In This Quarterly Report, Provided Exclusively to Rock Products, Capstone Partners Offers Insight Into Merger and Acquisitions (M&A), Capital Markets Trends, Aggregate Production and Pricing.

By Darin Good, Brian Krehbiel and Crista Gilmore

Merger and acquisition (M&A) activity has surged through year-to-date (YTD) 2021 as sellers are capitalizing on favorable industry tailwinds, elevated buyer interest and healthy valuations. Construction demand is forecast to remain robust through year end, with strategic buyers continuing to target accretive acquisition opportunities.

- Construction backlogs remain healthy through YTD, with the Infrastructure segment demonstrating the highest levels of projected activity.

- Despite labor shortages and inflationary pressures, industry participants remain confident in the growth of near-term sales and margins.

- M&A activity has surged YTD as many COVID-impacted businesses have experienced a normalization of earnings.

- Leading public companies have aggressively pursued acquisitions, with several notable transactions completed in recent months.

- Pricing across aggregates materials has improved, while volume has largely declined compared to the previous quarter.

Introduction

In this quarterly report, Capstone Partners provides insight into mergers & acquisitions, capital markets trends, aggregates production, and pricing data through YTD 2021.

Capstone’s Building Products & Construction Services team advises industry business owners, entrepreneurs, executives, and investors in the areas of M&A, capital raising, and various special situations. Due to our extensive background and laser focus within the industry, Capstone is uniquely qualified and has an unparalleled track record of successfully representing building products and construction services companies.

Public Companies

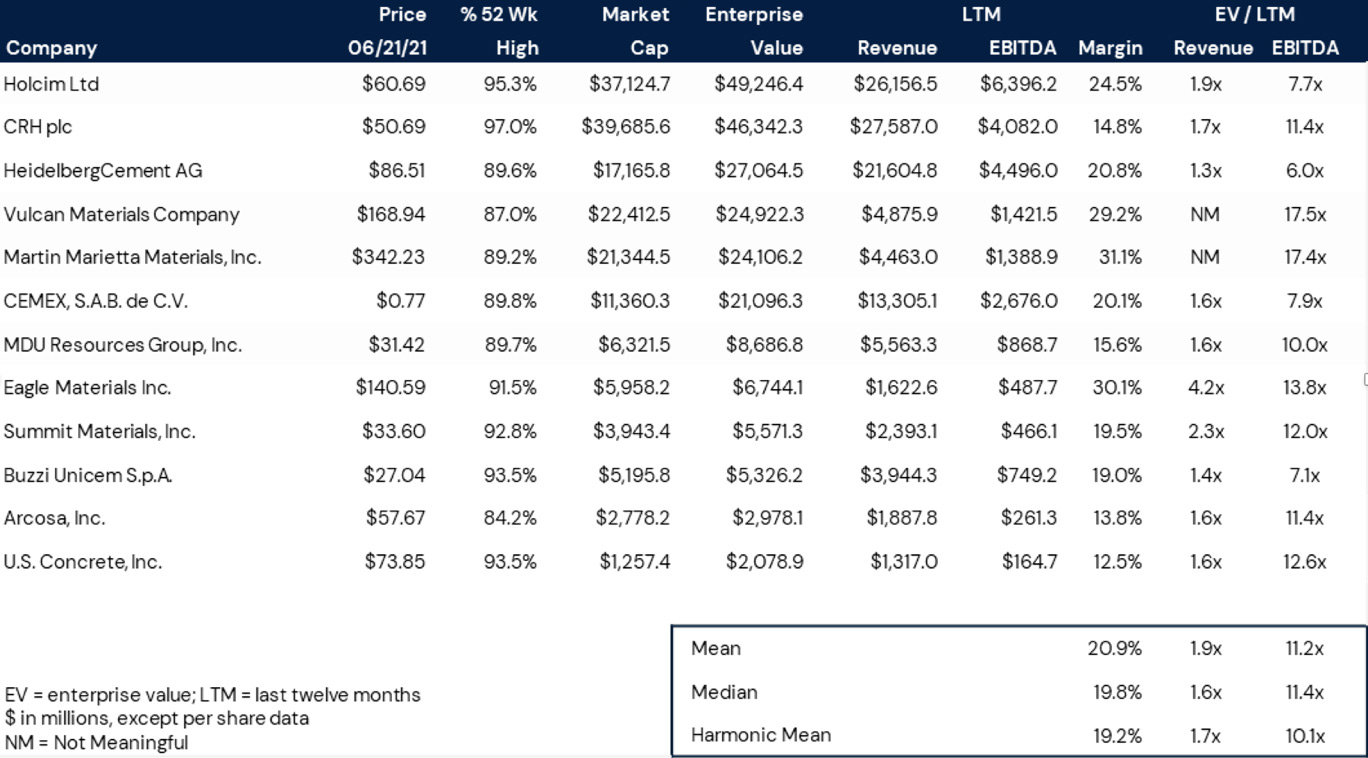

Public companies in the aggregates industry have continued to perform well in public markets, with the average trading EBITDA multiple remaining steady at 11.2x.

