In This Quarterly Report, Provided Exclusively to Rock Products, Capstone Partners Offers Insight Into Merger and Acquisition Activity, Capital Markets Trends, Aggregate Production and Pricing.

By Darin Good, Brian Krehbiel and Crista Gilmore

Capstone Partners’ Building Products & Construction Services Team is pleased to share its Rock Products report. Healthy backlogs and persistent aggregates-intensive construction projects have fueled demand for sector participants, despite a backdrop of economic uncertainty. Merger and acquisition (M&A) activity has continued at a healthy pace through year-to-date (YTD) 2022, dominated by strategic buyers. Several key report takeaways are included below.

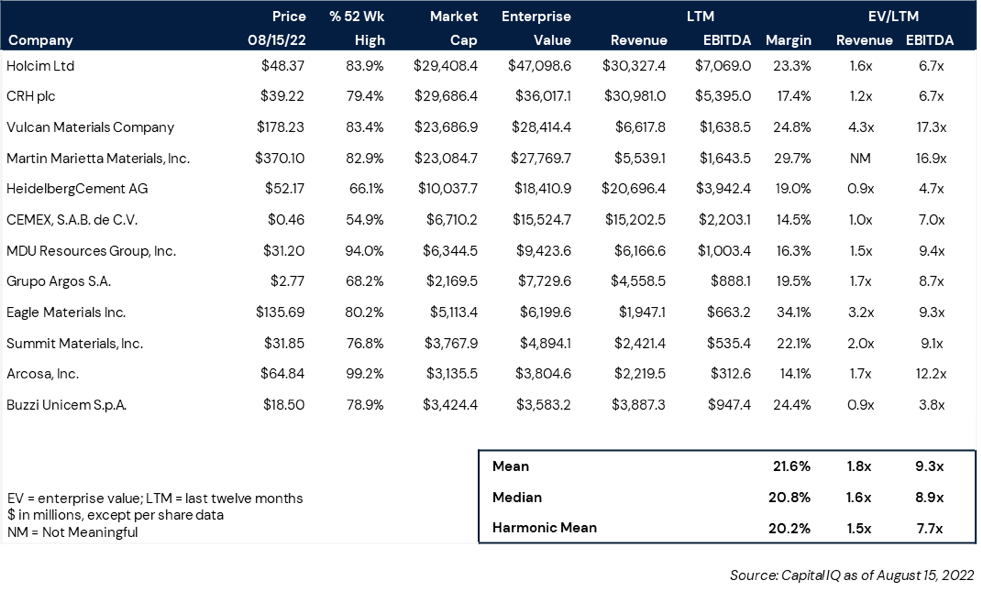

- Market uncertainty has negatively impacted aggregates public company trading multiples, which have fallen to an average of 9.3x EV/EBITDA from 10.5x in the prior year period.

- Construction backlogs remain healthy with sector optimism supported by the demand visibility provided by the Infrastructure Investment and Jobs Act.

- Leading public companies have captured robust revenue growth through Q2, however, elevated input and energy costs have increasingly pressured margins.

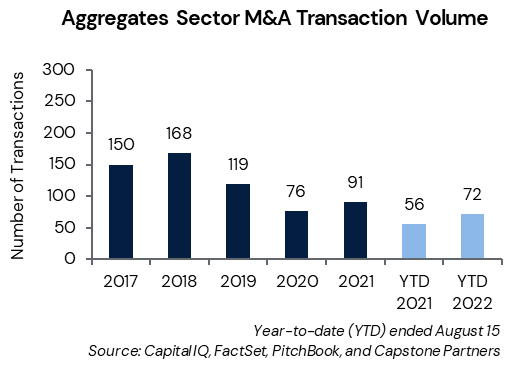

- M&A activity has yet to show any signs of weakness through YTD 2022 as strategic buyers have continued to drive transaction activity in search of quality assets that provide increased capacity and penetration in attractive geographies.

