In This Quarterly Report, Provided Exclusively to Rock Products, Capstone Partners Offers Insight Into Merger and Acquisition Activity, Capital Markets Trends, Aggregate Production and Pricing.

By Darin Good, Brian Krehbiel and Crista Gilmore

The Aggregates sector recorded healthy demand throughout 2021 with leading public players reporting strong revenue growth. Merger and acquisition (M&A) activity also reached elevated levels as sector participants have increasingly sought to increase scale and product offerings through inorganic growth. Several key report takeaways are included below.

- Public companies in the Aggregates sector have demonstrated robust operating performance, evidenced by increased valuations compared to the prior year.

- Despite labor shortages and cost pressures, sector participants have capitalized on the favorable backdrop of demand which is expected to continue in 2022.

- M&A activity increased substantially in 2021, with sellers recognizing the high valuation environment and strategic and financial buyers increasingly pursuing acquisition opportunities.

- Aggregates production volume and pricing remained strong through Q3 2021. Maintaining healthy margins will continue to remain an area of focus for the sector.

Introduction

In this quarterly report, provided exclusively to Rock Products, Capstone Partners provides insight into mergers & acquisitions, capital markets trends, aggregates production and pricing data through year-to-date 2022.

Capstone’s Building Products & Construction Services Team advises industry business owners, entrepreneurs, executives, and investors in the areas of M&A, capital raising, and various special situations. Due to our extensive background and laser focus within the industry, Capstone is uniquely qualified and has an unparalleled track record of successfully representing Building Products and Construction Services companies.

Public Company Commentary

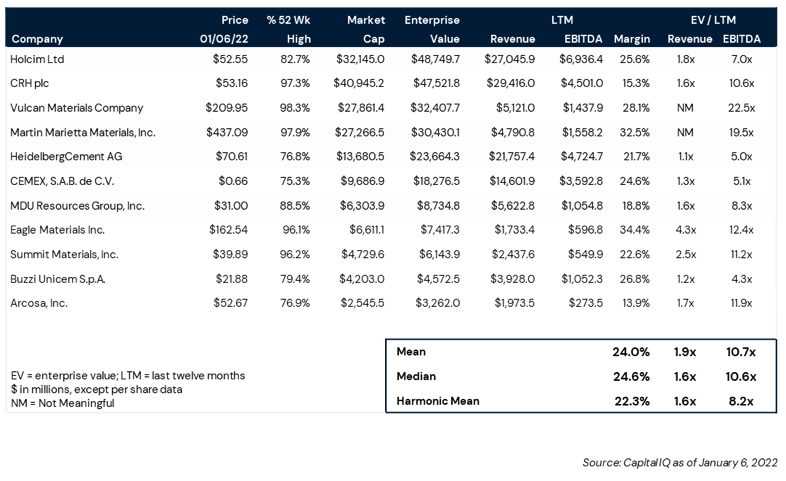

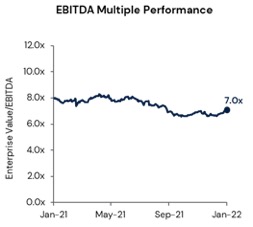

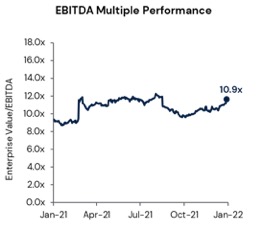

Public company valuations have remained robust to start 2022, evidenced by the average EBITDA trading multiple rising to 10.7x in January, compared to 10.0x in the prior year. Vulcan Materials and Martin Marietta continue to trade at premium multiples relative to their peers.

Rising inflation and the prospect of multiple interest rates increases have led to bouts of volatility in equity markets in early 2022. Capstone’s Aggregates Materials Index (AMI) has demonstrated healthy performance over the past year, with returns amounting to +22.1%, outpacing the Dow Jones Industrial Average and modestly trailing the S&P 500.

Strong Pricing and Demand Drive Sector Performance

Healthy construction backlogs, increased demand visibility and strengthening aggregates pricing contributed to a robust year in the Aggregates sector in 2021. Disciplined cost control has been key for sector participants as they look to grow earnings and maintain margins amid elevated energy costs and labor shortages.