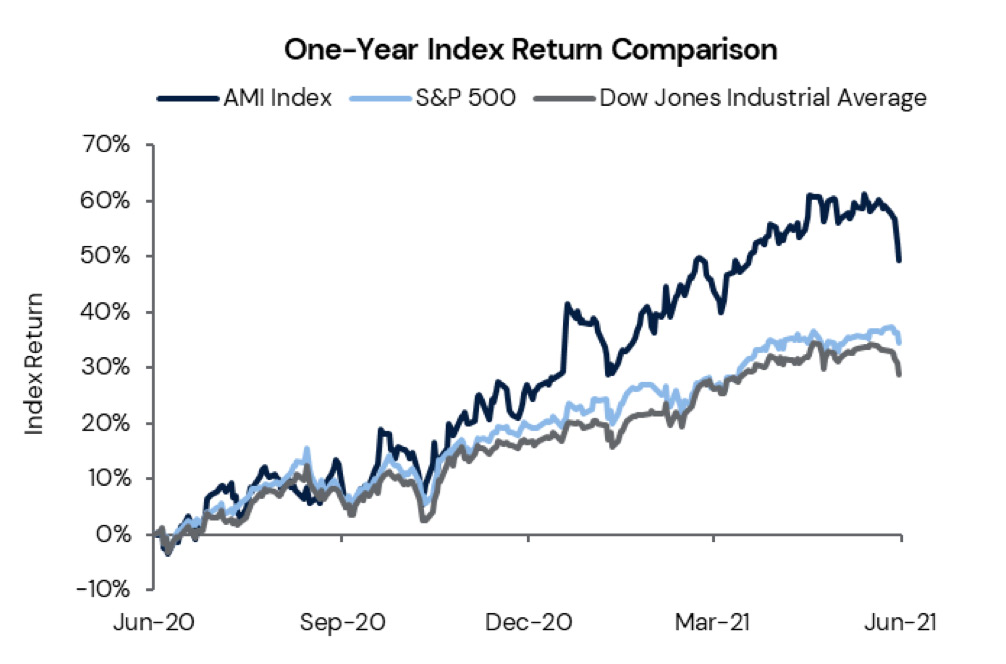

Aggregates Providers Outperform

Aggregate Materials Index: +49.4%

S&P 500: +34.5%

Dow Jones Industrial Average: +28.7%

While volatility in public equity markets has persisted, Capstone’s Aggregate Materials Index (AMI) has outperformed the S&P 500 and Dow Jones Industrial average, with the index’s value rising 49.4% over the past 12 months. Low interest rates present favorable macroeconomic conditions for industry participants, while cost inflation and labor shortages continue to serve as near-term headwinds.

Construction Backlogs Steady, Optimism Ahead

Healthy construction backlogs, improved state and local government balance sheets, and the prospect of a sizable long-term federal infrastructure package have fueled optimism in the aggregates industry. The Dodge Momentum Index, a monthly measure of nonresidential projects in planning increased 9.1% in May, with commercial planning experiencing the largest month-over-month increase since October 2017, according to Dodge Data and Analytics.1

The steadying of the Commercial sector bodes well for aggregates demand, and despite remote work and online shopping trends, backlog levels have improved year-over-year (YOY) to 8.0 months in May, according to Associated Builders and Contractors (ABC).2 Notably, aggregates intensive projects including data centers and warehouse construction have experienced heightened investment through YTD with continued activity forecast through year end. In addition, the Infrastructure segment remains a significant driver of demand, with backlog levels improving to 8.7 months in May, an increase of 0.8 from the previous month.

Construction employment remains a significant headwind for industry participants, with the Construction industry losing approximately 20,000 jobs in May, according to ABC.3 “The issue is not demand for workers, it is supply. The number of available, unfilled job openings in construction has been rising rapidly in recent months, but employment gains proved elusive in May. This is hardly unique to construction,” commented ABC Chief Economist Anirban Basu in a press release.

Despite labor shortages and inflationary pressures, contractor confidence remains high with expectations for growth in sales, profit margins, and staffing over the next six months. Pent-up demand in the Residential sector will also provide substantial activity for contractors as demand continues to drastically outpace supply. Notably, the existing home inventory declined to 1.16 million units in April, marking a 20.5% decline from the prior year and the 23rd straight month of YOY declines, according to National Association of Realtors.4 Home improvement and renovation projects have also bolstered demand for hardscapes as homeowners have increasingly pursued outdoor living investments.

Public Companies Drive Consolidation

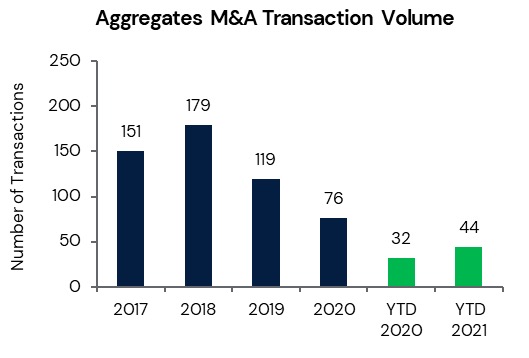

M&A activity has soared in YTD 2021 with 44 transactions announced or completed, an increase of 38% YOY. The surge in transaction volume has been fueled by a normalization of earnings among COVID-impacted businesses. This has allowed potential sellers to regain revenue visibility and they are now launching M&A sale processes previously delayed by the pandemic. In addition, the prospect of a capital gains tax increase has expedited the exit timelines of many business owners, choosing to pursue a liquidity event before year end to potentially lock in favorable tax rates.

