Highway Starts were Lower for the Month, But Up for the Year.

By Mark S. Kuhar

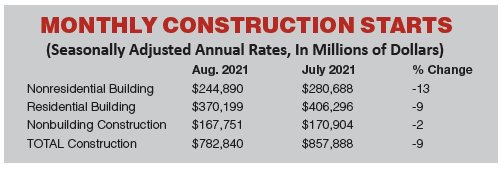

Total construction starts fell 9% in August to a seasonally adjusted annual rate of $782.8 billion, according to Dodge Data & Analytics. All three sectors lost ground during the month: nonbuilding starts were down 2%, residential starts were 9% lower, and nonresidential building starts fell 13%.

Highway and bridge starts were 4% lower.

“Construction starts have hit a rough patch following the euphoria seen in the early stages of recovery from the pandemic,” stated Richard Branch, chief economist for Dodge Data & Analytics. “The Delta variant has raised concern that the fledgling economic recovery is stalling out, undermining the already low level of demand for most types of nonresidential buildings. Additionally, significant price increases for construction materials, logistic constraints, and labor shortages are making a challenging situation worse. Construction starts are likely to remain unsteady over the next few months. However, the dollar value of projects entering planning continues to suggest that the recovery in construction starts should resume early in the new year.”

Nonbuilding Construction

Nonbuilding construction starts lost 2% in August to a seasonally adjusted annual rate of $167.8 billion. Starts in the environmental public works category (water-related projects) gained 4%, while miscellaneous nonbuilding starts (heavily pipelines) were up 14%.

Nonbuilding construction starts lost 2% in August to a seasonally adjusted annual rate of $167.8 billion. Starts in the environmental public works category (water-related projects) gained 4%, while miscellaneous nonbuilding starts (heavily pipelines) were up 14%.

Meanwhile, highway and bridge starts were 4% lower and utility/gas plants dropped 21% following a sizeable gain in July. Year-to-date, total nonbuilding starts were up 1% through August.

Environmental public works were up 23%, and utility/gas plant starts were up less than one percentage point through August. Starts in the highway/bridge (-2%) and miscellaneous nonbuilding sectors (-19%) were down through the first eight months of the year.

For the 12 months ending in August, total nonbuilding starts were 2% lower than the 12 months ending in August 2020. Environmental public works starts were 22% higher and highway and bridge starts were up 3%, while utility and gas plant starts were down 17% and miscellaneous nonbuilding starts were 22% lower on a 12-month rolling basis.

The largest nonbuilding project to break ground in August was the $677 million Oak Hill Parkway roadway in Austin, Texas.

Nonresidential Building

Nonresidential building starts fell 13% in August to a seasonally adjusted annual rate of $244.9 billion. The declines were broad-based across building types with few bright spots. Commercial starts dropped 10%, institutional starts lost 15%, and manufacturing starts fell 37% following a sizable gain in July.

Despite overall losses, there were gains in retail, parking, and public buildings. Year-to-date through eight months, nonresidential building starts were 3% higher. Commercial starts increased 2% and manufacturing starts were 33% higher. Institutional starts, however, were 1% lower through eight months.

For the 12 months ending in August, nonresidential building starts were 8% lower than in the 12 months ending in August 2020. Commercial starts were down 8%, institutional starts fell 4%, and manufacturing starts dropped 29% in the 12 months ending August 2021.

The largest nonresidential building project to break ground in August was the $800 million first phase of the Facebook Eastmark Parkway data center in Mesa, Ariz.

Residential Building

Residential building starts lost 9% in August to a seasonally adjusted rate of $370.2 billion. Single-family starts fell 12% in August, while multifamily starts increased 1%. Through eight months, residential starts were 24% higher than in the same period one year ago. Single-family starts gained 29%, while multifamily starts grew 13%.

For the 12 months ending in August 2021, total residential starts were 21% higher than the 12 months ending in August 2020. Single family starts gained 28%, while multifamily starts were up 2% on a 12-month sum basis.

The largest multifamily structure to break ground in August was the $615 million Flamingo Crossing Apartments in Winter Garden, Fla.

Regionally, total construction starts lost ground in August in all five regions.