Notably, Martin Marietta’s increase in total energy costs, which rose to $28 million in Q3, (approximately a 50% year-over-year increase) largely prevented gross margins from exceeding the record levels experienced in 2020, according to its earnings call.1 However, elevated shipment and pricing growth contributed to record adjusted EBITDA through the first nine months of the year. While cost pressure will remain a headwind in the coming year, sector participants have defended profitability through price increases, which have been supported by a robust backdrop of demand for aggregates intensive construction activity.

The pipeline of construction projects has remained healthy through the end of 2021, with the Associated Builders and Contractors’ backlog index increasing to 8.4 months in November, marking a year-over-year (YOY) increase of 1.2 months.2 Heavy industrial project backlogs have experienced the largest YOY increase, rising 5.4 months.

Notably, the South has experienced the highest backlog out of all regions in the United States, which may point to ongoing migration trends of households and individuals relocating to states with warmer climates, lower taxes, and fewer regulations. In addition, increased investment in warehouses, denoted by a 23.7% YOY increase in construction spending (U.S. Census Bureau3), and data centers provide favorable tailwinds for aggregates providers.

The improved finances of state and local governments and the passage of the infrastructure bill also add significant visibility to increased aggregates spending as elevated funding for projects, including highways, are expected to provide valuable revenue opportunities for sector participants. Rising interest rates and lingering supply chain challenges are likely to serve as key headwinds in 2022; however, the underlying demand environment remains favorable, which will encourage continued investment and consolidation activity.

M&A Volume and Purchase Multiples Healthy in 2021

Improved M&A activity in the Aggregates sector has been driven by healthy construction demand, seller friendly valuations, and heightened strategic and financial buyer appetite. Total M&A volume has increased 22% YOY with 93 transactions announced or completed in 2021, compared to 76 transactions in 2020. Prospective tax increases under the Biden administration pulled forward a significant number of M&A transactions, adding to a bustling year of middle market activity.

While the Build Back Better Act passed by the House in November did not include a capital gains tax revision, business owners continued to pursue liquidity events to capitalize on the high valuation environment. Notably, average EBITDA purchase multiples in the Aggregates sector amounted to 10.9x with premium multiples paid for target companies with national scale, expansive product lines, and high levels of recurring revenue. Notably, the average Aggregates sector purchase multiple in 2021 has outperformed the three-year average of the broader Building Products & Construction Services industry of 7.9x, according to Capstone’s Middle Market Valuation Index.

Private and public strategic buyers have comprised the majority of transaction activity, accounting for 86% of 2021 M&A volume. While leading public players have grappled with effective cost mitigation amid rising input and logistics prices, inorganic growth has been a key area of focus for those with ample cash on the balance sheet.

Top sector players including Holcim MDU Resources and Martin Marietta have completed multiple acquisitions in 2021. Private equity buyers (14% of transactions) have also demonstrated a strong appetite for the sector, often establishing platforms and scaling through small-scale add-on acquisitions. Sponsors have had the luxury of low interest rates and expansive levels of dry powder, which has contributed to record levels of private equity activity across the middle market.

Private Equity Activity

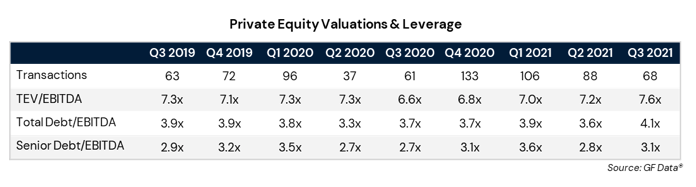

GF Data Resources, a provider of detailed information on business transactions ranging in size from $10 to $250 million, provides quarterly data from more than 200 private equity firm contributors on the number of completed transactions. The following chart provides the number of completed transactions from GF Data contributors, the average total enterprise value (TEV)/EBITDA multiples, and the average amount of debt utilized in the transaction computed as a multiple of EBITDA. The data, although not industry specific, highlights the current elevated valuation environment as the average EBITDA multiple soared to 7.6x in Q3.