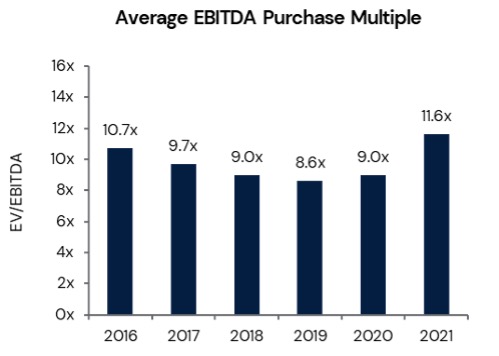

Leading public companies have bolstered their balance sheets and cash positions over the past six months, allowing for more aggressive inorganic growth pursuits. Through YTD, public aggregates buyers (29.5% of transactions) have spent over $4.4 billion on acquisitions, exceeding the total dollar amount paid by all buyers in full year 2020. Notably, Vulcan Materials flush with nearly $900 million of cash on the balance sheet, recently reached a merger agreement with U.S. Concrete for an enterprise value of $2.1 billion. Martin Marietta and MDU Resources have also been active acquirers, each completing acquisitions in recent months to add to their aggregates operations. Elevated purchase multiples, which have reached an average of 11.6x EBITDA, and heightened buyer appetite have created a favorable backdrop for near term M&A.

Sources: Capital IQ, FactSet, PitchBook, and Capstone Research

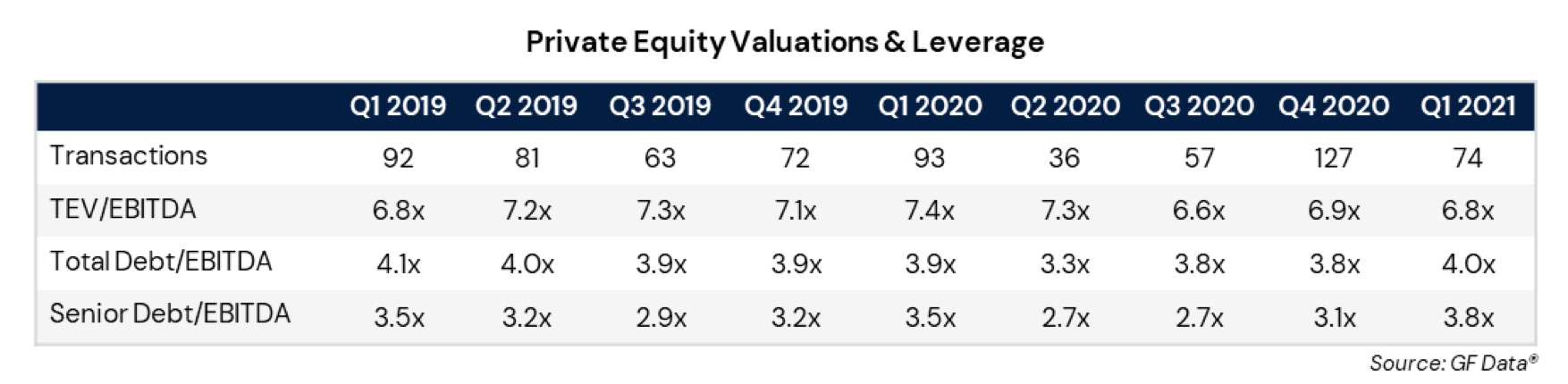

Private Equity Activity

GF Data Resources, a provider of detailed information on business transactions ranging in size from $10 million to $250 million, provides quarterly data from over 200 private equity firm contributors on the number of completed transactions. The following chart provides the number of completed transactions from GF Data contributors, the average total enterprise value (TEV)/EBITDA multiples, and the average amount of debt utilized in the transaction computed as a multiple of EBITDA. The data, although not industry specific, displayed a normalization of transaction volume and a slight decline in average EBITDA multiple in Q1.

Leading Strategics Pursue Large Scale M&A

Top industry players are allocating more resources towards inorganic growth, evidenced by several substantial disclosed transaction values. Select notable transactions are outlined below, followed by a more comprehensive transaction list on the following page.

Vulcan Materials and U.S. Concrete entered a merger agreement in which Vulcan will acquire all outstanding shares of U.S. Concrete for an enterprise value of $2.1 billion, equivalent to 11.3x EBITDA. U.S. Concrete operates across 27 aggregates operations, with 12.6 million tons shipped in 2020, according to a press release.5 The acquisition complements Vulcan’s existing aggregates business in California and bolsters its footprint in the Texas, New York, and New Jersey markets. In addition, the transaction is expected to increase Vulcan’s EBITDA by approximately $190 million before synergies and be accretive to earnings per share in the first full year post closing.

Vulcan Materials is the largest aggregates producer in the United States with $4.9 billion in revenues over the last 12 months from Q1 2021, according to its earnings release.6 The transaction highlights the high level of industry consolidation and improved health of the balance sheets of leading public companies. “U.S. Concrete is an important Vulcan customer in a number of key areas, and this transaction is a logical and exciting step in our growth strategy as we further bolster our geographic footprint,” commented Tom Hill, chairman and CEO of Vulcan Materials in a company press release.

