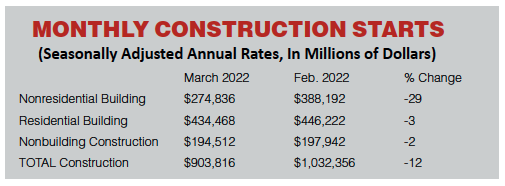

Total construction starts fell 12% in March to a seasonally adjusted annual rate of $903.8 billion, according to Dodge Construction Network. Nonresidential building starts lost 29%, in part due to the start of three large manufacturing facilities in the prior month. When those three large projects are removed, nonresidential starts in March would have risen 10%. Residential starts also fell 3%, and nonbuilding starts lost 2%.

Starts for highway and bridge projects dipped 7% but were up 4% on a 12-month rolling sum basis.

Year-to-date, total construction was 9% higher in the first three months of 2022 than in the same period of 2021. Nonresidential building starts rose 26%, residential starts gained 3%, while nonbuilding starts were 1% lower. For the 12 months ending March 2022, total construction starts were 15% above the 12 months ending March 2021. Nonresidential starts were 25% higher, residential starts gained 15% and nonbuilding starts were down 1%.

Nonbuilding construction starts declined by 2% in March to a seasonally adjusted annual rate of $194.5 billion. Starts in the environmental public works category rose 35%, and miscellaneous nonbuilding improved by 10%. Starts for highway and bridge projects lost 7%, and utility/gas plant starts shed 40% in March.

For the 12 months ending March 2022, total nonbuilding starts were 1% lower than in the 12 months ending March 2021. Environmental public works starts were up 11%, and utility/gas plant starts rose 2%. Highway and bridge starts were up 4% on a 12-month rolling sum basis, while miscellaneous nonbuilding starts were 30% lower.

Nonresidential building starts fell 29% in March to a seasonally adjusted annual rate of $274.8 billion. The decline in March followed a large gain in manufacturing activity in February, which saw three large plants break ground. In March, commercial starts rose 8% due to gains in office, hotel and warehouse starts. Institutional starts increased 9% in March as starts in all sectors moved higher.

For the 12 months ending March 2022, nonresidential building starts were 25% higher than in the 12 months ending March 2021. Commercial starts were up 21%, institutional starts rose 12% and manufacturing starts advanced 162% on a 12-month rolling sum basis.

Residential building starts fell 3% in March to a seasonally adjusted annual rate of $435 billion. Single family starts fell 5%, but multifamily starts rose 4%.

For the 12 months ending March 2022, residential starts improved 15% from the 12 months ending March 2021. Single family starts were 11% higher, while multifamily starts were 29% stronger on a 12-month rolling sum basis.

Regionally, total construction starts in March rose in the South Atlantic, but fell in all other regions.