential through the pandemic, with the exception of projects in New York and San Francisco. Its acquisition of Coram Materials in February ($142 million) has also begun to enhance production volumes and contribute positively towards earnings. Post-acquisition, Coram generated $1.7 million of adjusted EBITDA during the quarter.

“Current demand outlook remains resilient as all of our regions are reporting a very active level of new projects on which we are bidding. Since the initial onset of local regulations, we continue to see weekly improvements in volumes and productivity in every market. When local governments loosen their restrictions and our markets respond, we are positioned to reengage with our jobs and projects,” commented Ronnie A. Pruitt, president, CEO and director.11

U.S. Concrete has continued to evaluate processes and workflows to optimize its cost structure, liquidity position, and technological innovation. Recent measures include reduction of capital expenditures and idling of select plants to maximize utilization rates. It has also begun to introduce WheresMyConcrete, an analytical booking, tracking, and payment processing tool, into the Dallas-Fort Worth market in order to drive further cost savings and efficiencies. U.S. Concrete has withdrawn its previously communicated 2020 financial guidance due to uncertainty surrounding COVID-19.

Source: FactSet

Company Spotlight

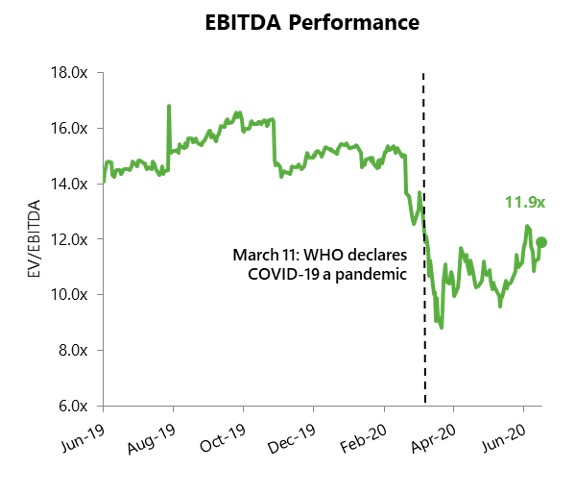

![]() Ticker: NYSE:MLM

Ticker: NYSE:MLM

Headquarters: Raleigh, North Carolina

Markets: Construction Materials

LTM Revenue: $4.4 Billion

Market Capitalization: $13.2 Billion

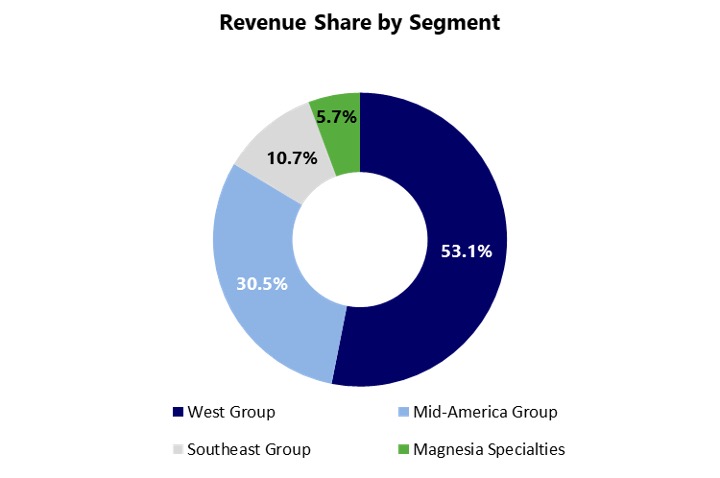

Martin Marietta’s operating results were not significantly affected by COVID-19 in Q1 2020, although the company has withdrawn previously issued full-year 2020 guidance in light of the uncertainty brought by the pandemic. Through Q1, total revenues increased to $958.2 million, an increase of 2.0% year-over-year, according to its most recent earnings report.12 Aggregates shipments and pricing increased 2.3% and 2.7%, respectively, led by gains in the Mid-America Group segment which experienced shipment growth of 4.3%. Increases in this segment were largely driven by warehouse and data center construction activity in Iowa and Indiana. Martin Marietta anticipates warehouse, distribution centers, and data centers to record strong demand in the near term with businesses focusing on e-commerce functions and become increasingly reliant on cloud and network services.

