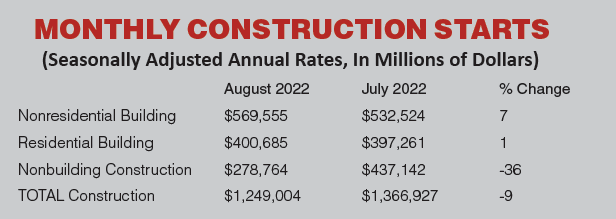

Total construction starts fell 9% in August to a seasonally adjusted annual rate of $1.25 trillion, according to Dodge Construction Network. The decline, however, comes on the heels of a massive increase in July that saw the start of three large manufacturing plants and two LNG export facilities. In August, nonresidential building starts rose 7%, residential starts were 1% higher, while nonbuilding starts lost 36%.

Highway and bridge starts were up 21%.

Year-to-date, total construction was 16% higher in the first eight months of 2022 compared to the same period of 2021. Nonresidential building starts rose 35% over the year, residential starts were 1% higher, and nonbuilding starts were up 21%.

Nonbuilding construction starts fell 36% in August to a seasonally adjusted annual rate of $278.8 billion. This decline follows a July that saw the start of two multi-billion-dollar LNG export plants. If these projects were excluded from July, August’s nonbuilding starts would have increased 27%.

In August, highway and bridge starts moved 21% higher, environmental public works increased 39%, while miscellaneous nonbuilding starts lost 9%.

Through the first eight months of the year, total nonbuilding starts were 21% higher than in 2021. Utility/gas plant starts gained 57% through the first eight months, highway and bridge starts were 21% higher, and environmental public works were 14% higher. Miscellaneous nonbuilding starts, by contrast, were down 14% through the first eight months.

For the 12 months ending August 2022, total nonbuilding starts were 15% higher than in the 12 months ending August 2021. Utility/gas plant starts were 46% higher, highway and bridge starts rose 11%, and environmental public works increased by 15%. Miscellaneous nonbuilding starts decreased by 14%.

Nonresidential building starts moved 7% higher in August to a seasonally adjusted annual rate of $569.6 billion. August’s gain comes on the heels of a massive increase in July that saw the start of several large manufacturing projects. Supporting the August gain were an airport terminal, a chip-fabrication facility and a large hotel and entertainment complex.

Commercial starts were 22% higher in August, with all categories posting an increase. Institutional starts were up 62%, despite education and healthcare declining, and manufacturing starts lost 42% during the month. Through the first eight months of 2022, nonresidential building starts were 35% higher than the first eight months of 2021. Commercial starts advanced 17% and institutional starts rose 18%, while manufacturing starts were 231% higher on a year-to-date basis.

Residential building starts rose 1% in August to a seasonally adjusted annual rate of $400.7 billion. Single family starts lost 10%, while multifamily starts gained 19%.

Regionally, total construction starts in August rose in the Northeast, South Atlantic, and West, but fell in the Midwest and South Central.