- Inflation, supply chain challenges, and adequate labor are expected to remain key challenges for sector players through the end of the year and into 2023

Public Company Commentary

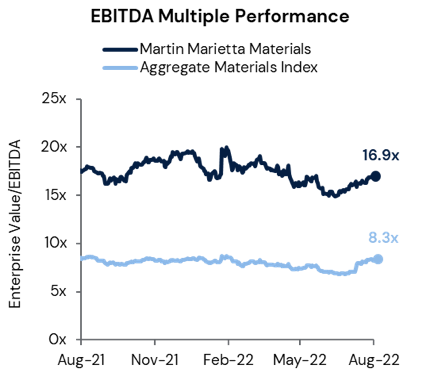

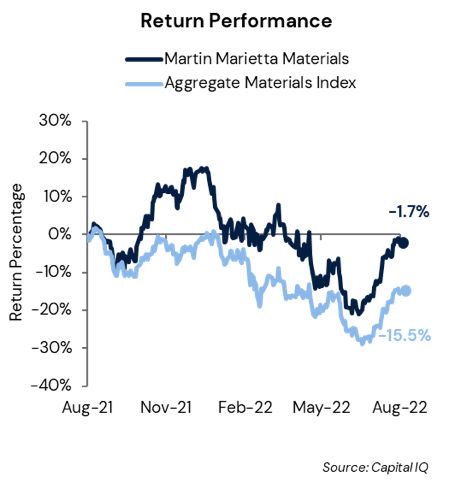

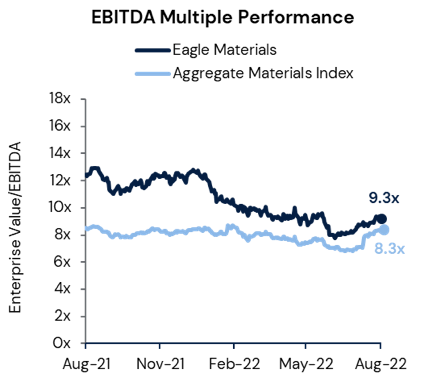

Public company trading multiples have declined compared to the prior year, with average last 12 month (LTM) EBITDA multiples falling to 9.3x from 10.5x. Vulcan Materials and Martin Marietta continue to lead from an EBITDA trading multiple perspective at 17.3x and 16.9x, respectively.

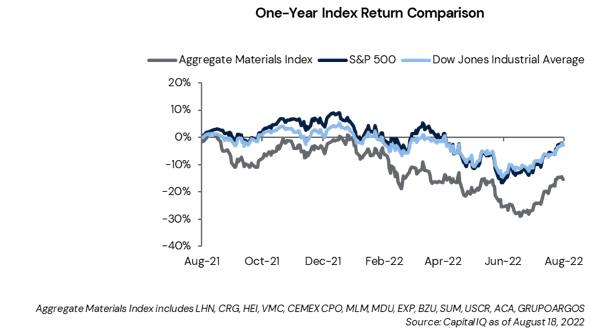

Aggregate Materials Continue to Trail Broader Market

Aggregate Materials Index: -15.5%

S&P 500: -2.9%

Dow Jones Industrial Average: -2.8%

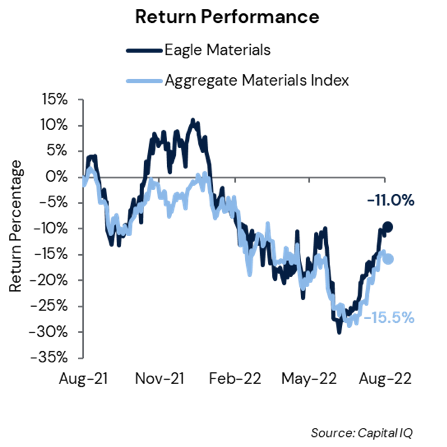

Return in Capstone’s Aggregate Materials Index has continued to fall behind the broader equity market, declining 15.5% over the past 12 months. Public aggregates players have faced significant inflationary, supply chain, and labor force headwinds, which have negatively impacted trading performance. Signs of an inflation peak and continued healthy construction demand are expected to provide favorable momentum for public company returns in the sector.

Sector Demand Continues Amid Uncertain Economic Outlook

Robust construction backlogs and persistent nonresidential and residential building activity have supported healthy demand in the Aggregates sector amid mounting economic uncertainty. While elevated inflation and financing costs have impacted the profitability of sector players, strong project pipelines have supported near-term optimism.