“Infrastructure, particularly for aggregates-intensive highways and streets, is expected to be the most resilient of the company’s three primary end uses in the near term. The vast majority of state departments of transportation are operational and continue to advertise and award projects. Nonetheless, we expect many state DOT budgets will face temporary headwinds from lower fuel taxes, tolls, user fees and other related revenue collections as much of the nation has been sheltered in place,” commented C. Howard Nye, Chairman, CEO and president.13

Martin Marietta plans to reduce full-year capital expenditures to $325-$350 million, revised downward from $425-$475 million, to enhance cash flows and maximize capacity. The company issued $500 million of 10-year senior notes in March to repay $300 million of maturing floating rate notes with the remainder of the cash preserved on the balance sheet. Through the end of Q1, Martin Marietta’s debt profile of 2.3x net debt-consolidated adjusted EBITDA is within its target range of 2.0 to 2.5x.

Source: FactSet

Source: FactSet

Construction Materials Update

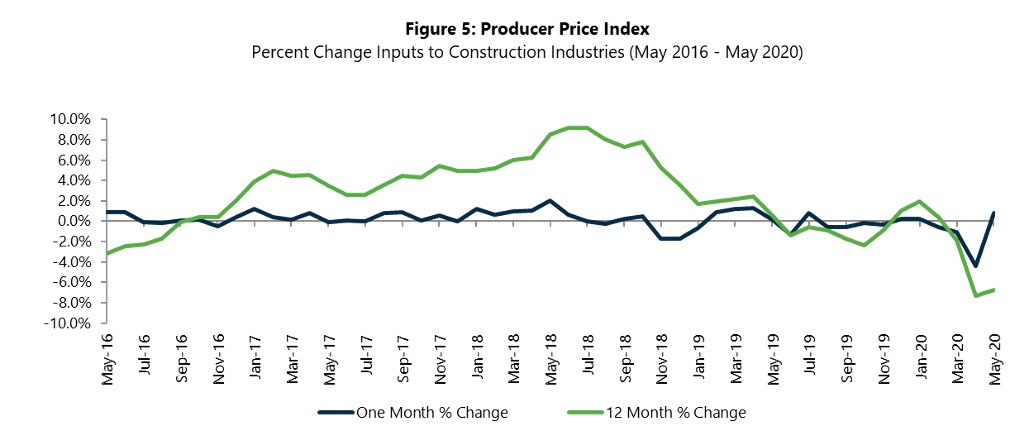

Construction input prices increased 0.8% in May from the previous month, however, prices have fallen 6.8% year-over-year, according to an Associated Builders and Contractors (ABC) analysis of data recently released by the U.S. Bureau of Labor Statistics.14 In recent readings since the outbreak, input prices have been volatile but yearly measures have been consistently lower reflecting supply chain challenges and the broader disruption induced by COVID-19.

Source: U.S. Bureau of Labor Statistics

Aggregate Materials

Aggregates production through Q1 2020 experienced declines from Q4 2019, but remain elevated on a year-over-year basis. Through Q1 2020, cement, ready-mix, crushed stone, and sand & gravel have all registered year-over-year increases in prices.

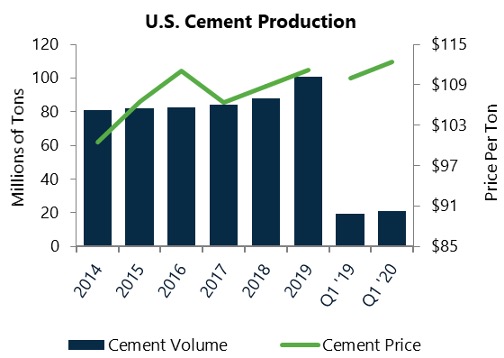

Cement

Cement

• Portland cement consumption reached 21 million metric tons in Q1 2020, an increase of 8.2% when compared to Q1 2019. Cement production declined by 15.0% compared to Q4 2019.

• The average net selling price per ton for Martin Marietta and Eagle Materials in Q1 2020 was $112.43, an increase of 2.2% year-over-year.

Source: U.S. Geological Survey and Capstone Research

Ready-Mix Concrete

Ready-Mix Concrete

• Ready-mix concrete (RMC) prices increased 4.9% in Q1 2020 compared to the previous year. Price data is computed from the average RMC net selling prices of U.S. Concrete, Vulcan Materials, Martin Marietta, and Eagle Materials.

• Ready-mix concrete volume reached 77.2 million cubic yards in Q1 2020, a 15.3% decline from the previous quarter, but an 8.7% increase when compared year-over-year.