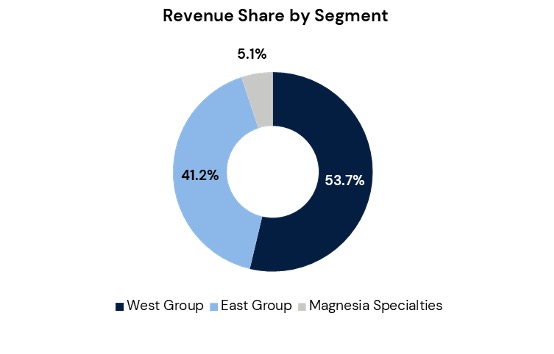

Martin Marietta Materials agreed to acquire Lehigh Hanson’s West Region Business from HeidelbergCement for an enterprise value of $2.3 billion. The transaction comes as HeidelbergCement focuses on simplifying and strengthening its portfolio in North America and improving operating margins. Martin Marietta will gain a new upstream materials-led growth platform inclusive of 17 active aggregates quarries and two cement plants with related distribution terminals. The acquisition marks Martin Marietta’s second transaction in May, having purchased Tiller, a manufacturer of aggregates and asphalt products for an undisclosed sum.

“Lehigh’s West Region has leading positions in some of the nation’s most attractive markets, providing Martin Marietta with access to new geographies for continued industry-leading growth. With this acquisition, our company will be well-positioned to capitalize on long-term demand drivers from increased state infrastructure investment in California and Arizona as well as continued private-sector growth across these regions,” commented Ward Nye, president and CEO of Martin Marietta in a press release.7

Select Transactions

Company Spotlights

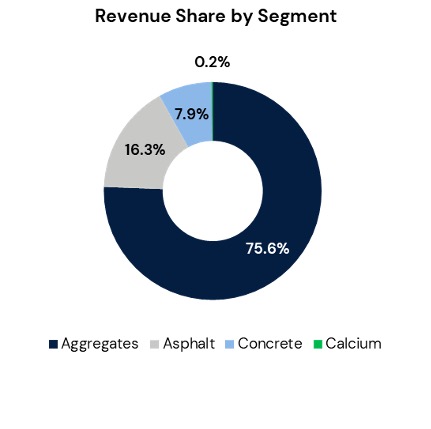

Vulcan Materials experienced robust earnings growth, driven by gains in its Aggregates business, which recorded a 15% increase in gross profit in Q1, according to its earnings release.The pricing environment has remained positive across Vulcan’s operating segments and is expected to increase throughout the remainder of the year, with the aggregates freight-adjusted price increasing 2.0% in Q1. In addition, first quarter adjusted EBITDA increased 22% YOY to $244 million, with full year guidance placing expectations between $1.38 and $1.46 billion. Efficient cost control also fueled Q1 EBITDA growth, with the aggregate total cost of sales per ton 2.0% lower YOY.

“Residential starts continued to accelerate and highway starts also increased due to improved lettings in the third and fourth quarters of last year. We’ve experienced an increase in both the number of jobs and the shipping speed in the heavy, nonresidential space, which is also the most aggregate-intensive. And finally, some of the jobs that had been postponed last year have started,” commented Thomas Hill in an earnings call.8

Vulcan’s recent acquisition of U.S. Concrete demonstrates its commitment to expanding into new markets and capitalizing on accretive acquisition opportunities. In addition, Vulcan has experienced strong performance in public markets, with its share price rising over 40% in the past year. Its balance sheet has also provided substantial flexibility for capital allocation, with net debt to adjusted EBITDA standing at 1.4x.

Martin Marietta has been an active acquirer through YTD, most recently purchasing Lehigh Hanson’s West Region Business for $2.3 billion. The acquisition follows its purchase of Tiller in May for an undisclosed sum. Tiller is a leading aggregates and hot mix asphalt supplier in the Minneapolis/St. Paul region. The transaction provides Martin Marietta with an expansive and complementary suite of product offerings. The acquisition is expected to be immedietly accretive to earnings and cash flow and contribute $170 million of product revenues and $60 million of adjusted EBITDA through the remainder of 2021.

Martin Marietta’s Building Materials business experienced record Q1 revenue and gross profit, driven by improvements in demand, increasing 3.1% and 25.1%, respectively, according to its earnings release.9 In addition, Martin Marietta achieved a 37% YOY increase in adjusted EBITDA, amounting to $204 million in Q1, largely fueled by pricing gains in its upstream aggregates and cement businesses.

“Non-residential construction continues to benefit from increased investment in aggregates-intensive heavy industrial warehouses and data centers, broadly offsetting weakness in the more COVID-19 impacted light commercial and retail sectors. Light non-residential activity should benefit from the attractive drag along effects of strong single-family residential growth in the longer-term. In some regions, we’re now seeing early signs of that recovery. Aggregates shipments to the non-residential market accounted for 37% of first quarter shipments,” commented C. Howard Nye chairman, president and CEO of Martin Marietta in an earnings call.10