The Associated Builders and Contractors’ Construction Backlog Index increased 0.2 months year-over-year (YOY) in July to 8.7 months.1 This marks a modest decline from June (0.2 months), but the reading remains higher than at any point between March 2020 and March 2022. Continued construction demand is expected to propel sales through the remainder of the year, however, margins have increasingly come under pressure – even among leading aggregates players.

Notably, Martin Marietta achieved a record aggregates gross profit of $309 million in Q2. However, its product gross margin fell 170 basis points due to significant energy, supplies, and freight costs, according to its earnings release.2 Moving through the second half of the year and into 2023, pricing adjustments will remain key levers for market participants to utilize to defend margins.

The prospect of a recession has clouded the immediate operating performance forecasts for many sector participants but the fundamentals for long-term demand remain sound. Aggregates-intensive projects, including data centers and warehouses, have continued at a healthy pace with a strong uptick in domestic manufacturing facilities construction.

Notably, manufacturing construction spending increased 0.3% YOY in June, which marked the sixth consecutive month of YOY growth in excess of 20%, according to the U.S. Census Bureau.3 This may be reflective of U.S. companies increasingly reshoring supply chains to grasp firmer control over their production processes. In addition, the Infrastructure Investment and Jobs Act (IIJA) has allocated substantial funding to State Department of Transportation budgets – fueling robust aggregates demand in the long-term. Aggregates providers are expected to begin to realize the benefits of IIJA dollars towards the end of 2022 and in 2023, creating healthy project visibility for the sector.