Public Companies Aggressively Pursue M&A Opportunities

Public companies in the Aggregates sector are leveraging healthy cash positions and robust balance sheets to actively target inorganic growth opportunities. As the Aggregates sector continues to demonstrate rapid consolidation, leading players are expected to remain aggressive in pursuing accretive transactions that can drive operational synergies and expand product portfolios.

Transaction Overview

Holcim has acquired leading supplier of ready-mix concrete and aggregates in Washington state, Cowden, for an undisclosed sum (January 2022). Cowden, established in 1945, serves both large commercial and small residential customers. Cowden operates two ready-mix concrete plants, eight aggregate facilities and a hauling fleet.

M&A and Sector Takeaways

The acquisition is the latest transaction for Holcim amid an aggressive acquisition spree as it expands its portfolio and geographic presence. The purchase of Cowden follows its addition of another concrete supplier, Marshall Concrete (December 2021, undisclosed), which serves the high growth Minneapolis/Saint Paul Metro market. Holcim’s emphasis on inorganic growth points to its healthy cash position and the rapid consolidation of the Aggregates sector.

In addition, as energy costs rise and sector participants focus on sustainable building solutions, sector players are expected to eye target companies that can assist in achieving ESG metrics. Holcim’s acquisition of Cowden aligns with its “Strategy 2025 – Accelerating Green Growth,” according to a press release.4

Transaction Overview

Knife River, a subsidiary of MDU Resources, has acquired Baker Rock Resources and Oregon Mainline Paving in November 2021. Terms of both transactions were not disclosed. Baker Rock is a leading construction materials provider in the Portland metro area, with an estimated 83 million to 88 million tons of construction aggregates, according to a press release.5 Oregon Mainline Paving is one of the largest asphalt paving contractors in its region, with two portable asphalt plants and three paving crews.

M&A and Sector Takeaways

The acquisitions of Baker Rock and Oregon Mainline provide Knife River with greater penetration into the Portland Metro Market, which has experienced a strong increase in demand for aggregate materials, and expands its paving operations in the Northwest. It also demonstrates MDU Resource’s commitment to scaling Knife River through acquisitions that expand its product portfolio and market share. The two recent acquisitions follow Knife River’s earlier purchase of Mt. Hood Rock Products in April 2021 for an undisclosed sum.

Select Transactions

Capstone Case Study

Capstone Partners advised Frontline Concrete, Inc., a market leading concrete construction company, on its sale to Lithko Contracting, LLC (December 2021).

Frontline is based in Salt Lake City, Utah, and serves both commercial and residential clients throughout the state. Frontline offers award-winning expertise in concrete construction with a focus on safety and quality. The company specializes in tilt-up concrete services, primarily to the industrial, warehouse and manufacturing markets, and cast-in-place concrete for the multifamily, mixed-use, parking structure, education, and single-family residential markets.

“Frontline is the leading tilt-up concrete contractor in Utah and the combination with Lithko, and its existing operations in the region, will result in diversification and significant opportunity to grow and better serve the growing market demand,” said Brian Krehbiel, director at Capstone. “Utah is leading the nation in construction activity and Frontline will continue to be the driving force behind the changing landscape.”

Rob Strobel, Lithko president, added, “We are excited to expand our offerings in the Wasatch Valley by partnering with Frontline. Collaborating with the Lithko team will support Frontline’s employees, customers, and continued expansion.”

Lithko is a market-leading, full-service commercial concrete contractor specializing in the execution of walls, tilt-ups, structural frames, slabs, super flats, sitework, foundations, and pre-construction services. Lithko has more than 4,000 employees serving more than 500 clients across 20 regions. Lithko has a unique local service model designed to keep employees close to home and ensure exceptional customer service in each territory.

