Using Mineralocity Aggregates To Address Community Concerns In Parleys Canyon, Utah.

By Stuart Burgess

I recently had lunch with an individual who is involved in exploring the potential of developing a construction aggregate quarry in Parleys Canyon, just outside of Salt Lake City. As with most quarries in the United States, the proposal is facing stiff opposition from the Not In My Backyard, or NIMBY crowd.

Our discussion focused on NIMBY opposition and the need to find a way to better portray the economic need for the quarry and benefits to the community beyond jobs and tax revenue. I put on my thinking cap and applied the Burgex Mineralocity Aggregates platform to create market intelligence for this specific proposed operation.

NIMBY-ism is not a new concept. According to Wikipedia, the word appeared in a June 1980 newspaper article from Virginia and has been used consistently since throughout the housing development, homeless shelter, incinerators, sewage treatment systems, fracking, nuclear waste repository, and mining and quarrying industries.

The idea behind NIMBY is that local residents aren’t necessarily opposed to the ideas behind a project, but want it to be built somewhere else – preferably far away. Far away from the noise, dust, and other perceived hazards. The concept makes sense and seems to follow natural human tendencies – many ideas are great in theory until they have a direct impact on your life.

Education

The answer to NIMBY by most industries is education. Educating the community about the impact of a project, both pros and cons is helpful to ease concerns. This can be difficult and may require some give and take, and in many cases the residents will remain strongly opposed regardless of efforts made.

The quality of the education and information provided certainly helps make a better case for a particular development. Within the construction aggregate industry, mentions are often made of jobs added, tax revenues, and other near-surface economic indicators that have a community impact.

What about the longer, deeper, and more far-ranging economic impacts? This is where Mineralocity Aggregates finds use in providing an information intensive, yet visual and approachable illustration of economic need.