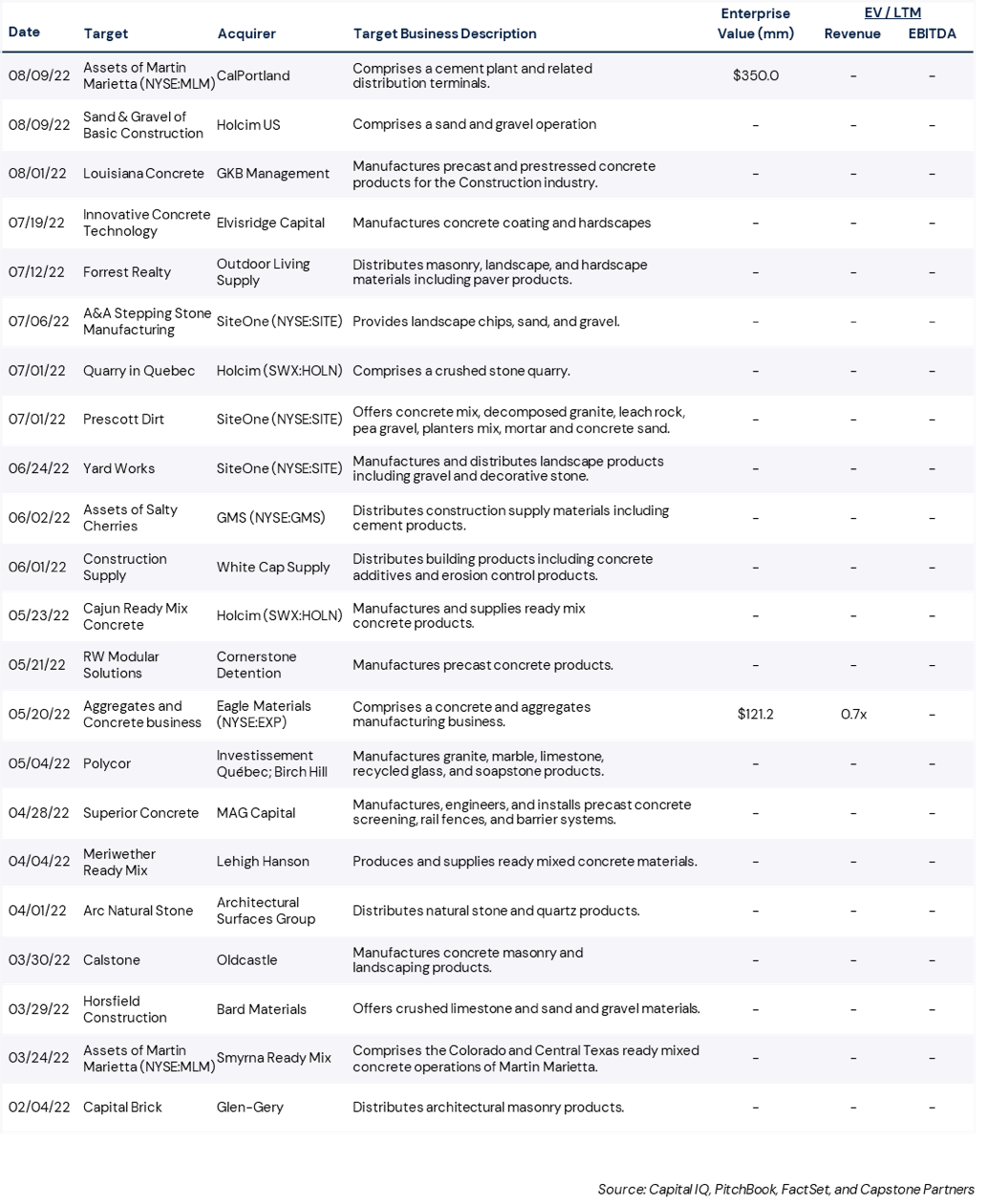

M&A Volume Unabated By Economic Uncertainty

M&A activity in the Aggregates sector has continued at a rapid pace, undeterred by a backdrop of economic uncertainty. YTD M&A volume amounted to 72 transactions announced or completed, which marks a 28.6% YOY increase. Sector players with strong margins, a healthy capital structure, and a firm grasp on labor and supply chains have continued to experience robust buyer demand.

Strategic buyers accounted for 79.2% of YTD transactions and have continued to facilitate divestitures to focus on core, high margin capabilities. These asset sales are often met with strong buyer demand as sector participants have actively sought to increase capacity through inorganic growth. Notably, Martin Marietta sold its Tehachapi, Calif., cement plant and related distribution terminals to CalPortland for an enterprise value of $350 million in August (more details further on). Private equity buyers have comprised the remaining 20.8% of YTD transactions, attracted to category leaders with a track record of growth. Elvisridge Capital recently announced its second acquisition in the Decorative Concrete and Hardscape market, purchasing Innovative Concrete Technology in July for an undisclosed sum.

Valuations among public companies in the Aggregates sector have fallen compared to the prior year, with the average LTM EBITDA trading multiple declining to 9.3x from 10.5x. Often, this can be viewed as a harbinger of lower pricing in M&A markets, however, M&A valuations have held steady through YTD. The average M&A transaction multiple of 8.3x EV/EBITDA has outpaced the three-year average of 8.1x EV/EBITDA, pointing to a greater degree of pricing insulation than public markets. While market volatility may discourage initial public offering filings and large-scale acquisitions, middle market M&A is often fueled by demographics. As the baby boomer generation ages into a prime stage to maximize liquidity of their business, an inevitable wave of M&A activity will ensue. Notably, the average age of the youngest business owner in the Building Products sector is 62 years old, according to proprietary customer profile data from Huntington Bancshares Incorporated and Capstone Partners.

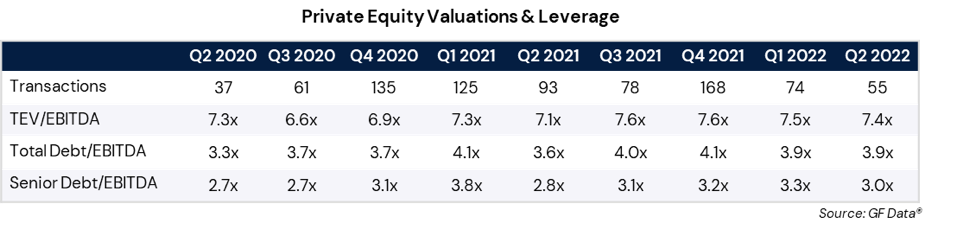

Private Equity Activity

GF Data, a provider of detailed information on business transactions ranging in size from $10 million to $250 million, provides quarterly data from over 200 private equity firm contributors on the number of completed transactions. The following chart provides the number of completed transactions from GF Data contributors, the average total enterprise value (TEV)/EBITDA multiples, and the average amount of debt utilized in the transaction computed as a multiple of EBITDA. The data, although not industry specific, demonstrated that EBITDA multiples held steady at 7.4x in Q2.