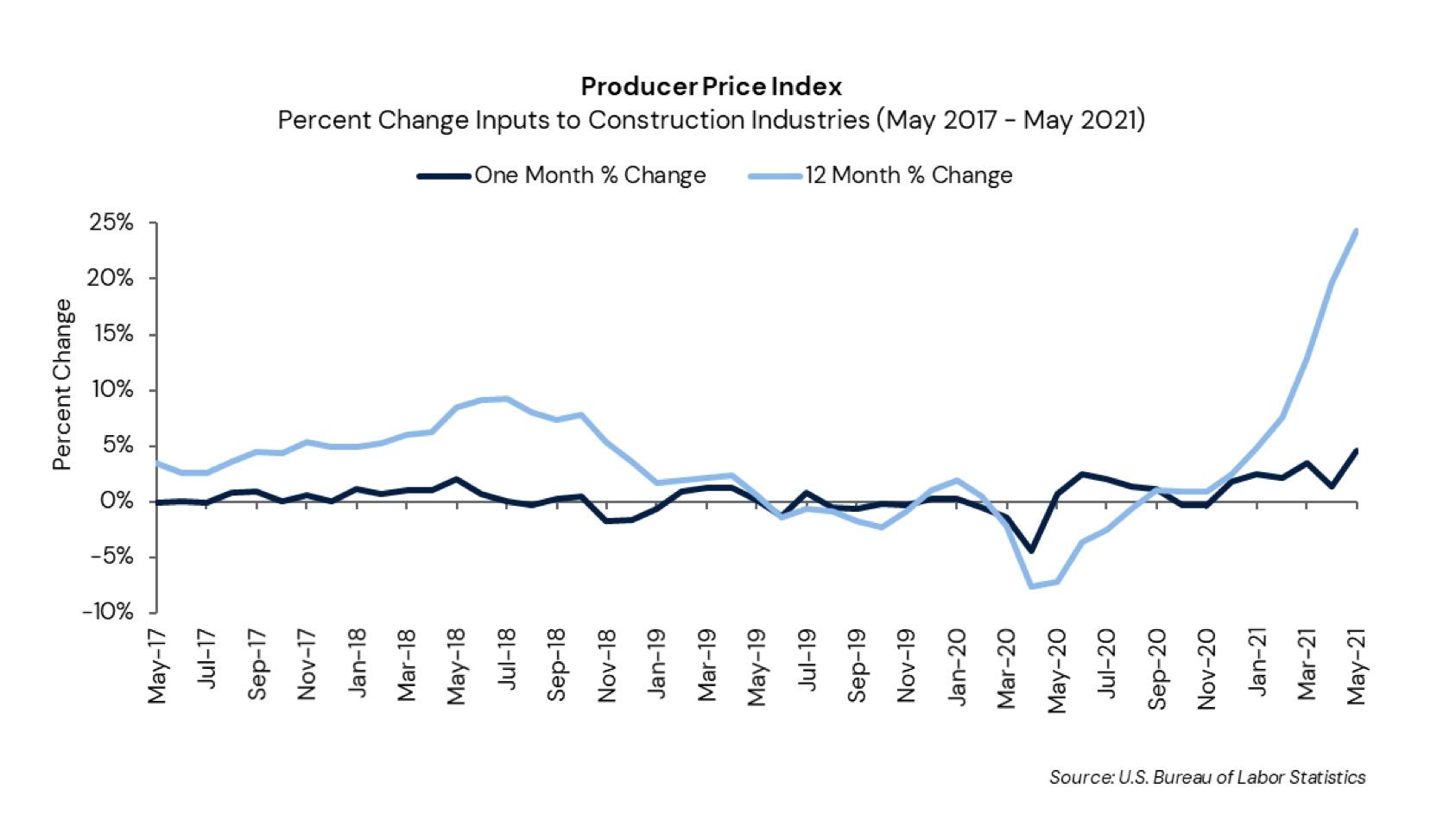

Construction Materials Update

Construction input prices increased 4.6% in May compared to the previous month with YOY prices increasing 24.3%, according to an ABC analysis of data recently released by the U.S. Bureau of Labor Statistics.11 Softwood lumber and crude petroleum have led YOY price increases, rising 154.3% and 186.7%, respectively.

Aggregate Materials Update

While select aggregates materials experienced slight increases in production year-over-year, many demonstrated significant declines compared to the prior quarter. However, pricing remains robust across all aggregates materials.