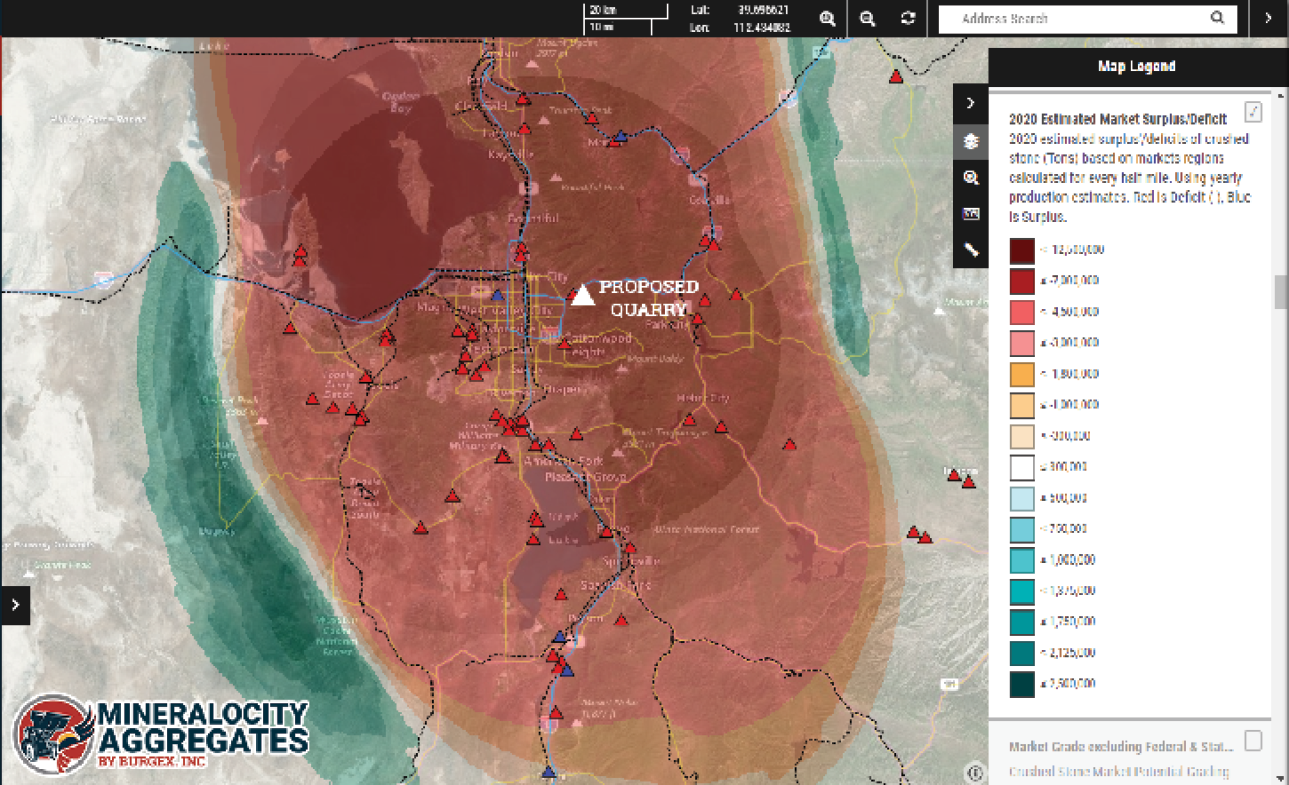

Salt Lake County, including Salt Lake City and surrounding suburbs, is one of the fastest growing regions in the country and has seen a 15.75% population growth since 2010. According to Census.gov, Utah experienced the nation’s fastest growth in housing units, with an increase of 2.7% between July 1, 2020, and July 1, 2021. Much of this growth has occurred within Utah and Salt Lake counties, both of which are within market reach of the proposed quarry.

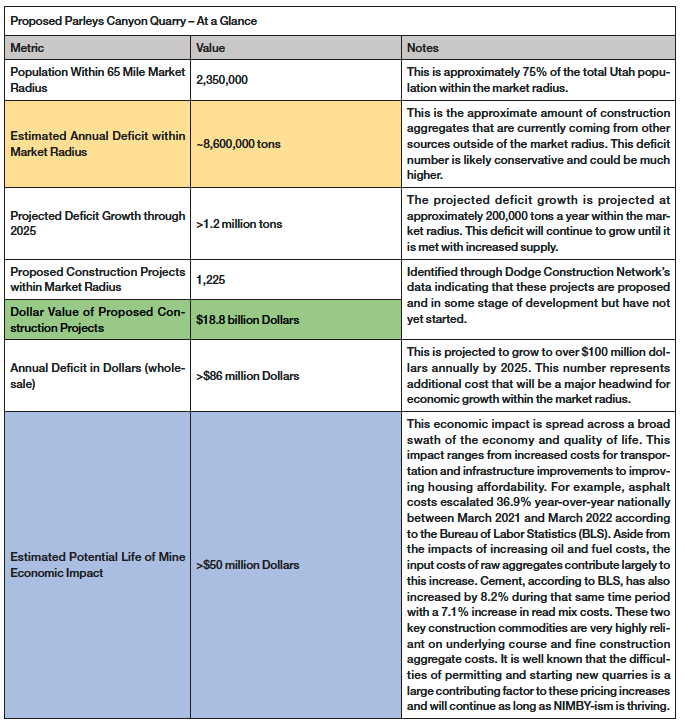

According to Mineralocity Aggregates, demand for construction aggregate between 2020-2025, within the market radius of the proposed quarry, is projected to increase by well over a million tons in annual consumption (see Figure 1).

