Rock Products’ Annual Survey on the Opinions, Concerns and Buying Intentions of Producers Reveals What is on the Industry’s Collective Mind.

By Mark S. Kuhar and Josephine Patterson

As 2018 became 2019, one big issue was the government shutdown. What is the possible upstream impact on the economy? What does this mean for the construction economy? What will that in turn mean for the aggregates Industry?

No one has a good answer to that, however, there was some movement on an infrastructure bill. Reuters reported that 20 high-ranking Trump administration officials met with the president to discuss a potential infrastructure plan. According to reporters David Shepardson and Alexandra Alper, “the administration is considering a 13-year program but has not settled on key issues, including whether it will propose new ways to pay for increased spending.” The 13-year aspect would mirror the longest ever highway funding bill, from 1957 to 1969.

This month, we share the results of our sixth annual, exclusive Rock Products survey, Benchmark 2019. This survey not only offers the opportunity to gauge current producer opinion, we can also compare to previous years to see what is the same and what is different.

So who took the survey this year? A typical survey respondent was, on average, an officer, executive owner or partner (37 percent); or a production manager, foreman or technical superintendent (20 percent.) More company officers, executives, owners or partners took part in the survey than in years past. Sales executives, geologists, safety directors and others also participated in the survey.

What types of operations are reflected by this year’s survey respondents? Operations cranking out up to 500,000 tpy (43 percent) were highly represented, up from 40 percent last year. Plants producing more than 2.5 million tpy (24 percent) came next. Plants producing 500,000 to 1 million tpy (19 percent) followed and plants producing 1.5 to 2.5 million tpy (11 percent) brought up the rear.

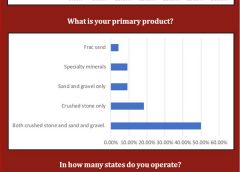

The number of survey participants from producers of both crushed stone, and sand and gravel increased this year (50 percent), way up from last year (38 percent), but producers of crushed stone only decreased (18 percent} from last year (23 percent). Producers of sand and gravel only were at 9 percent. Producers of specialty minerals and frac sand made up more than 13 percent of respondents. Geographic location was dominated by the, Southeast, Northeast and Midwest, in that order, with additional strong response coming from the Southwest.

Big Issues

When it comes to the key issues facing aggregates producers, the big “number-one” identified by survey participants this year is environmental regulation, which came in at number two last year.

Tied for second are the construction economy and labor, which tracks exactly with what has been widely reported for the past year, given concerns about a new transportation bill and the lack of qualified workers available to aggregates operations.

Permitting, the transportation economy, and the national economy were also named by many respondents.

Other concerns named in the survey with single answers ere weather, community complaints and market saturation.

Impacting the Industry

Respondents were asked the question “What will impact the U.S. aggregates industry the most in the near future and how should it prepare?”

One respondent echoed concerns about labor, saying, “The labor pool will shrink, older workers retiring, young workers are harder to recruit to the industry.” However that respondent also added a warning about global competition: “Global competition will increase, more global takeovers regardless of the position of the White House – we live in a global economy even in our local aggregates operations.”

Issues with qualified labor was a mantra repeated again and again. Here are some comments from survey respondents:

- “Labor is the biggest issue (Finding people to work). The future generations do not want to work outside and in construction.”

- “Lack of qualified operators and employees. Vocational classes and schools focus. Improve salary ranges.”

- “The greatest impact I see for our industry will be a shortage of trained workers.”

- “The labor-force needs for the industry are high and available labor pool is nonexistent.”

Permitting was on the mind of some survey respondents. One told us the main impact issue is, “More stringent permitting requirements as well as more NIMBY mentality from neighboring communities.” Another said, “Inability to zone and permit future reserves and greenfield operations. Aggregates reserves and operations should be protected and exempted from local zoning regulations. Statewide permitting should apply.”