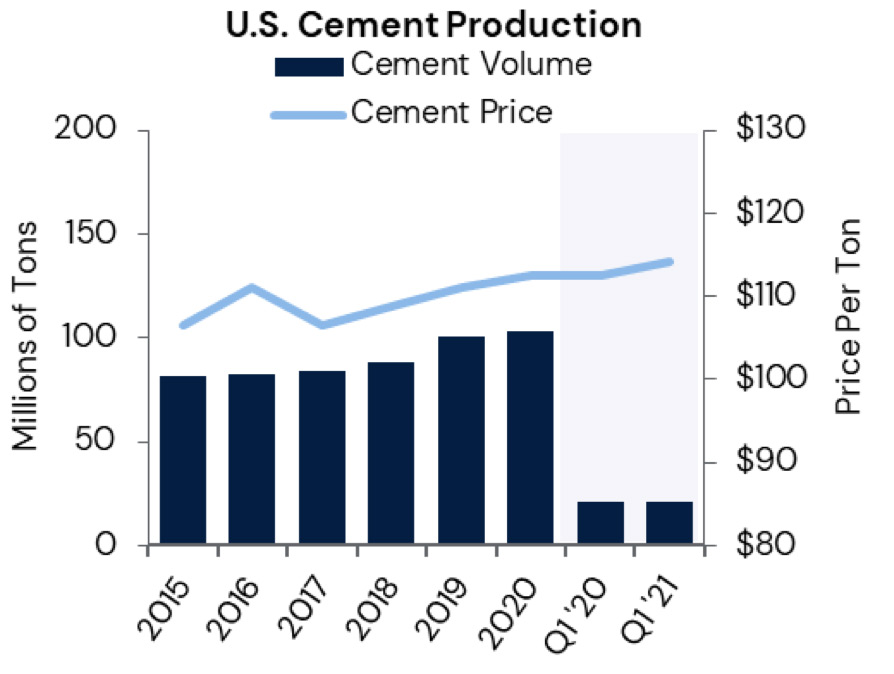

Cement

- Portland cement consumption totaled 21.4 million metric tons in Q1 2021, a 1.9% increase compared to the prior year quarter. However, consumption declined from the previous quarter, falling 17.4%.

- The average net selling price per ton for Martin Marietta and Eagle Materials cement in Q1 increased 1.5% year-over-year to $114.13 per ton.

Sources: U.S. Geological Survey and Capstone Research

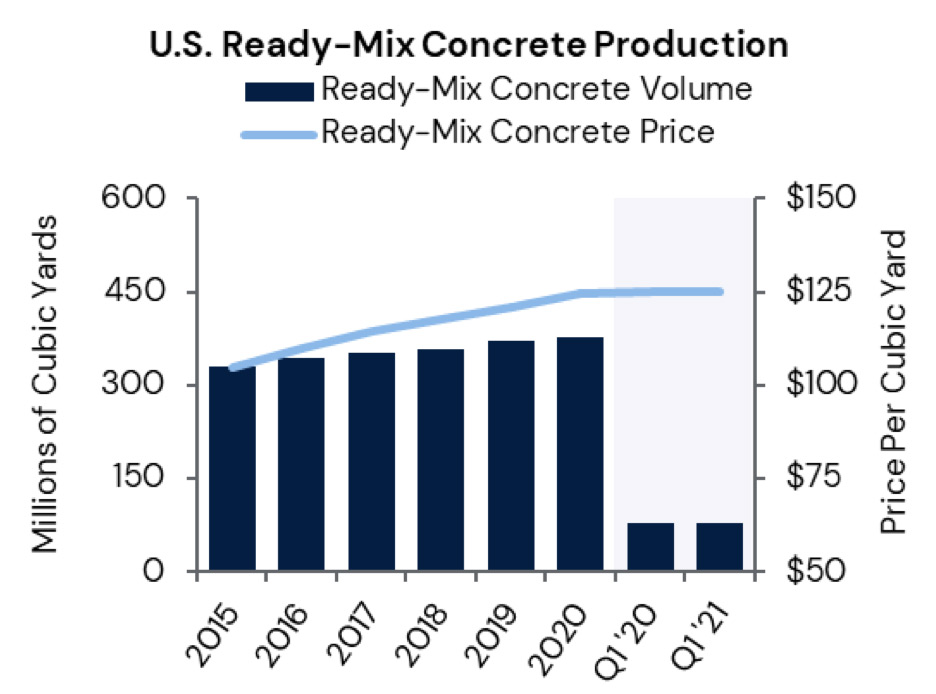

Ready-Mix Concrete

- Ready-mix concrete (RMC) prices increased 0.1% year-over-year to $125.11 per cu. yd. Price data is computed from the average RMC net selling prices of U.S. Concrete, Vulcan Materials, Martin Marietta and Eagle Materials.

- Ready-mix concrete volume increased 1.8% year-over-year in Q1 to 78.6 million cu. yd, although volume declined 17.6% from Q4.

Sources: NRMCA Industry Data Survey, Average RMC selling price of U.S. Concrete, Vulcan Materials, Martin Marietta Materials, Eagle Materials, and Capstone Research

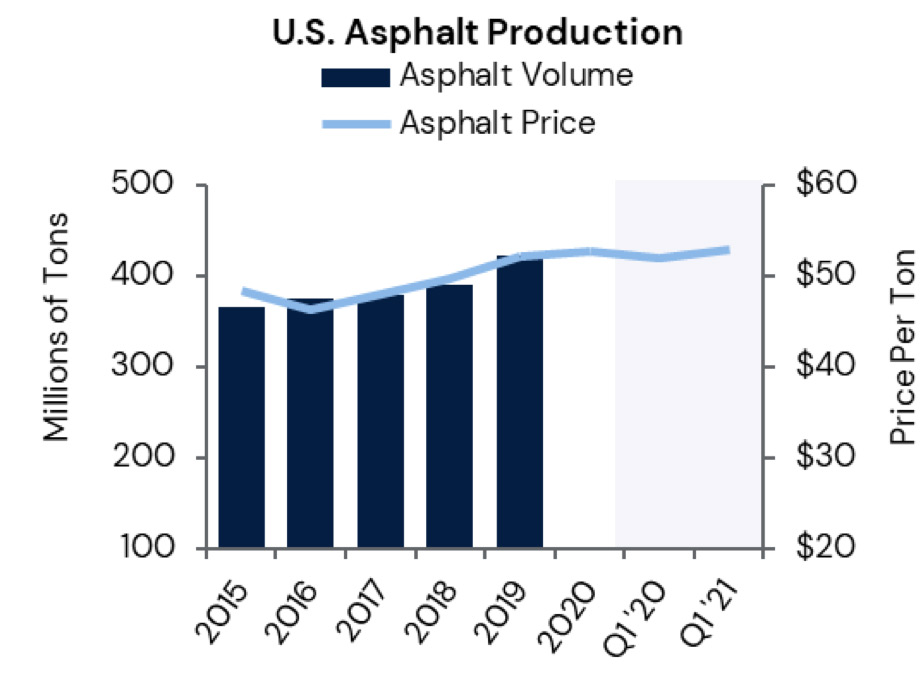

Asphalt

- Asphalt prices increased 1.8% year-over-year to $52.91 per ton, as measured by the average net asphalt selling prices of Vulcan Materials and Martin Marietta. Pricing in Q1 also increased by 0.4% compared to Q4.