Source: NRMCA Industry Data Survey, Average RMC selling price of U.S. Concrete, Vulcan Materials, Martin Marietta Materials, Eagle Materials, and Capstone Research

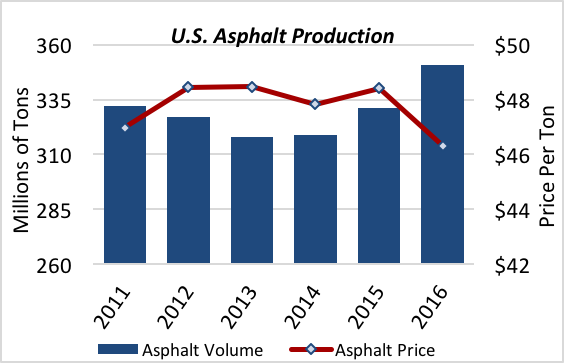

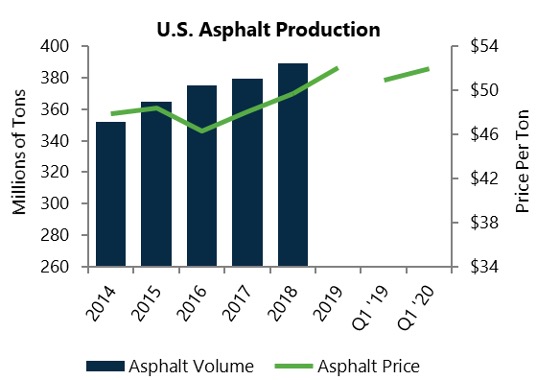

Asphalt

Asphalt

• Asphalt prices increased by 2.1% year-over-year, as measured by the average net asphalt selling prices of Vulcan Materials and Martin Marietta. Asphalt prices declined 0.3% compared to Q4 2019.

• Asphalt volume is reported on an annual basis and 2019 production has not been released.

Source: NAPA Asphalt Pavement Industry Survey, Vulcan Materials, Martin Marietta Materials average of net asphalt selling prices, and Capstone Research

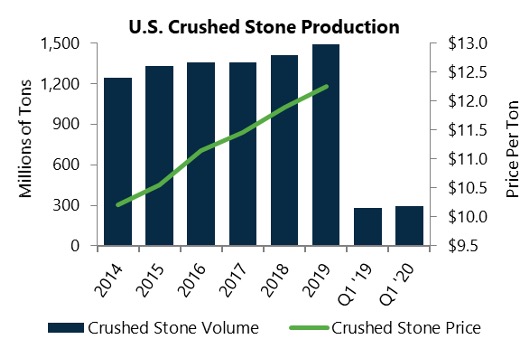

Crushed Stone

Crushed Stone

• Crushed stone production declined from heightened levels in Q4 2019 of 360 million metric tons to 291 million metric tons in Q1 2020. Production has increased year-over-year by 3.6%.

• Crushed stone prices are reported annually.

Source: U.S. Geological Survey and Capstone Research

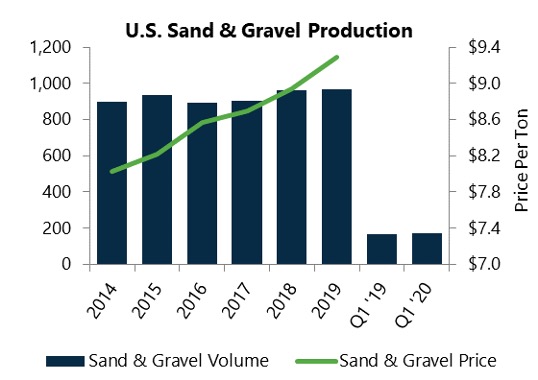

Sand & Gravel

Sand & Gravel

• An estimated 173 million metric tons of sand & gravel were produced and shipped for consumption in Q1, representing a 3.0% increase year-over-year. Production declined 24.8% from Q4 2019 in a year that recorded historic highs in volume.

• Sand & gravel prices are reported annually.

Source: U.S. Geological Survey and Capstone Research

Capstone Headwaters is an elite investment banking firm dedicated to serving the corporate finance needs of middle market business owners, investors and creditors. Capstone Headwaters provides merger & acquisition, private placement, corporate restructuring and financial advisory services across 16 industry verticals to meet the lifecycle needs of emerging enterprises. Headquartered in Boston, MA and Denver, CO, Capstone Headwaters has 19 offices in the United States, UK and Brazil with a global reach that includes more than 450 professionals in 40 countries. For more information, visit www.capstoneheadwaters.com. To discuss any information contained in this report, contact the Capstone Headwaters team: Darin Good, managing director, [email protected], 303-549-5674; Brian Krehbiel, senior vice president, [email protected], 970-215-9572; Crista Gilmore, vice president, [email protected], 303-531-5013; and, Dominic Cervi, vice president, [email protected], 303-531-4605

CITATIONS

1. U.S. Census Bureau, “Value of Construction Put in Place at a Glance,” https://www.census.gov/construction/c30/c30index.html, accessed June 18, 2020.

