In This Quarterly Report, Provided Exclusively to Rock Products, Capstone Partners Offers Insight Into Merger and Acquisition Activity, Capital Markets Trends, Aggregate Production and Pricing.

By Darin Good, Brian Krehbiel and Crista Gilmore

The Aggregates sector has continued to benefit from robust construction demand, despite persistent supply chain disruptions and rising inflation. The merger and acquisition (M&A) market has remained healthy with public companies actively refocusing their product portfolios. Several key report takeaways are outlined below.

1. Leading sector players have captured strong revenue growth, however, elevated costs have negatively impacted margins.

2. Surging demand for aggregates intensive projects, including warehouses and data centers, have provided sector participants with valuable revenue opportunities.

3. M&A activity has outpaced the prior year as public companies have focused on divesting non- core assets and bolstering the high margin areas of their businesses.

4. Middle market M&A purchase multiples in the Aggregates sector have demonstrated strength, outpacing the broader Building Products & Construction Services industry.

5. Prices across all Capstone-tracked aggregate materials have increased, reflecting the current inflationary environment.

Introduction

In this quarterly report, Capstone Partners provides insight into mergers & acquisitions, capital markets trends, aggregates production, and pricing data through year-to-date 2022.

Capstone’s Building Products & Construction Services Team advises industry business owners, entrepreneurs, executives, and investors in the areas of M&A, capital raising, and various special situations. Due to our extensive background and laser focus within the industry, Capstone is uniquely qualified and has an unparalleled track record of successfully representing Building Products & Construction Services companies.

Public Company Commentary

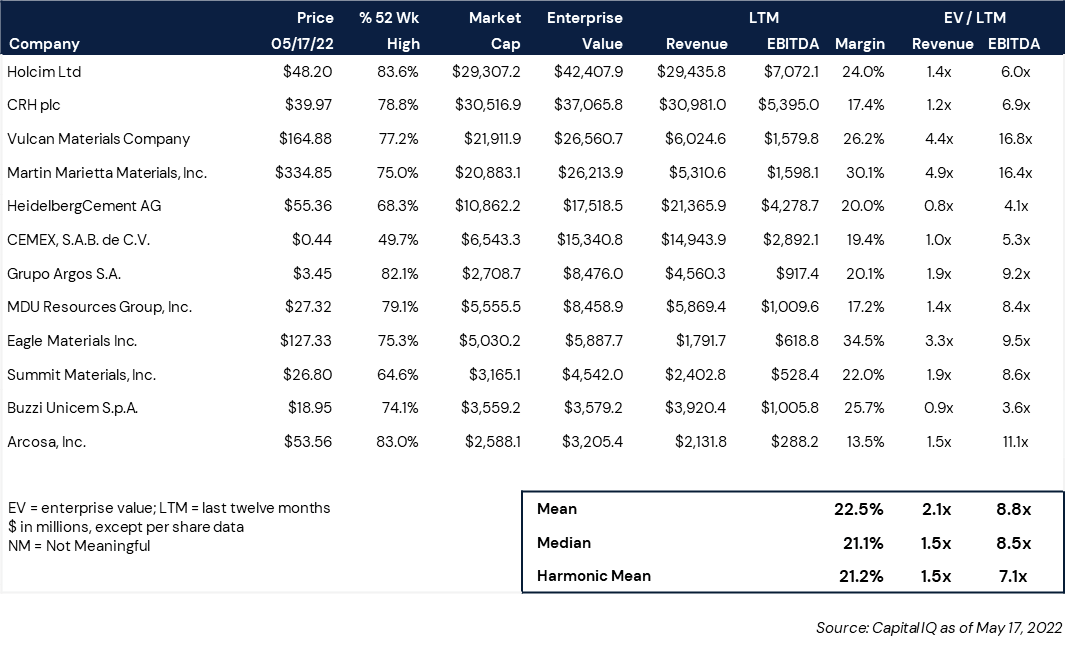

Public company EBITDA trading multiples in the Aggregates sector have averaged 8.8x over the last-twelve-month (LTM) period, a notable decline from the prior year’s average of 10.9x. Vulcan Materials and Martin Marietta continue to lead the sector from an EBITDA multiple perspective, trading at 16.8x and 16.4x, respectively.