Politics is never far from the discussion when it comes to what will impact the aggregates industry. One respondent said, “A Capital Bill for Illinois. With the new Democratic governor coming in, companies are optimistic that a Capital Bill will finally get done in this state. There is both public and private work slated to go in 2019. I think we need to be careful going into 2020 election year that the economy may stumble due to uncertainty in the country.” One prognosticator said, “The Democrats in charge of the House will slow the economy, the Republicans need to retake the House in 2020, Trump should win the presidency, and the Republicans add seats to the Senate.”

And at the end of the day, infrastructure funding is always top of mind. One respondent said the main impact issue is: “Passing or not passing continued infrastructure improvement bills. Most companies are prepared but waiting to see what happens.” Another noted, “Lack of transportation funding. Fuel/user tax increases. This is unsustainable.”

Equipment Capitalization

With a continued hope for a new federal infrastructure bill, producers plan to spend some money in 2019, building on 2018. Just over 43 percent of respondents said they increased capital spending last year.

This year approximately 29 percent of the survey group plan to spend up to $500,000. Another 29 percent of the survey group plan to spend $5 million to $10 million, a nice jump from last year when 23 percent picked that range. About 23 percent plan to spend $1 million to $5 million this year. Approximately 18 percent plan to spend $500,000 to $1 million.

And what do they plan to buy?

- Equipment upgrades, 58.75 percent.

- New equipment, 57.50 percent.

- Mine development, 33.75 percent.

- Plant additions, 32.50 percent.

- Permitting and bonding, 32.50 percent.

- Technology upgrades, 32.50 percent.

- Exploration, 20.00 percent.

- New plant construction, 22.50 percent.

- Quality control, 17.50 percent.

- New mine start up, 16.25 percent.

- Used equipment, 11.25 percent.

- Reclaim systems, 10.00 percent.

- Other, 5.00 percent.

Over and above consumables, such as oil, safety supplies, maintenance equipment, tires and replacement parts, the top equipment areas being considered for 2019 are:

- Material handling/conveying equipment, 49.35 percent.

- Pick-up/utility vehicles, 45.45 percent.

- Excavators/loaders/dredges, 44.16 percent.

- Screening and sizing equipment, 44.16 percent.

- Motors, 37.66 percent.

- Pumps, 37.66 percent.

- Drilling and blasting suppliers/services, 32.47 percent.

- Washing and classifying equipment, 27.27 percent.

- Automation products, 23.38 percent.

- Portable crushing/screening plants, 23.38 percent.

- Scales, 22.08 percent.

- Haul trucks, 22.08 percent.

- Crushers, 20.78 percent.

- Breakers, 18.18 percent.

- Energy management, 16.88 percent.

- Drones, 11.69 percent.

- Frac Sand equipment, 5.19 percent.

- Other, 3.90 percent.

Looking Ahead

Aggregates producers are pretty confident right now that they are sitting on an acceptable amount of reserves for the foreseeable future. About 82 percent of respondents said they have adequate reserves, up from 66 percent last year. When asked what limits their access to reserves, respondents cited permitting issues, followed by access to materials and NIMBY groups.

In addition, about 32 percent of respondents said their plants would operate at 70 to 80 percent capacity in 2019. About 23 percent of respondents said their plants would operate at 90 to 100 percent capacity, and another 23 percent said less than 70 percent capacity.

When asked to describe the attitude in the aggregates industry in 2019, the prevailing opinion is quite different than last year. Only 34 percent of producers are feeling more optimistic about their prospects going forward, versus 65.85 percent last year. However, just over 47 percent said they had no change in the level of optimism. While last year, only about 3 percent said they are pessimistic about the industry’s prospects, about 18 percent said they are pessimistic this year.

About 52 percent of aggregates producers expect their total production to increase this year. That is down from 60 percent last year. Just over 36 percent expect production to remain about the same.

Statistics based on information gathered by more than 400 respondents who accessed the survey.