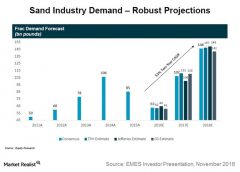

In a recent investor presentation, Emerge Energy Services (EMES) said, “Recently revised estimates from Wall Street analysts indicate sand demand will surpass historical peak levels by 2017.”

The company expects the recovery in the sand market to be driven by increased rig count and expected increases in drilling efficiencies, namely increased sand intensity per well and increased wells drilled per rig.

The below chart shows frac sand demand over the past years and also the forecast for the next three years. Re-fracking of existing older wells could add to a demand rebound. Another potential positive for the sector is the huge drilled but uncompleted well backlog, which offers huge frac sand demand potential.

“We believe that we are in the early stages of a recovery for the oil and gas markets,” said Ted Beneski, chair of the board of directors of the general partner of Emerge Energy in its third quarter 2016 earnings release.

“Activity levels with our customers increased across the board during the third quarter, resulting in a 28 percent sequential increase in our volumes of frac sand sold,” said Robert E. Rasmus, CEO of Hi-Crush Partners in the company’s third quarter 2016 earnings release.