Strategics Leverage M&A to Add Capacity

Strategic buyers have continued to drive transaction volume through YTD 2022. Many strategics have facilitated divestitures to focus on core competencies and high margin business segments. Sector players that maintain healthy balance sheets are poised to remain active buyers through the remainder of the year.

Transaction Overview

CalPortland has agreed to acquire Martin Marietta’s Tehachapi, Calif., cement plant and related distribution terminals for an enterprise value of $350 million (August 2022). CalPortland is a leading producer of cement, ready mixed concrete, aggregates, concrete products, and asphalt in the western U.S. and Canada.

M&A and Sector Takeaways

The transaction bolsters CalPortland’s cement product leadership and establishes itself as a premier cement operator in California with over four million tons of annual production capacity, according to a press release.4 The purchase of the Tehachapi cement plant follows its acquisition of additional assets from Martin Marietta. In July, CalPortland closed the acquisition of Martin Marietta’s Redding, Calif., cement mill and 14 ready mixed concrete plants for an enterprise value of $250 million. The Redding and Tehachapi assets represent part of the former Lehigh Hanson West Region which Martin Marietta acquired in May 2021 for an enterprise value of $2.3 billion. The transactions highlight the robust market for divested assets of large strategics among private companies seeking scale.

Transaction Overview

Holcim US, a subsidiary of Holcim, has acquired the sand and gravel operation of Basic Construction Co. in New Kent County, Va. (August 2022). Terms of the transaction were not disclosed. “We’re excited to add this 230-acre strategic reserve, which will support our continued expansion in the Virginia market and begin a strong community engagement in New Kent County,” said Cedric Barthelemy, head of the Mid-Atlantic Region, Holcim US in a press release.5

M&A and Sector Takeaways

The transaction adds significant aggregates reserves for Holcim US’ mid-Atlantic region and aligns with its goal of growth through bolt-on acquisitions in mature Aggregates markets. The addition of Basic Construction’s sand and gravel operation is the latest in a string of acquisitions for Holcim as it continues to enhance its aggregate materials offerings. Notably, Holcim acquired Cajun Ready Mix Concrete in May for an undisclosed sum. As large strategics continue to utilize M&A to add capacity and capabilities, privately-owned companies that offer geographic penetration are poised to capture healthy buyer interest.

SELECT TRANSACTIONS

Company Spotlight: Martin Marietta

Headquarters: Raleigh, N.C.

Markets: Construction Materials

LTM Revenue: $5.9 Billion

Market Capitalization: $23.1 Billion

Company Description

Martin Marietta experienced a healthy 19% YOY revenue increase in Q2, driven by pricing growth, sustained product demand, and contributions from divestitures. Cement product shipments and pricing increased 19.8% and 14.7%, respectively, a new quarterly record for the company. Ready mix concrete products enjoyed similar pricing increases due to strong demand in Texas, specifically Dallas, Austin, and San Antonio. Despite a Q2 record 12.3% increase in product gross profit in its Building Materials business, higher input costs contributed to a gross margin decline of 140 basis points to 27.7%.

“Despite increased inflationary pressure from rising input costs, and a challenging overall macroeconomic and geopolitical operating environment, our differentiated business model once again delivered outstanding results as we capitalized on an attractive commercial environment for our business and diligently executed our value-over-volume commercial strategy. We expect to see a positive inflection in the current price/cost dynamic, as well as record second-half pricing growth rates which will facilitate attractive margin expansion and accelerated unit profitability growth going forward,” said Martin Marietta CEO Ward Nye in the company’s earnings release.

Martin Marietta completed the announced divestitures of its Colorado, Central Texas, and West Coast cement and ready mixed concrete businesses in Q2, highlighting its commitment to strengthen its margin profile. These transactions also serve to improve the company’s economic durability through business cycles, while returning capital to shareholders.

COMPANY SPOTLIGHTS: EAGLE MATERIALS

Headquarters: Dallas, Texas

Markets: Construction Materials

LTM Revenue: $1.9 Billion

Market Capitalization: $5.1 Billion

Company Description

Eagle Materials achieved record revenue of $561.4 million in its fiscal Q1 2023 (ended June 30), an 18% YOY increase, according to its earnings report.6 Strong sales growth was driven by higher cement and wallboard pricing, which increased 10% and 24%, respectively. Eagle’s Cement segment is a key driver of sales, accounting for approximately 50% of Eagle Materials’ total revenues in fiscal Q1 2023. While cement revenue increased 5% YOY, operating earnings declined slightly due to higher energy and maintenance costs. However, elevated cement pricing helped to partially offset these costs.