Company Spotlights

Headquarters: Switzerland

Markets: Construction Materials

LTM Revenue: $27.1 Billion

Market Capitalization: $32.1 Billion

Company Description

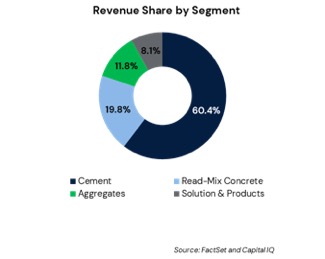

Holcim has placed a heavy focus on supply chain strength and margin resilience through the first nine months of Q3, which has led to healthy operating performance. Elevated levels of demand has contributed to robust sales growth, rising 5% in Q3 on a like-for-like (LFL) basis, according to its earnings release.6 Holcim’s solid operating margins are reflected in its record Q3 recurring EBIT which increased 4.7% LFL in Q3 driven by strong pricing and effective cost management. Through the first nine months of 2021, Holcim’s Cement segment has recorded the highest LFL net sales increase, rising 14.8%. Cost mitigation will remain a key area of focus for Holcim moving into 2022, as the company experienced a 28% increase in energy costs in Q3, according to its earnings call.7

“Since the beginning of the year, we have recorded a huge growth of 33% of the recurring EBIT of which 35% is like-for-like. This corresponds to a like-for-like growth of 26% compared to the first nine months of 2019. And this demonstrates that we are not only talking about post-COVID rebound here, but also about true growth based on strong pricing and industrial cost monitoring,” commented Géraldine Picaud, Holcim chief financial officer, in an earnings call.

Holcim has pursued an aggressive M&A strategy through 2021, facilitating nine bolt-on acquisitions targeting aggregates and ready-mix concrete opportunities in the first nine months of the year. It has already added to its portfolio in 2022, acquiring Cowden in January for an undisclosed sum. Holcim has demonstrated a propensity for smaller, value accretive local acquisitions but its M&A pipeline also consists of more transformative targets. While outside the traditional Aggregates space, Holcim recently announced its acquisition of Malarkey Roofing Products for $1.35 billion (December 2021).

Headquarters: Ireland

Markets: Construction Materials

LTM Revenue: $29.4 Billion

Market Capitalization: $41.1 Billion

Company Description

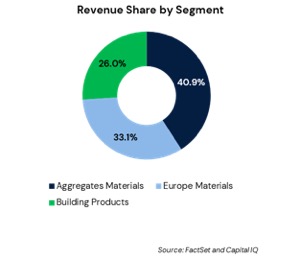

The positive demand environment in North America and Europe has fueled continued momentum for CRH with total sales increasing 11% YOY through the first nine months of 2021, according to its most recent earnings release.8 CRH has also managed to increase profitability with EBITDA increasing 15% YOY, representing a 50 basis point improvement to its margin. CRH’s Europe Materials segment led LFL growth through the first nine months of 2021, increasing 13%, followed by its Building Products segment at +6% LFL. Inclement weather dampened volume growth in its Americas Materials segment with sales increasing a modest 3% LFL.

“In North America and Europe, construction demand remains robust despite an inflationary input cost environment in the areas of energy, raw material, labor, and logistics. There is broad-based support for increased infrastructure investment across our markets and we are pleased to see that in the United States, Congress has passed the $1.2 trillion Infrastructure Investment and Jobs Act,” commented Albert Jude Manifold, CRH chief executive and director, in an earnings call.9

“In North America and Europe, construction demand remains robust despite an inflationary input cost environment in the areas of energy, raw material, labor, and logistics. There is broad-based support for increased infrastructure investment across our markets and we are pleased to see that in the United States, Congress has passed the $1.2 trillion Infrastructure Investment and Jobs Act,” commented Albert Jude Manifold, CRH chief executive and director, in an earnings call.9

Efficient allocation of capital has been a key focus for CRH, which has manifested in increased acquisition activity. Through the first nine months of 2021, CRH invested $1.4 billion on 17 acquisitions, equating to an average pre-synergy EBITDA multiple of 7.0x. Its healthy balance sheet and cash generation can also be reflected in its ongoing share buyback program, which has returned nearly $800 million as of its Q3 earnings call.

