Synergy: Syn·Er·Gy, Noun: Putting People, Companies and Ideas Together to Make an Even Bigger Mess.

By Ryan Brown

Can we start using the word “synergy” again with a straight face?

Nearly all mergers and acquisitions look great on paper. But according to recent Harvard Business Review report from 2017, the failure rate for mergers and acquisitions (M&A) sits between 70 percent and 90 percent. It’s the stuff that doesn’t show up on a spreadsheet that can derail an integration.

North American aggregate producers wrapped up a year of moderate growth in 2017 (despite extreme weather conditions) and began to see a much-improved business and regulatory climate. Last year alone brought historical deals for top aggregate producers: Vulcan Materials (Aggregates USA), Martin Marietta (Bluegrass Materials) and CRH (Ash Grove Cement).

|

|

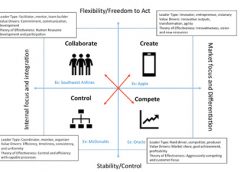

| Exhibit 1: The Organizational Culture Assessment Instrument (OCAI) based on research by Robert E. Quinn and Kim S. Cameron (University of Michigan). |

The industry, on the heels of the third longest recovery since the Great Depression, is flush with significant available liquidity in which to fund more acquisition-related growth. If these deals follow historical patterns, however, there will be some shortfalls in meeting expectations.

Executives know instinctively that corporate culture matters in capturing value from M&A. In a 2013 survey by Mercer M&A Consulting Services, 50 percent said that “cultural fit” lies at the heart of a value enhancing merger, and 85 percent called its absence the key reason a merger had failed. But 80 percent also admitted that culture is hard to define.

Hardly surprising then that most executives feel more comfortable dealing with costs and synergies than culture, despite the potential of culture to enhance or destroy merger value.

The Way We Do Things Around Here

The essence of culture is reflected in a company’s leadership style, its approach to innovation, how decisions are made, and its internal vs. external focus. Merging companies that have conflicting working norms risk frustration among employees, hampering the success of the integration. But if something can’t be seen, can it be managed?

Not unlike a personality assessment, the matrix in Exhibit 1 arranges common profiles of business culture into quadrants that highlight how organizations tend to go about their business. High culture clash can be expected between the diametrically opposed cultures, such as the “Collaborate” and “Compete” organizations. Common ground can be found in adjacent quadrants.

To see how this analysis works in practical terms, consider the recent merger of construction materials companies.

The analysis showed that:

- Company A had a patriarchal leadership style, driven by the owners and managers of this old, family-run business. Employees looked to the owners for vision and leadership and felt an emotional stake in the company. Success was defined as addressing the needs of the clients and fostering employee loyalty.

- Company B, the acquirer, had a more market-focused (compete) leadership style mixed in with a desire for process. They were a results-based organization that emphasized getting things done along the guidelines of tight quality processes. Reputation and profitability were valued above teamwork, participation and consensus.

|

| Exhibit 2: Analysis of cultural alignment. |

This scenario could have been a recipe for synergy disaster for three reasons.

1. Expectations for getting results were drastically different (accountability) with the acquired company believing the new owners were just “numbers guys.” Pressure from analysts and shareholders for quarterly returns on synergy promises was a new experience for the acquirees.

2. The parent company believed in process control not only in manufacturing but also in managing change. This felt like a lot of red tape to the entrepreneurial style of the acquired group.

3. The purchasers were committed to upholding a very strict safety culture in all its facilities. This would require a significant mindset change within a very short time amongst members of the acquired management.

However, the companies found some common ground. Both had bottom-line management views with emphasis on keeping tabs on the competition and a keen sense of customer service. As they worked through synergy projects, managers of both companies were jointly involved and successfully identified sources of value.

Within six months of working together on projects to report to the board, both organizations began to understand the other’s rationale for operating the way they do. Management still has lot to do to integrate the two organizations, but there have been no unexpected high-level departures. Managing the culture clash has been a big key to this early success.

Thinking about conflicts and opportunities in terms of management practices makes culture easier to define, identify and tackle. High-performing acquirers understand the complexity and importance of addressing these culture differences during an integration. Companies that apply diagnostics to highlight key areas of alignment and critical disconnects have the best chance of delivering on the full potential of the deal.

And that I can say with a straight face.

Ryan Brown is the founding consultant at Next Level Essentials LLC, a profit-improvement practice that seeks to help operations minimize landed costs, maximize margins and streamline the problem-solving process. Contact him at [email protected] or visit www.nextlevelessentials.net.

Rock Products is the aggregates industry’s leading source for market analysis and technology solutions, a distinction it has held since 1896. Rock Products delivers to its readers critical content focusing on aggregates-processing equipment; operational efficiencies; management best practices; comprehensive market analysis; and emerging trends designed to increase plant profitability. Do you have a story idea of interest to the aggregates industry? Email Editor Mark Kuhar at [email protected].