“In our Heavy Materials business, we implemented a second round of cement price increases in early July given the strong demand environment and our sold-out position. Looking ahead, we expect demand for cement to remain strong with infrastructure investment increasing as federal funding from the Infrastructure Investment and Jobs Act begins in earnest this fiscal year. In our Light Materials sector, wallboard shipments and orders remain strong, but we recognize quantitative tightening will likely have an impact on residential construction activity in the future. In the near term, we expect record home construction backlogs to support product demand this year,” said Michael Haack, president and CEO, in the earnings release.

Eagle Materials has continued to allocate capital towards acquisitions that extend its network of cement terminals, enhance aggregates operations, or bolster its position as a low-cost producer – reflected by its purchase of a concrete and aggregates business for an enterprise value of $121 million (May). Moving through the remainder of the year, Eagle’s healthy free cash flows provide a strong foundation for continued acquisition growth and return on capital.

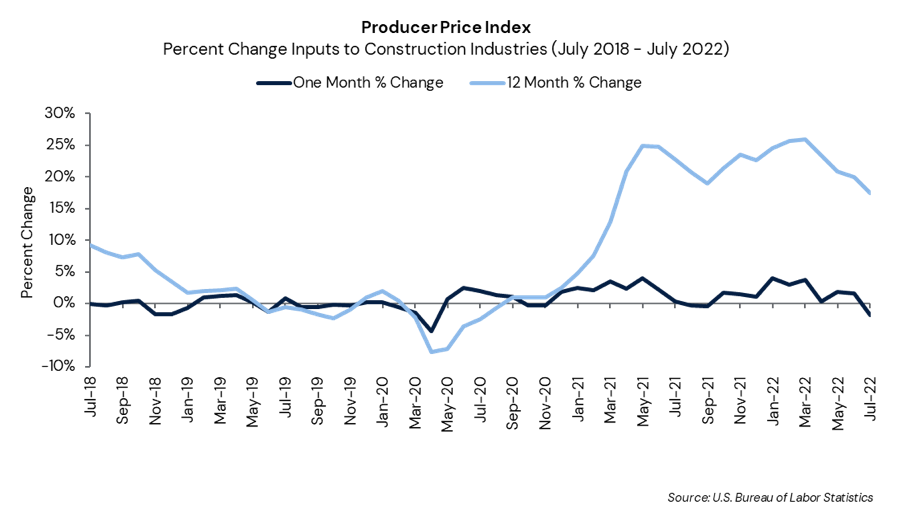

Construction Materials Update

Construction input prices fell 1.8% in July from the previous month, which marked the first month-over-month decline since September 2021, according to the U.S. Census Bureau of Labor Statistics.7 However, construction input prices remain 17.4% higher YOY.

Aggregate Materials Update

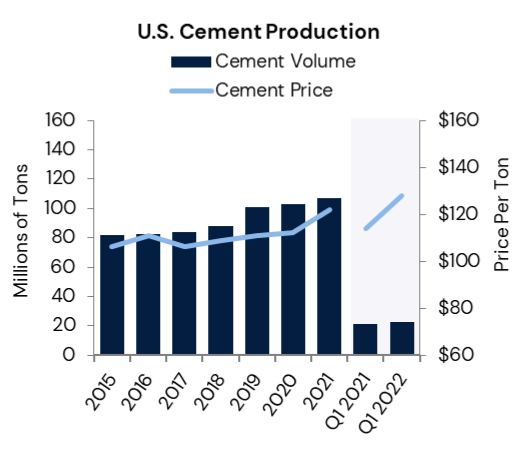

Pricing across aggregate materials increased in Q1 2022, with the largest growth seen in cement, which registered a 12.1% YOY increase. Production across all aggregate materials increased on a YOY basis but fell when compared to Q4 2021.

Cement

- Portland cement consumption amounted to 22.7 million metric tons in Q1 2022, representing a 6.1% YOY increase. Cement consumption fell nearly 17% in Q1 compared to Q4 2021.