2. ENR, “Nearly 40% of Firms Have Laid Off Workers, New AGC Survey Says,” https://www.enr.com/articles/49166-nearly-40-of-firms-have-laid-off-workers-new-agc-survey-says?oly_enc_id=6990E2455378F3Z, accessed June 22, 2020.

3. Associated Builders and Contractors, “ABC’s Construction Backlog Indicator Inches Higher in May; Contractor Confidence Continues to Rebound,” https://www.abc.org/News-Media/News-Releases/categoryid/1061/Default, accessed June 18, 2020.

4. Procore, “How a global crisis is changing American construction,” https://www.procore.com/covid-insights, accessed June 22, 2020.

5. Associated Builders and Contractors, “Construction Employment Sees Record Rebound in May, Says ABC,” https://www.abc.org/News-Media/News-Releases/entryid/17652/construction-employment-sees-record-rebound-in-may-says-abc, accessed June 19, 2020.

6. Dodge Data & Analytics, “Dodge Momentum Index Flat in May,” https://www.construction.com/news/dodge-momentum-index-flat-may-2020, accessed June 19, 2020.

7. Business Wire, “Eagle Materials Sells Non-Core Concrete and Aggregates Assets,” https://www.businesswire.com/news/home/20200417005006/en/Eagle-Materials-Sells-Non-Core-Concrete-Aggregates-Assets, accessed June 18, 2020.

8. The Columbian, “Northwest Pipe acquires competitor Geneva Pipe,” https://www.columbian.com/news/2020/feb/03/northwest-pipe-acquires-competitor-geneva-pipe, accessed June 18, 2020.

9. Northwest Pipe Company, “2020 Annual Shareholder Meeting,” https://investor.nwpipe.com/, accessed June 18, 2020.

10. US Concrete, “U.S. Concrete Announces First Quarter 2020 Results,” http://investorrelations.us-concrete.com/news-releases/news-release-details/us-concrete-announces-first-quarter-2020-results, accessed June 19, 2020.

11. US Concrete, “Q1 2020 US Concrete Inc Earnings Call,” http://investorrelations.us-concrete.com/financial-information/quarterly-results, accessed June 19, 2020.

12. Martin Marietta, “Martin Marietta Reports First-Quarter 2020 Results,” https://ir.martinmarietta.com/static-files/12be0098-19d3-455e-89eb-1ef443e93dc2, accessed June 19, 2020.

13. Martin Marietta, “Q1 2020 Martin Marietta Materials Inc Earnings Call,” https://ir.martinmarietta.com/events-presentations, accessed June 19, 2020.

14. Associated Builders and Contractors, “Construction Input Prices Rise in May, Says ABC,” https://www.abc.org/News-Media/News-Releases/entryid/17714/construction-input-prices-rise-in-may-says-abc, accessed June 22, 2020.

Disclosure: This report is a periodic compilation of certain economic and corporate information, as well as completed and announced merger and acquisition activity. Information contained in this report should not be construed as a recommendation to sell or buy any security. Any reference to or omission of any reference to any company in this report should not be construed as a recommendation to buy, sell or take any other action with respect to any security of any such company. We are not soliciting any action with respect to any security or company based on this report. The report is published solely for the general information of clients and friends of Capstone Headwaters. It does not take into account the particular investment objectives, financial situation or needs of individual recipients. Certain transactions, including those involving early-stage companies, give rise to substantial risk and are not suitable for all investors. This report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Prediction of future events is inherently subject to both known and unknown risks and other factors that may cause actual results to vary materially. We are under no obligation to update the information contained in this report. Opinions expressed are our present opinions only and are subject to change without notice. Additional information is available upon request. The companies mentioned in this report may be clients of Capstone Headwaters. The decisions to include any company in this report is unrelated in all respects to any service that Capstone Headwaters may provide to such company. This report may not be copied or reproduced in any form, or redistributed without the prior written consent of Capstone Headwaters. The information contained herein should not be construed as legal advice.