- Asphalt volume is reported on an annual basis. The most recent asphalt production amounted to nearly 422 million tons in 2019.

Sources: NAPA Asphalt Pavement Industry Survey, Vulcan Materials, Martin Marietta Materials average of net asphalt selling prices, and Capstone Research

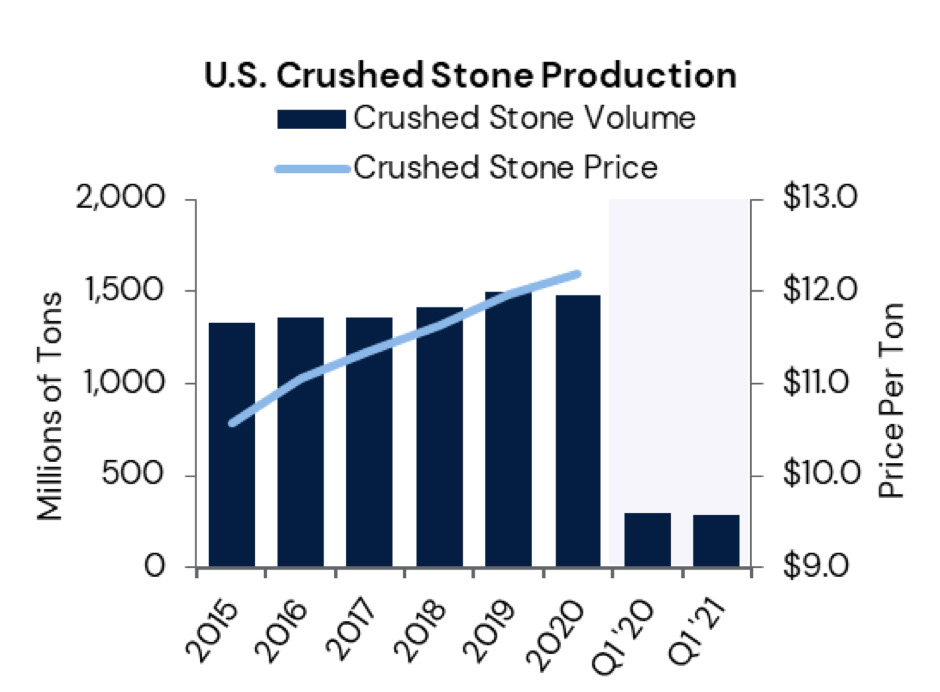

Crushed Stone

- Crushed stone production declined 1.7% year-over-year in Q1, amounting to 286 million metric tons. Total production has exhibited a larger decline compared to the prior quarter, falling 21.4%.

- Crushed stone prices are recorded on an annual basis.

Sources: U.S. Geological Survey and Capstone Research

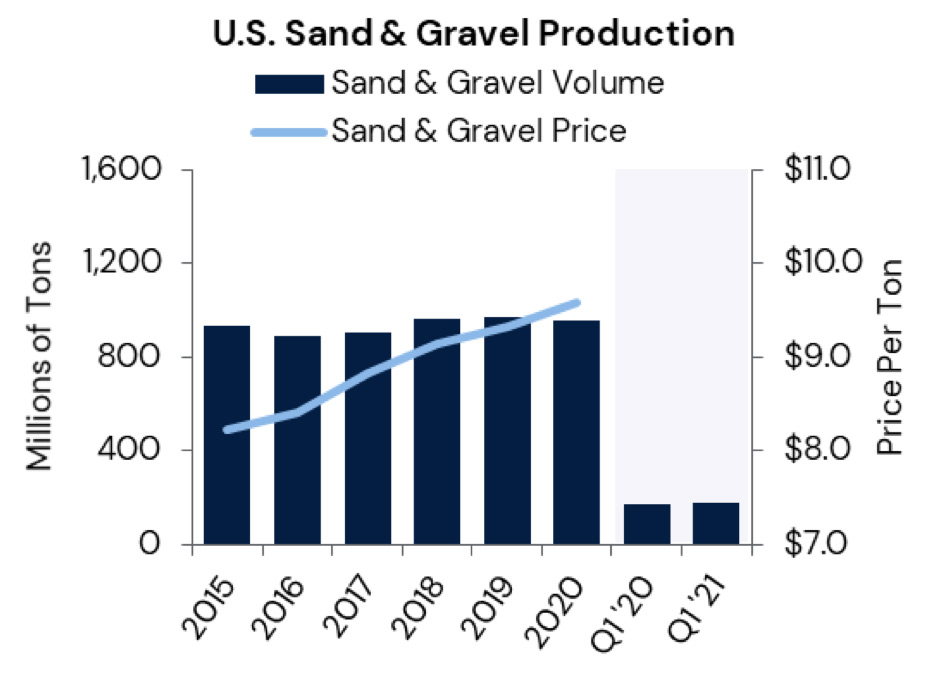

Sand & Gravel

- An estimated 178 million metric tons of sand & gravel were produced and shipped for consumption in Q1 2021, an increase of 2.9% year-over-year. Compared to Q4, total consumption fell 26.4%.