- The average net selling price per ton for Martin Marietta and Eagle Materials cement in Q1 grew a substantial 12.1% YOY.

Source: U.S. Geological Survey and Capstone Partners

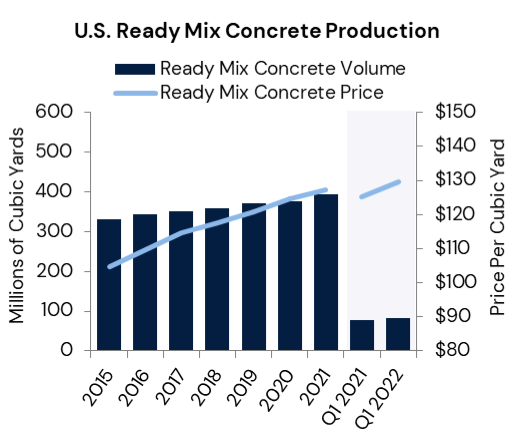

Ready Mix Concrete

- Ready mix concrete prices increased 3.6% YOY in Q1 2022 to $129.55 per cubic yard. Price data is computed from the average ready-mix net selling prices of Vulcan Materials, Martin Marietta, and Eagle Materials.

- Ready mix volume increased 6.5% YOY in Q1 to 83.8 million cubic yards. Volume declined 16.1% when compared to Q4 2021.

Source: NRMCA Industry Data Survey, Average ready-mix selling price of U.S. Concrete (not included after Q1 2021 due to acquisition by Vulcan), Vulcan Materials, Martin Marietta Materials, Eagle Materials, and Capstone Partners

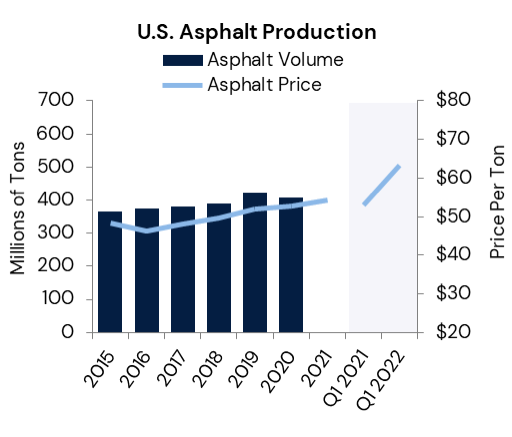

Asphalt

- Asphalt prices increased significantly in Q1 2022, rising 19.5% YOY to $63.23. Prices are measured by the average net asphalt selling prices of Vulcan Materials and Martin Marietta. Prices also increased 12% when compared to Q4 2021.

- Asphalt volume is reported on an annual basis. The most recent asphalt production amounted to nearly 408 million tons in 2020.

Source: NAPA Asphalt Pavement Industry Survey, Vulcan Materials, Martin Marietta Materials average of net asphalt selling prices, and Capstone Partners

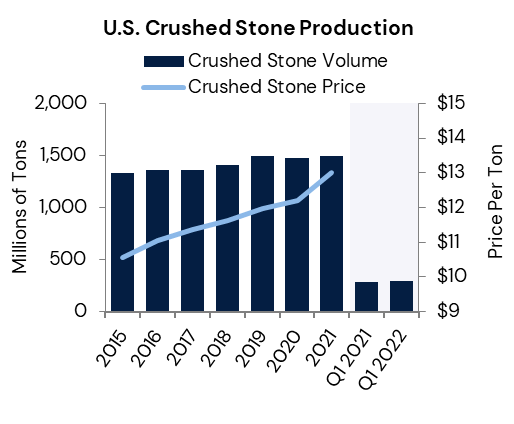

Crushed Stone

- Crushed stone production in Q1 2022 increased 3.6% YOY to 291 million metric tons. Production volume decreased compared to Q4 2021, falling 24.6%.

- Crushed stone prices are reported on an annual basis.

