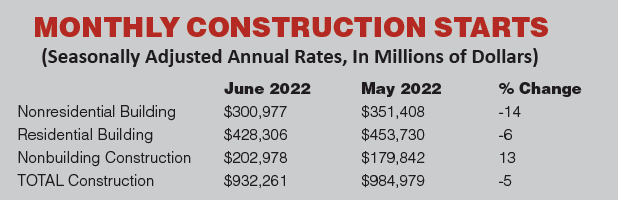

Total construction starts fell 5% in June to a seasonally adjusted annual rate of $932.3 billion, according to Dodge Construction Network. Nonresidential building starts lost 14% during the month and residential was 6% lower. On the contrary, nonbuilding starts gained 13% in June due to the start of several large solar projects.

Highway and bridge starts declined 6%.

Year-to-date, total construction was 5% higher in the first six months of 2022 compared to the same period of 2021. Nonresidential building starts rose 13% and residential starts gained 3%, while nonbuilding starts were 2% lower. For the 12 months ending June 2022, total construction starts were 7% above the 12 months ending June 2021. Nonresidential starts were 17% higher, residential starts gained 5% and nonbuilding starts were down 2%.

Nonbuilding construction starts rose 13% in June to a seasonally adjusted annual rate of $203.0 billion. Powering the increase was a sharp rise in the utility/gas category due to the start of a large solar project in Nevada and a transmission line through Utah and Wyoming.

Miscellaneous nonbuilding starts rose 21% in June, while highway and bridge starts lost 6% and environmental starts slid 16%. Through the first six months of the year, total nonbuilding starts were 2% lower than in 2021.

Highway and bridge starts gained 15% through six months, but environmental public works projects were 4% lower. At the same time, miscellaneous nonbuilding starts dropped 19% and utility/gas plants starts plunged 28% through six months.

Nonresidential building starts dropped 14% in June to a seasonally adjusted annual rate of $301.0 billion. It was a broad-based decline for the month, with commercial starts falling 16%, manufacturing starts down 14%, and institutional starts moving 12% lower.

Through the first six months of 2022, nonresidential building starts were 13% higher than during the first six months of 2021. Commercial starts advanced 14% and institutional starts rose 1%, while manufacturing starts were 83% higher on a year-to-date basis.

Residential building starts fell 6% in June to a seasonally adjusted annual rate of $428.3 billion. Single-family starts dropped 7% and multifamily starts were 3% lower. Through the first six months of 2022, residential starts were 3% higher than in the first six months of 2021. Multifamily starts were up 23%, while single family housing slipped 4%.

For the 12 months ending June 2022, residential starts improved 5% from the same period ending June 2021. Single-family starts were 2% lower and multifamily starts were 25% stronger on a 12-month rolling sum basis.

Regionally, total construction starts in June rose in the Northeast and the West, but fell in the Midwest, South Atlantic, and South Central.