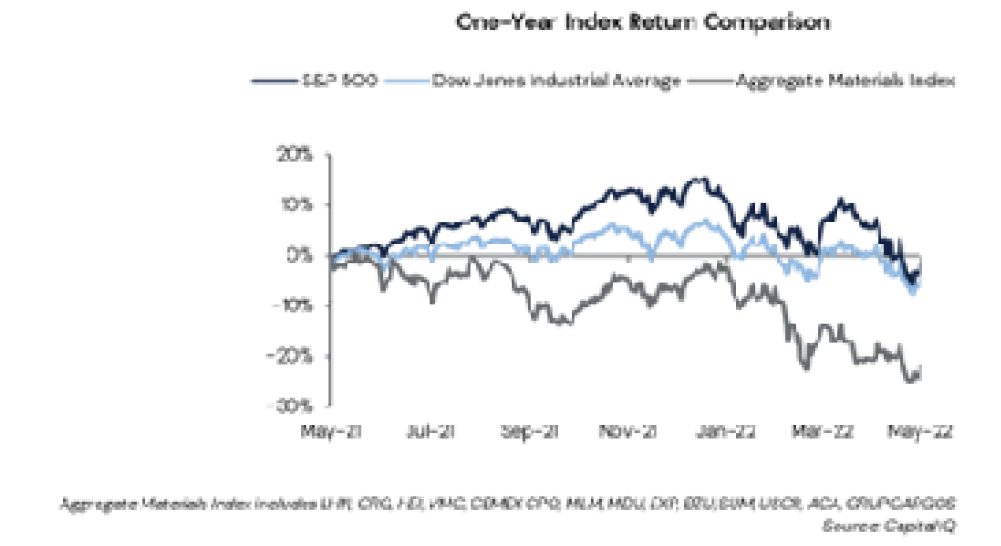

Public Equity Markets Struggle Amid Elevated Volatility

Aggregate Materials Index: -21.8%

S&P 500: -1.8%

Dow Jones Industrial Average: -4.9%

Elevated inflation, supply chain disruptions, and rising interest rates have contributed to a broad selloff across equity markets in recent weeks. Market uncertainty has been heightened as the Federal Reserve aims to curb inflation through multiple interest rate hikes – a delicate balance between quelling higher prices and inducing an economic downturn. Public companies in the Aggregates sector have trailed the broader markets, with Capstone’s Aggregate Materials Index falling -21.8% in the past year.

Healthy Aggregates Sector Demand Persists

Surging demand in the Aggregates sector has continued through year-to-date (YTD) 2022, uninterrupted by rising interest rates and persistent labor shortages as total construction spending increased 11.7% year-over-year (YOY) in March, according to the U.S. Census Bureau.1

While the sector has certainly encountered challenges with elevated materials and transportation costs, healthy construction backlogs and favorable aggregates pricing have driven top line growth for leading industry players. Market participants have gained solid demand visibility, evidenced by the Associated Builders and Contractors (ABC) backlog index rising to 9.3 months, marking a healthy YOY increase of 1.3 months.2

Despite elevated construction input costs, which rose nearly 24% YOY in March (U.S. Census Bureau), contractors remain confident that sales, profit margins and staffing are poised to grow over the next six months, according to ABC.

The favorable aggregates pricing environment has helped to offset continuous cost inflation and rising diesel and other energy expenses. Martin Marietta, while encountering reduced first quarter profitability, achieved a 25% YOY increase in revenues – marking a new first quarter record, according to its earnings release.3

In addition, strong demand in aggregates intensive projects including warehouses, data centers, and manufacturing facilities has contributed to sector optimism. Notably, manufacturing construction spending has experienced a significant boost, rising 31.9% YOY in March, which may be reflective of a reshoring of supply chains.

Well-funded state departments of transportation (DOT) budgets have also supported the favorable outlook in the Aggregates space, bolstered by the Infrastructure Investment and Jobs Act which has buoyed growth prospects for highways and other infrastructure projects. Moving through Q2, supply chain disruptions and elevated materials costs will continue to present challenges for sector participants, forcing many to focus on margins and core business operations. This presents significant consolidation opportunities as aggregates businesses shed assets that may provide meaningful synergies or diversification for other strategic players.