Construction Materials Update

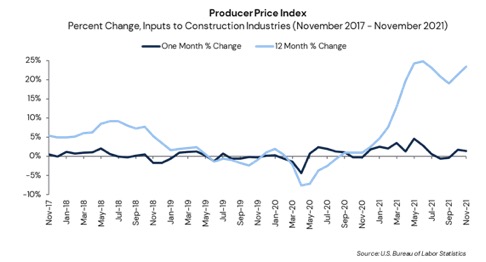

Construction input prices increased 1.4% in November 2021 and registered substantial YOY gains of 23.5%, according to an Associated Builders and Contractors analysis of the U.S. Census Bureau of Labor Statistics data.10 Natural gas pricing has led YOY increases, rising 150.6%.

Aggregate Materials Update

Aggregate materials have exhibited healthy pricing and volume increases compared to the prior year amid an elevated backdrop of demand for construction activity.

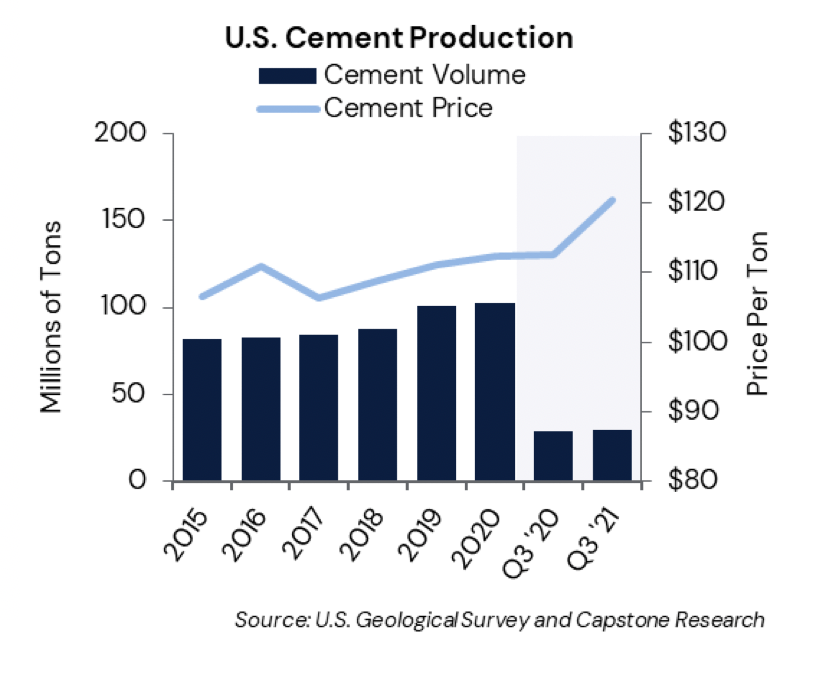

Cement

- Portland cement consumption amounted to 29.5 million metric tons in Q3, marking a YOY increase of 2.1%. Consumption has increased 1.7% compared to the prior quarter.

- The average net selling price per ton for Martin Marietta and Eagle Materials cement in Q3 increased 7.0% YOY to $120.35.