- Sand & gravel prices are recorded on an annual basis.

Sources: U.S. Geological Survey and Capstone Research

Capstone Partners has developed a full suite of corporate finance solutions, including M&A advisory, debt advisory, financial advisory, and equity capital financing to help privately owned businesses and private equity firms through each stage of the company’s lifecycle, ranging from growth to an ultimate exit transaction. To learn more about Capstone’s wide breadth of advisory services and aggregates industry expertise, please contact Managing Director Darin Good, [email protected].

ENDNOTES

- Dodge Data & Analytics, “Dodge Momentum Index Jumps in May,” https://www.construction.com/news/Dodge-momentum-index-jumps-in-may-2021, accessed June 19, 2021.

- Associated Builders and Contractors, “ABC’s Construction Backlog Inches Higher in May; Materials and Labor Shortages Suppress Contractor Confidence,” https://www.abc.org/News-Media/News-Releases/entryid/18799/abc-s-construction-backlog-inches-higher-in-may-materials-and-labor-shortages-suppress-contractor-confidence, accessed June 21, 2021.

- Associated Builders and Contractors, “Construction Employment Decreases in May; Labor and Materials Shortages Frustrate Job Growth, Says ABC,” https://www.abc.org/News-Media/News-Releases/entryid/18791/construction-employment-decreases-in-may-labor-and-materials-shortages-frustrate-job-growth-says-abc, accessed June 21, 2021.

- National Association of Realtors, “April 2021 Existing-Home Sales Drop as Home Prices Rise and Inventory Shortage Continues,” https://www.nar.realtor/blogs/economists-outlook/april-2021-existing-home-sales-drop-as-home-prices-rise-and-inventory-shortage-continues, accessed June 2, 2021.

- Cision, “Vulcan To Acquire U.S. Concrete,” https://www.prnewswire.com/news-releases/vulcan-to-acquire-us-concrete-301306495.html, accessed June 19, 2021.

- Vulcan Materials, “VULCAN REPORTS FIRST QUARTER 2021 RESULTS,” https://ir.vulcanmaterials.com/investor-relations/news-releases/news-details/2021/Vulcan-Reports-First-Quarter-2021-Results/default.aspx, accessed June 19, 2021.

- Martin Marietta, “Martin Marietta Announces Acquisition of Lehigh Hanson’s West Region Business,” https://ir.martinmarietta.com/news-releases/news-release-details/martin-marietta-announces-acquisition-lehigh-hansons-west-region, accessed June 21, 2021.

- Seeking Alpha, “Vulcan Materials Company 2021 Q1 – Results – Earnings Call Presentation,” https://seekingalpha.com/article/4424495-vulcan-materials-company-2021-q1-results-earnings-call-presentation, accessed June 19, 2021.

- Martin Marietta, “Martin Marietta Reports First-Quarter 2021 Results,” https://ir.martinmarietta.com/news-releases/news-release-details/martin-marietta-reports-first-quarter-2021-results, accessed June 21, 2021.

- Seeking Alpha, “Martin Marietta Materials, Inc. (MLM) CEO Ward Nye on Q1 2021 Results – Earnings Call Transcript,” https://seekingalpha.com/article/4424253-martin-marietta-materials-inc-mlm-ceo-ward-nye-on-q1-2021-results-earnings-call-transcript, accessed June 21, 2021.

- Associated Builders and Contractors, “Construction Input Prices Rise 4.6% in May; Softwood Lumber Prices Up 154% From a Year Ago, Says ABC,” https://www.abc.org/News-Media/News-Releases/entryid/18815/construction-input-prices-rise-4-6-in-may-softwood-lumber-prices-up-154-from-a-year-ago-says-abc, accessed June 21, 2021.

Disclosure

This report is a periodic compilation of certain economic and corporate information, as well as completed and announced merger and acquisition activity. Information contained in this report should not be construed as a recommendation to sell or buy any security. Any reference to or omission of any reference to any company in this report should not be construed as a recommendation to buy, sell or take any other action with respect to any security of any such company. We are not soliciting any action with respect to any security or company based on this report. The report is published solely for the general information of clients and friends of Capstone Partners. It does not take into account the particular investment objectives, financial situation or needs of individual recipients. Certain transactions, including those involving early-stage companies, give rise to substantial risk and are not suitable for all investors. This report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Prediction of future events is inherently subject to both known and unknown risks and other factors that may cause actual results to vary materially. We are under no obligation to update the information contained in this report. Opinions expressed are our present opinions only and are subject to change without notice. Additional information is available upon request. The companies mentioned in this report may be clients of Capstone Partners. The decisions to include any company in this report is unrelated in all respects to any service that Capstone Partners may provide to such company. This report may not be copied or reproduced in any form or redistributed without the prior written consent of Capstone Partners. The information contained herein should not be construed as legal advice.