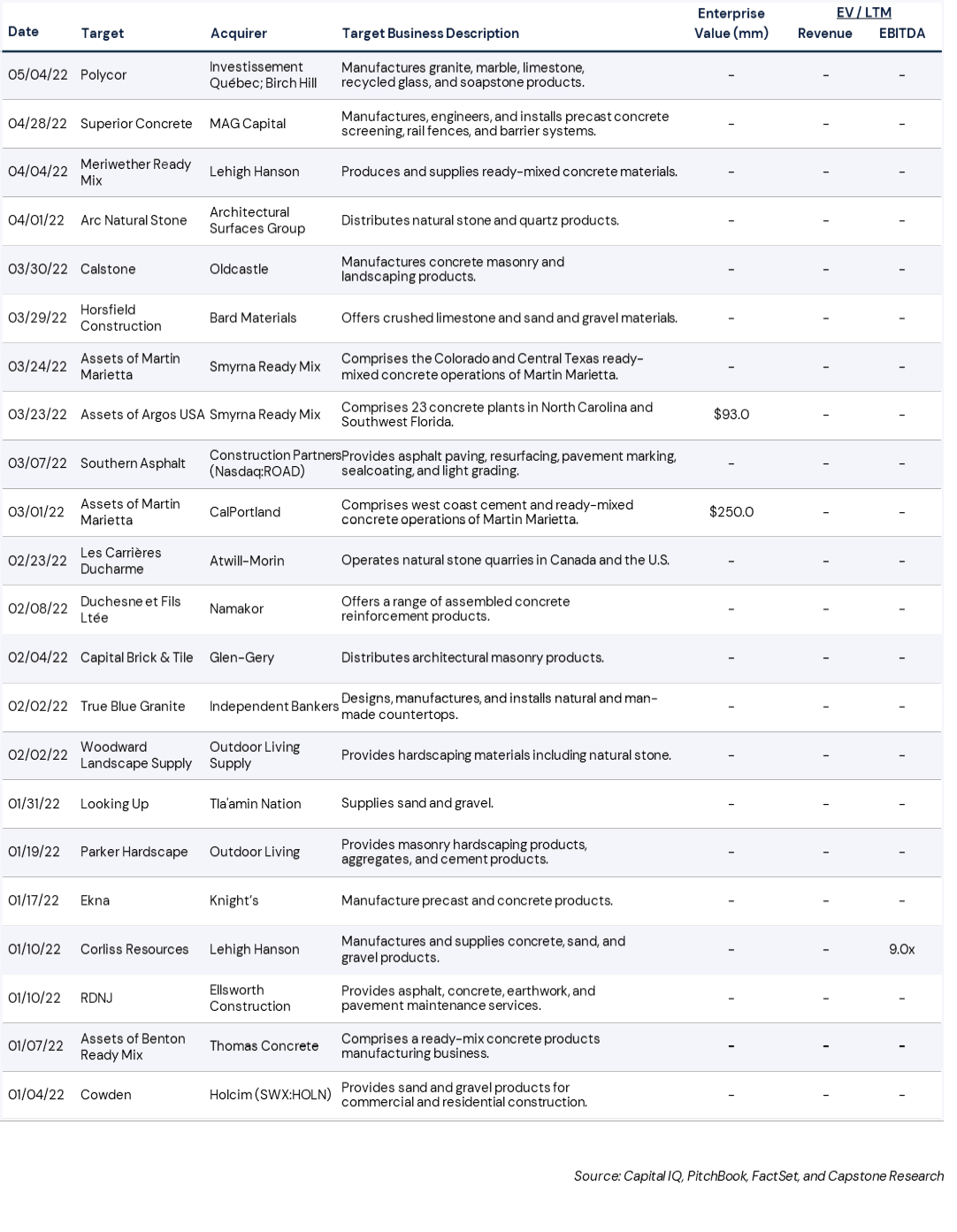

M&A Volume Continues at Rapid Pace in 2022

M&A activity in the Aggregates sector has continued to outpace the prior year with 52 transactions announced or completed through YTD. Private strategic buyers have dominated M&A volume, accounting for 61.5% of total 2022 transactions as sector players have leveraged inorganic growth to scale operations and penetrate new geographies.

While private equity firms have accounted for a modest 21.2% of transaction activity, sponsors have nearly surpassed last year’s total M&A count with 11 transactions to-date compared to 13 in all of 2021. In addition, the Building Products industry has recently become one of the top sectors sought by private equity firms within Capstone’s network.

Amid an elevated cost environment, public companies have increasingly utilized divestitures to optimize their portfolios and drive margin strength. Notably, Summit Materials has continued to divest non-core businesses that do not meet return or margin targets. In Q1 it completed its ninth divestiture, selling a business in its East segment which generated $48 million of sale proceeds and equated to an 8x EBITDA multiple, according to its earnings call.4 Martin Marietta has adopted a similar strategy as it looks to optimize its aggregates portfolio, divesting its Colorado and Central Texas ready-mix concrete businesses to Smyrna Ready Mix in April for an undisclosed sum (see more details on page 92).

