TOP NEWS

StonePoint Acquisition

StonePoint Materials LLC has acquired Standard Gravel Co. LLC. Standard is a leading regional producer of sand and gravel serving eastern Louisiana and southern Mississippi from four active mine sites.

Graymont Acquisition

Graymont and Grupo Calidra are moving forward with the previously announced acquisition of the global lime and limestone business of the Belgium-based Sibelco Group.

Historic Cone

CB Con-Agg, a division of Cleveland Brothers, visited H&K Group Inc.’s corporate office in Skippack, Pa., to meet with H&K’s executive management team to formally recognize H&K’s ownership, maintenance and operation of one of the first Metso HP300 cone crushers in existence.

MSHA WATCH

The Mine Safety & Health Administration took a step closer to an updated regulation for respirable crystalline silica. In a published Request for Information, the agency is soliciting “data and information on economically and technologically feasible best practices” to protect the health of coal miners and metal/nonmetal workers from “exposure to quartz, including a reduced [workplace exposure] standard, new or developing protective technologies, and/or technical and educational assistance.”

USGS STATS

The crushed stone industry continues to be concerned with environmental, health, and safety regulations. Shortages in some urban and industrialized areas are expected to continue to increase owing to local zoning regulations and land-development alternatives. These issues are expected to continue and to cause new crushed stone quarries to locate away from large population centers, according to Jason Willett, crushed stone commodity specialist for the U.S. Geological Survey.

ECONOMIC INDICATORS

Construction spending during July 2019 was estimated at a seasonally adjusted annual rate of $1,288.8 billion, 0.1% (±1.3%) above the revised June estimate of $1,288.1 billion, according to the U.S. Census Bureau.

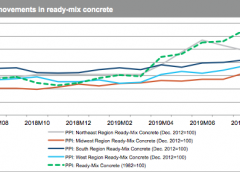

“It was interesting to see the increase in ready mix pricing driven by an uptick in Midwest (where prices had been muted for most of 2019) and West. Prices in Northeast started to give back and remain at moderate escalation levels in U.S. South,” said Deni Koenhemsi, senior economist at IHS Markit.

ENERGY

- WTI Crude Oil Futures: 9/17/2019: $59.34/barrel, up $1.94 from week earlier; down $9.57 from year earlier.

- Natural Gas Futures: 9/17/2019: $2.668/MMBtu, up $0.088 from week earlier; down $0.146 from year earlier.

- Retail Gasoline: 9/16/2019: $2.552/gal., up $0.002 from week earlier; down $0.289 from year earlier.

- Retail Diesel: 9/16/2019: $2.987/gal., up $0.016 from week earlier; down $0.281 from year earlier.

- Electricity: 6/20/2019: Average price to industrial customers 6.91 cents/kilowatt hour; down from 7.18 cents/kilowatt hour from year earlier.

Source: U.S. Energy Information Administration