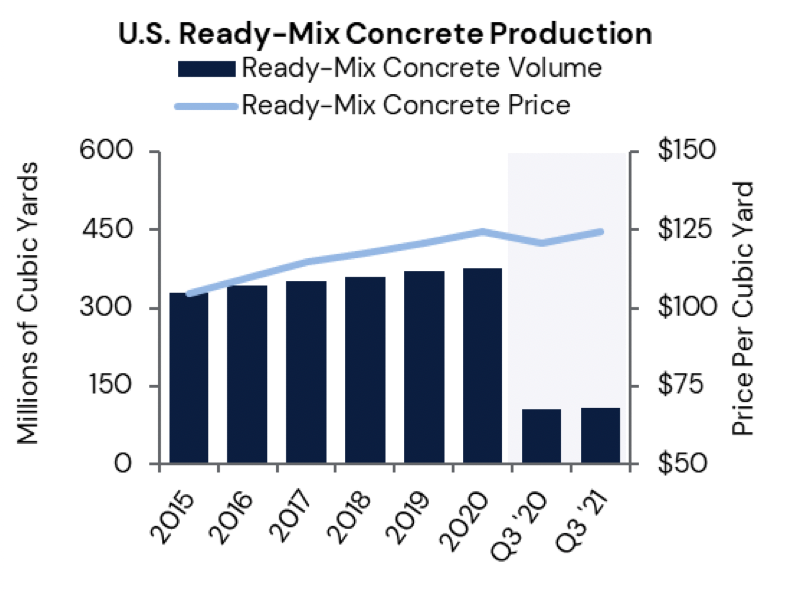

Ready-Mix Concrete

- Ready-mix concrete (RMC) prices increased 3.0% YOY to $124.40 per cubic yard. Price data is computed from the average RMC net selling prices of Vulcan Materials, Martin Marietta, and Eagle Materials.

- RMC volume increased 2.4% YOY in Q3 to 108.4 million cubic yards. Production volume increased 2.0% compared to the Q2.

Source: NRMCA Industry Data Survey, Average RMC selling price of U.S. Concrete (not included in Q3 2020 and Q3 2021 due to acquisition by Vulcan), Vulcan Materials, Martin Marietta Materials, Eagle Materials, and Capstone Research

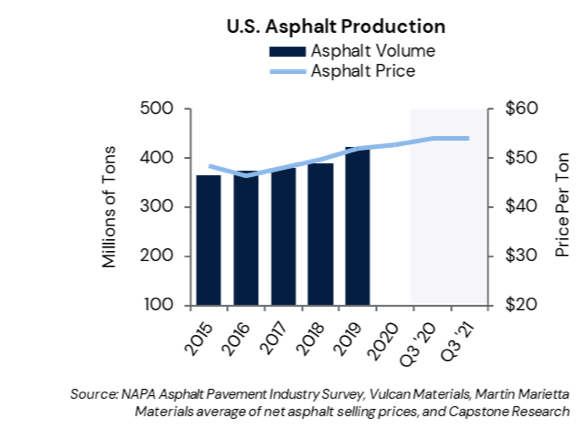

Asphalt

- Asphalt prices increased 0.2% YOY in Q3 to $54.08, as measured by the average net asphalt selling prices of Vulcan Materials and Martin Marietta. Pricing also increased by 1.1% compared to Q2.

- Asphalt volume is reported on an annual basis. The most recent asphalt production amounted to nearly 422 million tons in 2019.

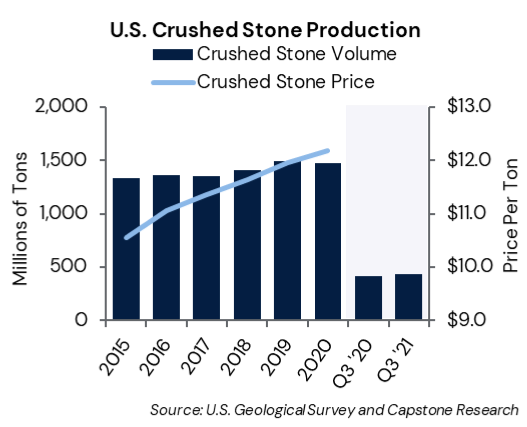

Crushed Stone

- Crushed stone production increased 4.1% YOY to 436 million metric tons. Production volume has increased 5.1% in Q3 compared to Q2.

- Crushed stone prices are recorded on an annual basis.

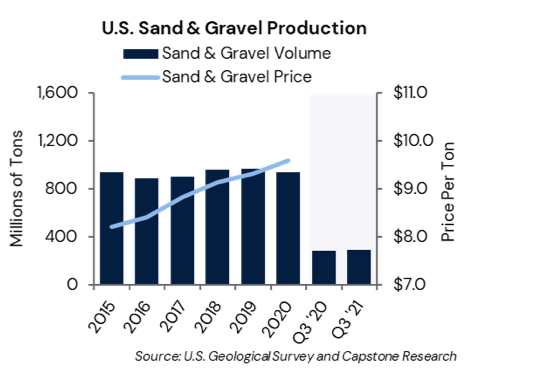

Sand & Gravel

- An estimated 294 million metric tons of sand & gravel were produced and shipped for consumption in Q3, an increase of 3.5% YOY. Sand & gravel production has increased 5.4% compared to the prior quarter.