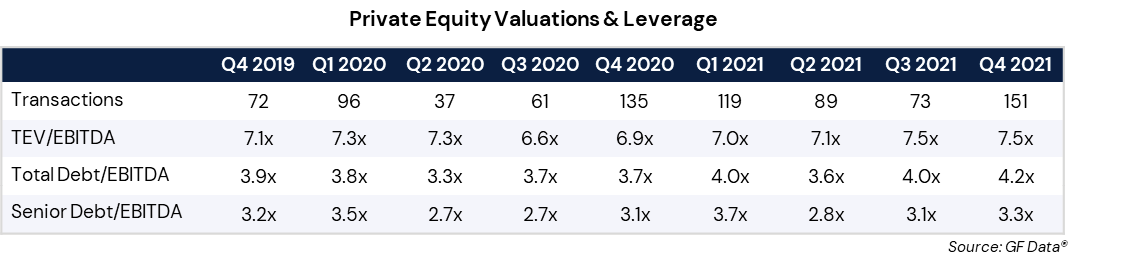

Following elevated M&A valuations across the middle market in 2021, many sectors have noted declines in pricing through YTD 2022, potentially signaling the beginning of a shift to a buyer’s market. However, multiples in the Aggregates sector have remained healthy, with the average EBITDA multiple spanning 2019 to YTD 2022 amounting to 9.5x. At the middle market level, characterized by transactions below $500 million in enterprise value, the average sector multiple has stood at a robust 8.7x, outperforming the broader Building Products & Construction Services industry valuation of 7.9x EBITDA, according to Capstone Partners Middle Market M&A Valuations Index.

Private Equity Activity

GF Data Resources, a provider of detailed information on business transactions ranging in size from $10 million to $250 million, provides quarterly data from over 200 private equity firm contributors on the number of completed transactions. The following chart provides the number of completed transactions from GF Data contributors, the average total enterprise value (TEV)/EBITDA multiples, and the average amount of debt utilized in the transaction computed as a multiple of EBITDA. The data, although not industry specific, demonstrated that EBITDA multiples held steady in Q4 2021 at 7.5x.

Public Strategic Players Look To Optimize Portfolios

Public strategics in the Aggregates space have been active M&A participants through YTD 2022, both as buyers and sellers of assets. Leading sector players are expected to continue to engage in M&A through the remainder of the year, with many leveraging healthy balance sheets and liquidity positions.

Transaction Overview

Lehigh Hanson, a subsidiary of HeidelbergCement, has acquired Meriwether Ready Mix for an undisclosed sum (April 2022). Founded in 2005, Meriwether is a leading ready-mix concrete producer serving residential and commercial clients in the Metro Atlanta area. The transaction includes four ready-mixed concrete plants and a fleet of mixer trucks.

M&A and Sector Takeaways

Lehigh Hanson has continued to optimize its aggregates portfolio with the addition of Meriwether, which follows its January purchase of Corliss Resources for a 9x EBITDA multiple (enterprise value not disclosed). Corliss is a leading aggregates and ready-mixed concrete provider in the U.S. Pacific Northwest. Lehigh’s recent acquisition streak also showcases HeidelbergCement’s focus on establishing a greater U.S. presence through Lehigh Hanson. The addition of Meriwether also aligns with longer term ESG (environmental, social, and governance) initiatives in the Aggregates sector, as Meriwether is expected to bolster Lehigh Hanson’s sustainable, low carbon concrete product offerings.

Transaction Overview

Lehigh Hanson, a subsidiary of HeidelbergCement, has acquired Meriwether Ready Mix for an undisclosed sum (April 2022). Founded in 2005, Meriwether is a leading ready-mix concrete producer serving residential and commercial clients in the Metro Atlanta area. The transaction includes four ready-mixed concrete plants and a fleet of mixer trucks.

M&A and Sector Takeaways

Lehigh Hanson has continued to optimize its aggregates portfolio with the addition of Meriwether, which follows its January purchase of Corliss Resources for a 9x EBITDA multiple (enterprise value not disclosed). Corliss is a leading aggregates and ready-mixed concrete provider in the U.S. Pacific Northwest. Lehigh’s recent acquisition streak also showcases HeidelbergCement’s focus on establishing a greater U.S. presence through Lehigh Hanson. The addition of Meriwether also aligns with longer term ESG (environmental, social, and governance) initiatives in the Aggregates sector, as Meriwether is expected to bolster Lehigh Hanson’s sustainable, low carbon concrete product offerings.

Transaction Overview

Smyrna Ready Mix Concrete (SRM Concrete) has aggressively expanded its ready-mix operations in recent months with two acquisitions in March acting as the counterparty to divestitures from Argos USA and Martin Marietta. In March, SRM Concrete acquired Martin Marietta’s Colorado and Central Texas ready-mix operations for an undisclosed sum. The transaction was preceded by SRM’s purchase of 23 ready-mix concrete batching plants from Argos USA for an enterprise value of $93 million (March 2022).

M&A and Sector Takeaways

The transaction highlights SRM’s focus on bolstering its scale and geographic concentration. It also demonstrates the active market for public company divestitures. With a potential economic downturn on the horizon, many sector players are fortifying their operations, focusing on high margin categories that are core to operations. Argos USA’s parent company Cementos Argos sold its concrete plants to shed assets in suburban markets that were not already integrated into its production and logistics chain, according to a press release.5 Martin Marietta’s rationale for sale revolved around its capital allocation priorities, specifically returning cash to shareholders, according to a company release.6

Company Spotlights

Summit Materials

Arcosa