Source: U.S. Geological Survey and Capstone Partners

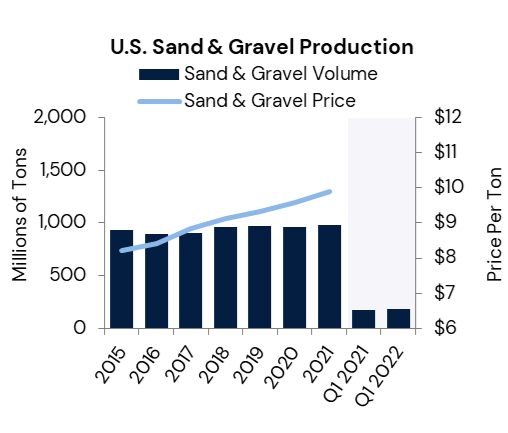

Sand & Gravel

- An estimated 185 million metric tons of sand & gravel were produced and shipped for consumption in Q1 2022, an increase of 5.1% YOY. Production volume fell 24.5% compared to Q4 2021.

- Sand & gravel prices are reported on an annual basis.

Source: U.S. Geological Survey and Capstone Partners

Capstone’s Building Products & Construction Services Team advises industry business owners, entrepreneurs, executives, and investors in the areas of M&A, capital raising, and various special situations. Due to our extensive background and laser focus within the industry, Capstone is uniquely qualified and has an unparalleled track record of successfully representing Building Products & Construction Services companies.

Capstone Partners has developed a full suite of corporate finance solutions, including M&A advisory, debt advisory, financial advisory, and equity capital financing to help privately owned businesses and private equity firms through each stage of the company’s lifecycle, ranging from growth to an ultimate exit transaction.

To learn more about Capstone’s wide breadth of advisory services and Rock Products industry expertise, please contact Managing Director Darin Good.

ENDNOTES

- Associated Builders and Contractors, “ABC’s Construction Backlog Indicator and Contractor Confidence Index Waver in July,” https://www.abc.org/News-Media/News-Releases/entryid/19538/abcs-construction-backlog-indicator-and-contractor-confidence-index-waver-in-july, accessed August 16, 2022.

- Martin Marietta, “Martin Marietta Reports Second-Quarter 2022 Results,” https://ir.martinmarietta.com/news-releases/news-release-details/martin-marietta-reports-second-quarter-2022-results, accessed August 16, 2022.

- U.S. Census Bureau, “Construction Spending,” https://www.census.gov/construction/c30/c30index.html, accessed August 16, 2022.

- Concrete Products, “CalPortland, Martin Marietta ink third cement plant deal,” https://concreteproducts.com/index.php/2022/08/09/calportland-martin-marietta-ink-third-cement-plant-deal/, accessed August 16, 2022.

- Cision, “Holcim US Increases Aggregate Capabilities with Latest Acquisition,” https://www.prnewswire.com/news-releases/holcim-us-increases-aggregate-capabilities-with-latest-acquisition-301602507.html, accessed August 16, 2022.

- Eagle Materials, “Eagle Materials Reports First Quarter Results,” http://ir.eaglematerials.com/news-releases/news-release-details/eagle-materials-reports-first-quarter-results-2, accessed August 16, 2022.

- U.S. Bureau of Labor Statistics, “PPI Commodity Data,” https://data.bls.gov/timeseries/WPUIP2300001, accessed August 16, 2022.

Disclosure

This report is a periodic compilation of certain economic and corporate information, as well as completed and announced merger and acquisition activity. Information contained in this report should not be construed as a recommendation to sell or buy any security. Any reference to or omission of any reference to any company in this report should not be construed as a recommendation to buy, sell or take any other action with respect to any security of any such company. We are not soliciting any action with respect to any security or company based on this report. The report is published solely for the general information of clients and friends of Capstone Partners. It does not take into account the particular investment objectives, financial situation or needs of individual recipients. Certain transactions, including those involving early-stage companies, give rise to substantial risk and are not suitable for all investors. This report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Prediction of future events is inherently subject to both known and unknown risks and other factors that may cause actual results to vary materially. We are under no obligation to update the information contained in this report. Opinions expressed are our present opinions only and are subject to change without notice. Additional information is available upon request. The companies mentioned in this report may be clients of Capstone Partners. The decisions to include any company in this report is unrelated in all respects to any service that Capstone Partners may provide to such company. This report may not be copied or reproduced in any form or redistributed without the prior written consent of Capstone Partners. The information contained herein should not be construed as legal advice.