Market Trends Including Mergers and Acquisitions, Aggregate Production and Pricing.

By Brian Krehbiel

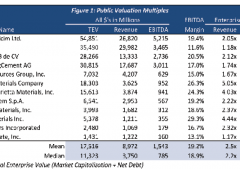

With regard to publicly traded companies, average EBITDA margins were down from 20.0 percent to 19.2 percent from the prior quarter but average EBITDA multiples increased from 12.3x to 12.6x, likely due to the dip in margins inflating multiples.

On May 8, 2017, the Australian company, Boral Limited, completed the previously announced acquisition of Headwaters Inc. (No affiliation with Headwaters MB) for an aggregate enterprise value of $2.6 billion. Headwaters Inc. was delisted from the New York Stock Exchange as of the date of closing.

Public Valuations

Figure 1 includes the constituents of Headwaters Aggregates Materials Index as of 3/31/2017.

Source: FactSet

Aggregates Performance

2017 YTD Total Returns (Figure 3):

2017 YTD Total Returns (Figure 3):

- Aggregate Materials Index – (4.1%)

- S&P 500 – 9.7%

- Dow Jones Industrial Average – 7.2%

While publicly traded aggregates producers continue to experience top line growth, investors have been disappointed in the short-term delays to President Trump’s infrastructure plans pushing growth expectations into 2018 and beyond. Average margins have also dipped slightly in 2017.

Select Merger and Acquisition Activity

As shown in Figure 4, acquisition activity in Q1 2017 was consistent with Q1 in prior years in terms of the number of transactions completed (30) in the U.S. and Canada . Conversely, transaction activity was down 16.7 percent compared to Q4 2016 but it is not uncommon for transaction activity to dip in Q1 after a large transaction push at year-end. Publicly traded aggregates producers were notably active during the quarter including CRH, Summit Materials, Eagle Materials.

Private Equity Transaction Activity and Valuations

GF Data Resources, a provider of detailed information on business transactions ranging in size from $10 million to $250 million, provides quarterly data from over 200 private equity firm contributors on the number of completed transactions. Figure 5 provides the number of completed transactions from GF Data contributors, the average Total Enterprise Value (TEV)/EBITDA multiple and the average amount of debt utilized in the transaction computed as a multiple of EBITDA. The data, although not industry specific, shows valuations and debt levels during the quarter consistent with levels experienced over the last two years as private equity valuations have remained relatively flat.

Company Spotlight

Summit Materials reported Q1 2017 organic cement sales volume and average selling price growth of 17.6 percent and 6.3 percent, respectively. “Our business performed ahead of expectations during the first quarter, as organic growth in materials sales volumes and average selling prices contributed to strong year-over-year increases in gross margins and Adjusted EBITDA,” stated Tom Hill, CEO of Summit Materials. “Demand within our core early-cycle residential and commercial construction markets continues to accelerate, while a combination of federal and state level funding for critical infrastructure projects remains a significant opportunity for us, particularly in Texas where a combination of FAST Act, Proposition 1 and Proposition 7 funding combine to support robust multi-year investment in public infrastructure.” Summit has completed a total of six acquisitions year-to-date. The four acquisitions since February have added a combined 90 million tons of permitted aggregate reserves to the Summit portfolio. Additionally, Summit has a pipeline of more than 20 transactions under review, four of which are in late-stage diligence.

Summit Materials reported Q1 2017 organic cement sales volume and average selling price growth of 17.6 percent and 6.3 percent, respectively. “Our business performed ahead of expectations during the first quarter, as organic growth in materials sales volumes and average selling prices contributed to strong year-over-year increases in gross margins and Adjusted EBITDA,” stated Tom Hill, CEO of Summit Materials. “Demand within our core early-cycle residential and commercial construction markets continues to accelerate, while a combination of federal and state level funding for critical infrastructure projects remains a significant opportunity for us, particularly in Texas where a combination of FAST Act, Proposition 1 and Proposition 7 funding combine to support robust multi-year investment in public infrastructure.” Summit has completed a total of six acquisitions year-to-date. The four acquisitions since February have added a combined 90 million tons of permitted aggregate reserves to the Summit portfolio. Additionally, Summit has a pipeline of more than 20 transactions under review, four of which are in late-stage diligence.

Eagle Materials recently reported record results for its fiscal year ended March 31, 2017, with revenue of $1.2 billion, up 6.0 percent while Q4 experienced 11.0 percent growth year-over-year. Fiscal year 2017 cement volume increased 2.0 percent, concrete volume increased 14.0 percent and aggregates volume increased 21.0 percent compared to 2016. On February 10, 2017, Eagle Materials completed the previously announced acquisition of Cemex S.A.B. de C.V.’s Fairborn, Ohio cement plant and related assets for $400 million. The transaction was funded with existing cash and borrowings from its bank credit facility.

Eagle Materials recently reported record results for its fiscal year ended March 31, 2017, with revenue of $1.2 billion, up 6.0 percent while Q4 experienced 11.0 percent growth year-over-year. Fiscal year 2017 cement volume increased 2.0 percent, concrete volume increased 14.0 percent and aggregates volume increased 21.0 percent compared to 2016. On February 10, 2017, Eagle Materials completed the previously announced acquisition of Cemex S.A.B. de C.V.’s Fairborn, Ohio cement plant and related assets for $400 million. The transaction was funded with existing cash and borrowings from its bank credit facility.

Transaction Spotlight

CRH plc acquired Mulzer Crushed Stone Inc., Hardrives Inc., Chard Tiling & Excavating Inc., Columbia Asphalt & Gravel Inc., Costello Industries Inc. and certain quarry assets in the Greater Montreal Area on February 28, 2017. The acquisitions and investment spend amounted to approximately $531 million.