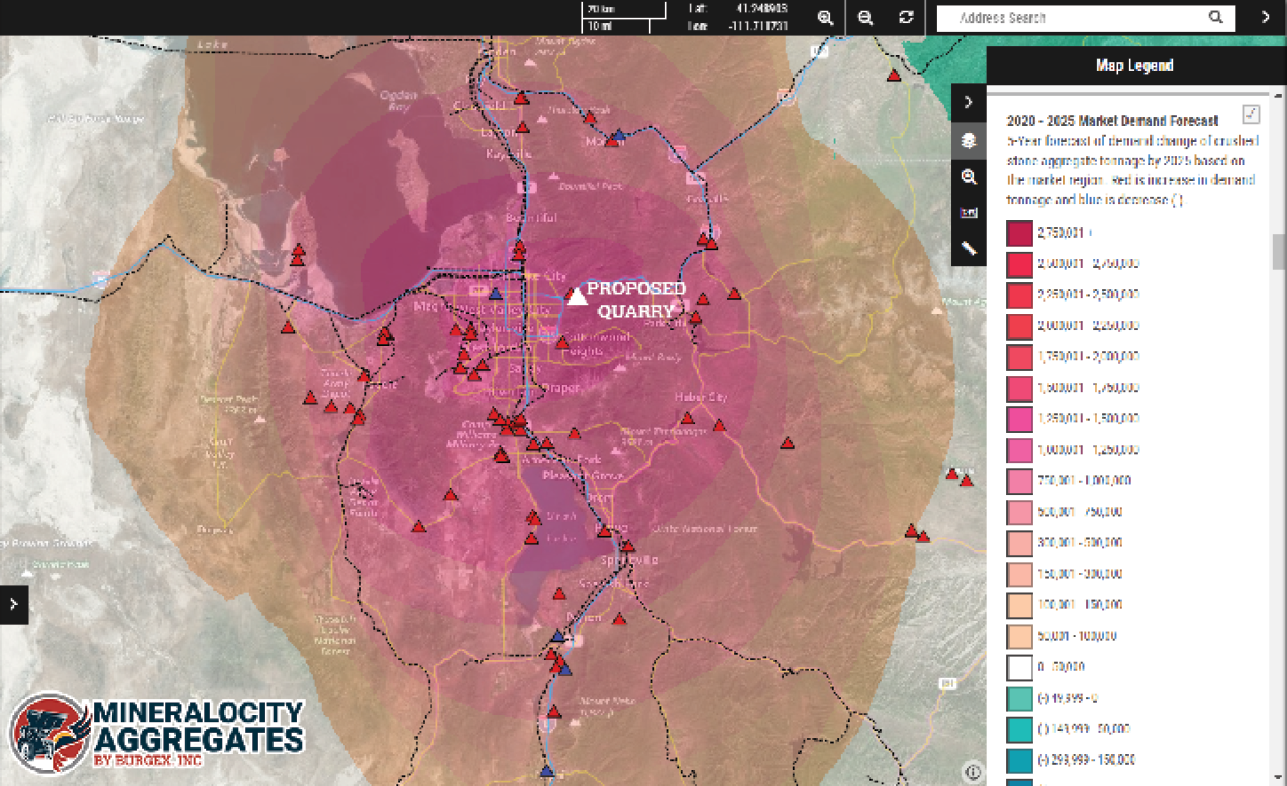

Currently, Mineralocity Aggregates estimates that there is a supply deficit of construction aggregates within the market for the proposed quarry of over 8.6 million tons (see Figure 2). This is material that is being shipped into the market, often by truck at a high cost. This deficit is projected to grow through 2025 and beyond.

As a customer of Dodge Construction Network, using its comprehensive projects database, we identified the total value and number of construction projects within a 65-mile market radius of the proposed quarry site. This data indicates that there are 1,225 construction projects at a total value of over $18.8 billion dollars proposed in some stage of development.

Virtually all these projects will require some construction aggregates that could be produced at this proposed quarry. If not supplied by the quarry, they will need to be sourced elsewhere – further putting supply constraints on existing regional quarries and ultimately driving up prices. It is believed that many of the existing quarries within the market are operating at or near maximum capacity.

Market Opportunity

Assuming a current deficit of approximately 8.6 million tons and an increase to roughly 10 million tons by 2025, at an average Utah wholesale price of $10 per ton – this means there is a market opportunity for over $100 million dollars’ worth of annual construction aggregate sales within the market radius of the proposed quarry.

It is unlikely that this proposed operation can meet all of this demand, but even just an additional half a million tons of annual regional production will help keep supply chains open for all of the proposed construction projects in the region. Over the life of the operation, it could potentially add tens of millions of dollars to the economy directly and through cost savings to downstream consumers – from Utah DOT to commercial construction contractors, and even homebuyers themselves.

Regardless of whether the new Parleys Canyon quarry moves forward or not, this local deficit in construction aggregate materials will increase if construction growth continues – which it is projected to do.

Our deficit projections also assume that current output from existing quarries remains consistent, which may not be the case as some major quarries within the market are thought to be reaching the end of their reserves – with no available replacements. It is likely that several new quarries will need to be developed within the next decade to meet the growing demand from commercial, housing, transportation, and infrastructure growth.

There are limited locations that allow for the production of fine and coarse aggregates that meet stringent quality specifications and are also located within trucking distance from Utah’s high growth region. These quarries will need to be built somewhere – otherwise costs will continue to escalate until it becomes too expensive for continued regional growth.

This problem is not isolated to Salt Lake County or Utah as a whole, but is faced on a nationwide level. NIMBY-ism makes things more expensive, and when it impacts key economic inputs like construction aggregates, the impacts can be felt by all.

With a nationwide dataset and many layers of market intelligence and economic insight, the Mineralocity Aggregates platform gives aggregate producers, trade associations, and government entities the insights that they need to make smart decisions and conduct short- and long-term planning. When it comes to addressing NIMBY concerns, this insight could make the difference between success and failure.

Stuart Burgess is chairman and co-founder of Burgex Mining Consultants, Sandy, Utah, www.burgex.com.

Mineralocity Aggregates

Mineralocity Aggregates was developed by Burgex Inc. Mining Consultants to be the leading platform for construction aggregate mineral market intelligence in the United States.

With the advanced GIS layers created by Mineralocity Aggregates, dynamic calculations are run on a matrix of granular grids of less than one square mile that cover entire states and regions. This generates a high-resolution interactive map that can be used to identify areas of supply deficit, which could be ideal for the placement of a new quarry, pit, or distribution yard.

The platform also provides a host of other interactive layers such as the estimated annual production range of existing commercial quarries, favorable geological units for construction aggregates, regional economic and population growth indicators for future planning, projections, plus cement plants.