- Sand & gravel prices are recorded on an annual basis.

Capstone’s Building Products & Construction Services Team advises industry business owners, entrepreneurs, executives, and investors in the areas of M&A, capital raising, and various special situations. Due to our extensive background and laser focus within the industry, Capstone is uniquely qualified and has an unparalleled track record of successfully representing Building Products & Construction Services companies.

Capstone Partners has developed a full suite of corporate finance solutions, including M&A advisory, debt advisory, financial advisory, and equity capital financing to help privately owned businesses and private equity firms through each stage of the company’s lifecycle, ranging from growth to an ultimate exit transaction.

To learn more about Capstone’s wide breadth of advisory services and Rock Products industry expertise, please contact Managing Director Darin Good.

ENDNOTES

- Martin Marietta, “Martin Marietta Q3 2021 Earnings Conference Call,” https://ir.martinmarietta.com/events-presentations, accessed January 8, 2022.

- Associated Builders and Contractors, “ABC: Construction Backlog and Contractor Confidence Rebound in November,” https://www.abc.org/News-Media/News-Releases/entryid/19148/abc-construction-backlog-and-contractor-confidence-rebound-in-november, accessed January 5, 2022.

- U.S. Census Bureau, “Construction Spending,” https://www.census.gov/construction/c30/c30index.html, accessed January 9, 2022.

- Rock Products, “Holcim Acquires Cowden Inc.,” https://rockproducts.com/2022/01/04/holcim-acquires-cowden-inc/, accessed January 9, 2022.

- Cision, “Knife River Acquires Baker Rock Resources and Oregon Mainline Paving,” https://www.prnewswire.com/news-releases/knife-river-acquires-baker-rock-resources-and-oregon-mainline-paving-301429850.html, accessed January 9, 2022.

- Holcim, “Q3 2021 Trading Update,” https://www.holcim.com/sites/holcim/files/atoms/files/29102021-finance-holcim_q3_2021_analyst_presentation-en.pdf, accessed January 3, 2022.

- Holcim, “Q3 2021 Sales and Revenue Call – Trading Update,” https://www.alpha-sense.com/, accessed January 3, 2021.

- CRH, “Trading Update – November 2021,” https://www.crh.com/media/3922/crh-trading-update-23nov2021-announcement.pdf, accessed January 3, 2022.

- CRH, “Q3 2021 Sales and Revenue Call – Trading Update,” https://www.alpha-sense.com/, accessed January 3, 2022.

- Associated Builders and Contractors, “Monthly Construction Input Prices Continue to Climb in November, Says ABC,” https://www.abc.org/News-Media/News-Releases/entryid/19150/monthly-construction-input-prices-continue-to-climb-in-november-says-abc, accessed January 3, 2022.

Disclosure

This report is a periodic compilation of certain economic and corporate information, as well as completed and announced merger and acquisition activity. Information contained in this report should not be construed as a recommendation to sell or buy any security. Any reference to or omission of any reference to any company in this report should not be construed as a recommendation to buy, sell or take any other action with respect to any security of any such company. We are not soliciting any action with respect to any security or company based on this report. The report is published solely for the general information of clients and friends of Capstone Partners. It does not take into account the particular investment objectives, financial situation or needs of individual recipients. Certain transactions, including those involving early-stage companies, give rise to substantial risk and are not suitable for all investors. This report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Prediction of future events is inherently subject to both known and unknown risks and other factors that may cause actual results to vary materially. We are under no obligation to update the information contained in this report. Opinions expressed are our present opinions only and are subject to change without notice. Additional information is available upon request. The companies mentioned in this report may be clients of Capstone Partners. The decisions to include any company in this report is unrelated in all respects to any service that Capstone Partners may provide to such company. This report may not be copied or reproduced in any form or redistributed without the prior written consent of Capstone Partners. The information contained herein should not be construed as legal advice.