CRH plc acquired Mulzer Crushed Stone Inc., Hardrives Inc., Chard Tiling & Excavating Inc., Columbia Asphalt & Gravel Inc., Costello Industries Inc. and certain quarry assets in the Greater Montreal Area on February 28, 2017. The acquisitions and investment spend amounted to approximately $531 million.

Mulzer is one of the largest privately held aggregates producers in the U.S. and operates six quarries, five sand and gravel operations, fourteen aggregates yards, four ready-mix concrete plants and three asphalt plants, serving the Ohio and Kanawha river valleys.

Mulzer is one of the largest privately held aggregates producers in the U.S. and operates six quarries, five sand and gravel operations, fourteen aggregates yards, four ready-mix concrete plants and three asphalt plants, serving the Ohio and Kanawha river valleys.

Two acquisitions were completed in the greater Minneapolis/St. Paul region, Hardrives Inc. and Chard Tiling and Excavating. These acquisitions added two aggregates operations, eight asphalt plants, asphalt construction and an asphalt terminal operation and are expected to provide immediate synergies as they are integrated with CRH’s existing aggregates and asphalt business in southern Minnesota.

Columbia Asphalt is a vertically integrated business in Yakima, Wash., comprised of three aggregates sites, three asphalt plants and one ready-mix concrete plant.

Columbia Asphalt is a vertically integrated business in Yakima, Wash., comprised of three aggregates sites, three asphalt plants and one ready-mix concrete plant.

The acquisition of Costello Industries Inc., a cold milling contractor in Connecticut, will provide synergies with CRH’s existing asphalt production and paving business in the region.

The acquisition of certain quarry assets in the greater Montreal area strengthens CRH’s position in the concrete stone market by adding licensed reserves and securing long-term concrete stone supply for its vertically integrated ready-mix concrete business. CRH also purchased certain assets of Connell Resources, a vertically integrated aggregates, asphalt and construction company with operations in Colorado.

Construction Materials

Construction input prices rose in April increasing by 0.7 percent on a monthly basis and 4.3 percent on a year-over-year basis, according to a recent analysis of U.S. Bureau of Labor Statistics data released by Associated Builders and Contractors.

Nonresidential input prices as a whole experienced similar increases, due in part to surging iron, steel and softwood lumber prices, rising 0.7 percent for the month and 4.2 percent on the year. “The price increases from the report reinforce the recent growth in compensation costs, which means that the most advantageous period for purchasers of construction services is now well behind us,” said ABC Chief Economist Anirban Basu. “Today’s PPI report is particularly significant because it indicates that inflationary pressures continue to build within the U.S. economy.

Aggregates Materials

Industry results in Q1 2017 showed quarterly decreases in volume compared to the same period in 2016 for crushed stone (2.6 percent) and sand and gravel (4.1 percent) while cement volume was up 0.7 percent. Asphalt prices continued to decline in Q1 and have done so for the past two years due mainly to depressed oil prices.

Cement

|

| Sources: U.S. Geological Survey, Average of Vulcan Materials, Martin Marietta and Eagle Materials average net selling price |

- Portland cement consumption (17.0 million metric tons) increased by 0.7 percent in Q1 2017 compared to Q1 2016.

- The average net selling price per ton for Vulcan Materials, Martin Marietta and Eagle Materials in Q1 was $104.40, an increase of 1.9 percent over the prior quarter and a 4.1 percent increase over the same period in 2016.

Ready-Mix Concrete (RMC)

|

| Sources: NRMCA Industry Data Survey, Average RMC selling price of U.S. Concrete, Vulcan Materials, Martin Marietta Materials & Eagle Materials |

- RMC prices rose 3.5 percent in Q1 2017 and were up 6.2 percent when compared to Q1 2016. Price data is computed from the average RMC net selling prices of U.S. Concrete, Vulcan Materials, Martin Marietta and Eagle Materials.

- Ready-mix concrete volume is not tracked on a quarterly basis.

Crushed Stone

|

| Source: U.S. Geological Survey |

- An estimated 261 million metric tons of crushed stone was produced and shipped for consumption in the U.S. in Q1 2017.

- Crusted stone production in Q1 2017 declined 2.6 percent compared to Q1 2016.

Sand & Gravel

|

| Source: U.S. Geological Survey |

- Sand and gravel production in Q1 2017 decreased 4.1 percent compared to Q1 2016, the third consecutive quarterly decline when compared to the same period in the prior year.

Asphalt

|

| Sources: EAPA Asphalt in Figures, NAPA, Vulcan Materials & Martin Marietta Materials average of net asphalt selling prices |

- Asphalt prices declined 2.9 percent in Q1 2017 after falling 4.3 percent during Q4 2016 as measured by the average net asphalt selling prices of Vulcan Materials and Martin Marietta.

- Asphalt volume is not tracked on a quarterly basis.

Headwaters MB is an independent, middle market investment banking firm providing strategic merger and acquisition advice, capital raising and special situations advisory. Named “Investment Bank of the Year” by major industry organizations for its third consecutive year, Headwaters MB is headquartered in Denver, CO, with seven regional offices across the United States and partnerships with 18 firms covering 30 countries. For more information, visit www.headwatersmb.com. To discuss any information contained in this report, contact the Headwaters MB team: Darin Good, managing director, [email protected], 303-549-5674; Brian Krehbiel, vice president, [email protected], 303-531-5008.

1 Summit Materials, Inc. Reports First Quarter 2017 Results, May 3, 2017

2 Eagle Materials Fourth-Quarter and 2017 Fiscal Year Results, May 18, 2017

3 CRH Development Strategy Update, March 1, 2017

4 Associated Builders and Contractors, Inc., “Construction Economic Update” May 11, 2017

5 U.S. Geological Survey